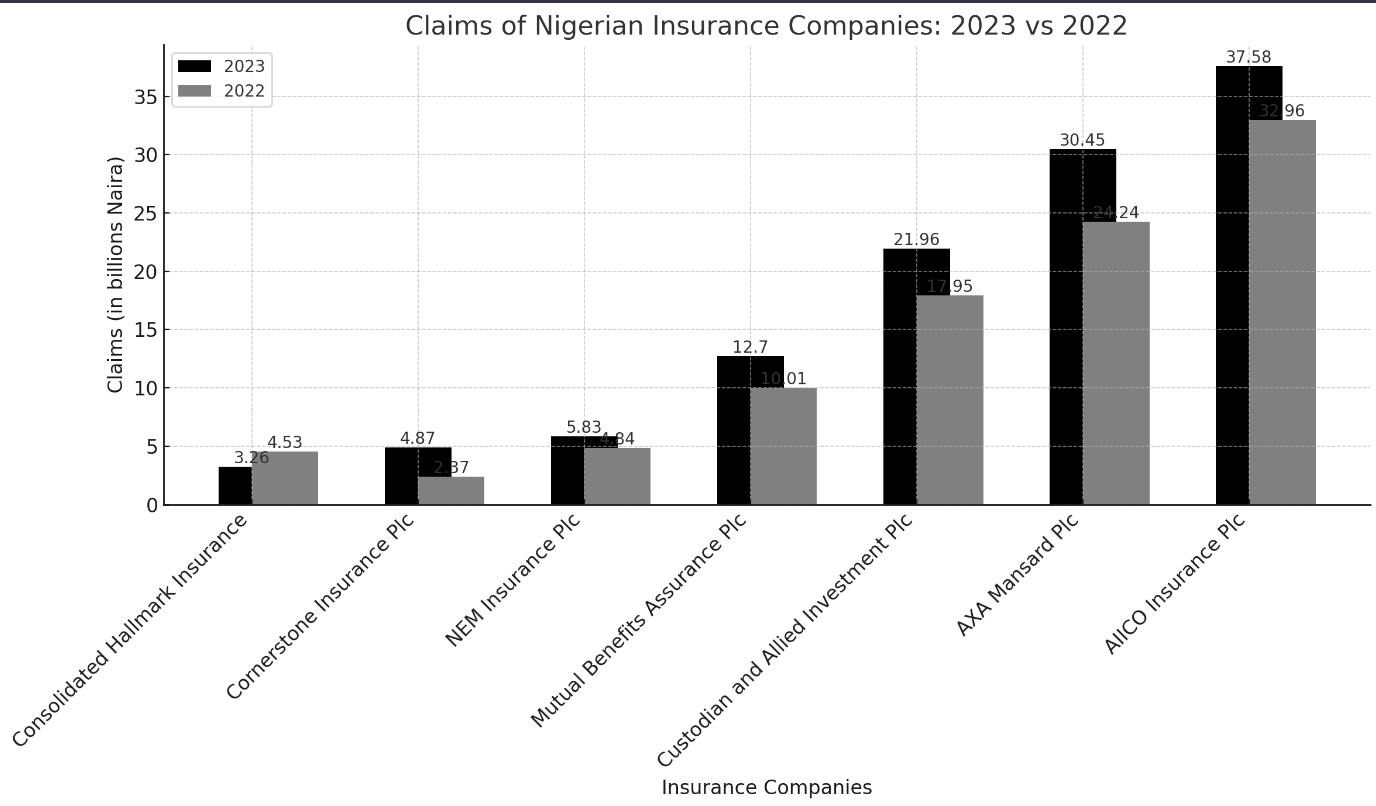

Leading insurance companies in Nigeria reported a total of N116.636 billion in net claims paid during the first nine months of 2023, marking a significant increase from the N96.902 billion recorded in the same period in 2022, representing a notable growth of 20.36%.

These escalating claims have cast a shadow on the premium growth rate and overall profitability of insurance firms in the country. Several factors, including economic challenges, inflation, and an upsurge in fraudulent claims, have contributed to this predicament.

This insightful data has been meticulously compiled by Nairametrics, drawing from the financial reports of prominent insurance companies listed on the Nigerian Exchange, such as AIICO Insurance Plc, Custodian and Allied Investment Plc, NEM Insurance Plc, AXA-Mansard Plc, Mutual Benefits Assurance Plc, Cornerstone Insurance Plc, and Consolidated Hallmark Insurance Plc.

In addition to the increased claims, these insurance companies reported a total of N339.848 billion in gross premiums during the review period, showing substantial growth compared to the N274.628 billion recorded in 2022.

One key takeaway from this data is that insurance companies allocated 34.32% of their premium revenue towards claims expenses, as opposed to 35.28% in the corresponding period of the previous year.

This slight reduction of 0.96% in claims expenditure suggests a potential stabilization in the industry.

Now, let’s delve deeper into the implications of these findings:

Experts in the insurance sector point out that the rising claims recorded by insurance firms in recent years have had a profound impact on their premium growth rate and overall profitability.

Several economic challenges, including difficulties in accessing foreign exchange (forex) as the year progressed, have compounded the situation.

