President Bola Tinubu has instructed the Nigeria Education Loan Fund (NELFUND) management to broaden its scope by providing interest-free loans to Nigerian students seeking skill-development programmes.

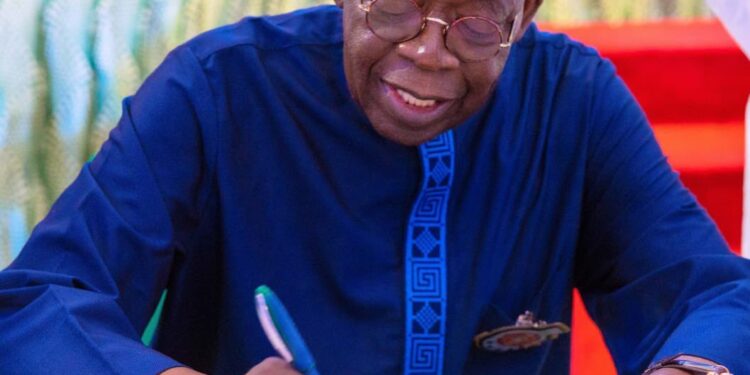

The directive was given at the State House on Monday following a briefing by Mr. Akintunde Sawyerr, NELFUND’s Executive Secretary, outlining preparations for the upcoming program launch later this month, according to a statement by the presidential spokesperson.

President Tinubu emphasized the significance of the program catering to individuals not inclined toward university education, underscoring the equal importance of skill acquisition alongside traditional academic qualifications at the undergraduate and graduate levels.

- “This is not an exclusive programme. It is catering to all of our young people. Young Nigerians are gifted in different areas. This is not only for those who want to be doctors, lawyers, and accountants. It is also for those who aspire to use their skilled and trained hands to build our nation. In accordance with this, I have instructed NELFUND to explore all opportunities to inculcate skill-development programmes because not everybody wants to go through a full university education,” the President said.

Furthermore, the President emphasized the imperative of equity and inclusivity in the program’s management.

- “No matter how economically challenged you are, accredited and qualified students will and must have access to this loan to advance their education in higher institutions. There is no compromise in our commitment to the disadvantaged citizens of this nation,” he said.

More Insights

During his presentation to the President, Mr. Akintunde Sawyerr, the Executive Secretary of the Fund, conveyed that the loan application process would rely on technology, minimizing human interaction and ensuring the complete elimination of any potential maladministration in the program.

- “By design, this is a perpetual programme and will not terminate. The funds, earmarked for bona-fide Nigerian students, will be disbursed directly to the institutions in the initial phase through electronic transfer. Our students will be catered to in a way that bypasses human interference through the full utilization of available technological platforms, in adherence to Your Excellency’s stated objectives,” he said.

He further mentioned that NELFUND has established a strong risk-mitigation mechanism to handle potential risks associated with the program.

Regarding the program’s funding mechanism, Dr. Zacch Adedeji, Executive Chairman of the Federal Inland Revenue Service (FIRS), stated that funding sources are in place to facilitate the seamless initiation and continuity of the program.

- “Mr. President is permanently solving the problem of funding for education in Nigeria. By the directive of the President, the Education Tax Fund is being reviewed to additionally cater to the needs of our university students across all local government areas in the country as they seek to access vocational and traditional university education. Funding for the programme will be adequately covered,” he said.

What you should know

- Nairametrics recently reported that the Federal Government plans to launch the Nigerian Education Loans Fund through an application.

- President Tinubu had previously announced that the distribution of student loans to Nigerians will commence in January 2024.

- The Education Loan Fund, backed by the Student Loan Act, aims to provide interest-free loans to Nigerians pursuing tertiary education and skill development programmes.