Additionally, security challenges within the country and the ripple effects of Russia’s invasion of Ukraine have further exacerbated the challenges faced by insurance companies.

Inflationary pressures have adversely affected the financial well-being of many Nigerian households during the review period.

This inflationary environment has intensified the pre-existing challenges faced by insurance companies.

Moreover, the shrinking revenues of both federal and state governments, the devaluation of the Naira, and the soaring energy costs have added to the hurdles faced by insurance companies in Nigeria.

Nigerian insurance companies and their claims

Highlighted below are the seven Nigerian insurance firms by claims, based on published financial statements.

Consolidated Hallmark Insurance – N3.256 billion

- Claims paid in 2023: N3.256 billion (down from N4.534 billion in 2022)

- Gross premium in 2023: N10.981 billion (a 20.91% increase from 2022)

- Claims as a percentage of gross premium: 29.65%

- Profit after tax in 2023: N1.557 billion (a 133% increase from 2022)

Cornerstone Insurance Plc – N4.870 billion

- Claims paid in the period: N4.870 billion (up by 105.83% from 2022)

- Gross premium income in 2023: N20.858 billion (a 40.16% increase from 2022)

- Claims as a percentage of gross premium: 23.35%

- Profit after tax in 2023: N10.863 billion (boosted by net gain on financial assets)

NEM Insurance Plc – N5.826 billion

- Claims paid in 2023: N5.826 billion (a 20.25% increase from 2022)

- Gross premium in 2023: N53.638 billion (a 41.46% increase from 2022)

- Claims as a percentage of gross premium: 10.86%

- Profit after tax in 2023: N5.207 billion (a 31.65% increase from 2022)

Mutual Benefits Assurance Plc – N12.700 billion

- Claims paid in 2023: N12.700 billion (a 26.89% increase from 2022)

- Gross premium in 2023: N34.347 billion (a growth of 30.40%)

- Profit after tax in 2023: N4.995 billion (a 38.44% increase from 2022)

Custodian and Allied Investment Plc – N21.958 billion

- Claims paid in 2023: N21.958 billion (a 22.29% increase from 2022)

- Gross premium in 2023: N73.590 billion (a 14.22% increase from 2022)

- Claims as a percentage of gross premium: 29.84%

- Profit after tax in 2023: N11.792 billion (a 105.65% increase from 2022)

AXA Mansard Plc – N30.448 billion

- Claims paid in the nine months: N30.448 billion (a 25.62% increase from 2022)

- Gross premium in the review period: N61.296 billion (a 16.81% increase from 2022)

- Claims as a percentage of gross premium: 49.67%

- Profit after tax in 2023: N12.555 billion (a 738% growth from 2022)

AIICO Insurance Plc – N37.578 billion

- Claims paid in 2023: N37.578 billion (a 14.03% increase from 2022)

- Gross premium in 2023: N85.138 billion (a 22.49% increase from 2022)

- Claims as a percentage of gross premium: 44.14%

- Profit after tax in 2023: N6.086 billion (a 23.12% increase from 2022)

What operators are saying

The Managing Director of Tangerine General Insurance Plc, Mr Mayowa Adeduro, reacted to the development in an exclusive chat with Nairametrics.

He said that the sustainable high claims were due to the incidences of the economic downturn which made people ask for claims even for minor things.

- “We noticed that people’s maintenance culture has decreased due to the high cost of living spiked by inflation. The impact of inflation has made the number of claims go higher.

- “Inflation is a factor because the imported items have gone up due to a hike in the exchange rate and this affected the maintenance culture in Nigeria.

- “Disposable income has gone down, and people are struggling to maintain what they have. For instance, if vehicles are not maintained very well and an accident occurs, the insurance firm will still pay the claims.

- “Social vices such as armed robbery, kidnapping, and setting houses ablaze, among others are on the increase. All of these are having a negative economic impact on the economy. Due to economic hardships, fraudulence insurance claims are also on the rise. There are incidences where some people set their houses ablaze and come for insurance claims.

- “Low maintenance culture, job infidelity, theft of goods on transit, and breakdown of vehicles on the roads due to bad roads, all combined to help spike the increase in claims,” Adeduro said.

Speaking at its 12th Annual General Meeting held in Lagos, Adetola Adegbayi, Chairman of the Nigeria Liability Insurance Pool, said that hyperinflation has significantly increased living costs and insurance claims in Nigeria due to high dependence on importation.

She noted that the incidence of fraudulent claims is also on the increase due to the impact of inflationary trends and unemployment.

- “To abate this, the industry is advised to be proactive and more dynamic in its claims management, especially with the increased cover granted under the motor policy due to recently released rate review guidelines.

- “The need for the industry to be more dynamic and pro-active in its claims management and administration is therefore of the essence,” Adegbayi stated.

It’s Custodian and Allied Insurance Ltd (the general insurance company) and Custodian Life Assurance Ltd (the life insurance company). Custodian Investment Plc is the group which consists of other subsidiaries.

Who are the beneficiaries of the claims? The insurance companies should publush their names. I believe they are all rich people with high connections. The Nigerian government should make insurance payments (expecially for vehicles) optional. Any Nigerian that has confidence in the insurance companies will not hesitate to pay the premium but forcing every Nigerian to pay is unfair.