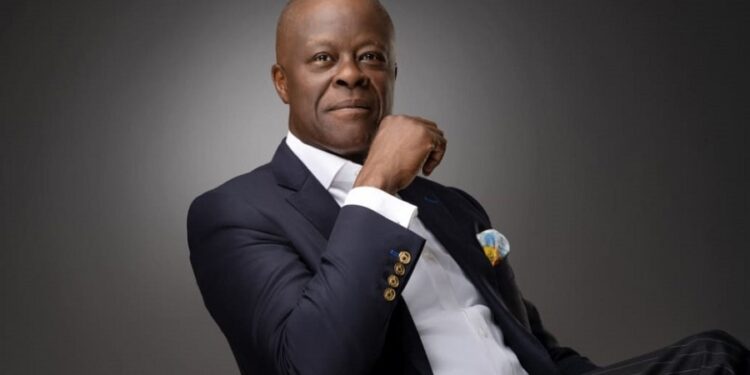

The Minister of Finance and Coordinating Minister of the Economy, Mr Wale Edun, has stressed that Nigeria is not in a position to depend on borrowing to fund the 2024 national budget.

He stated the country had to make tough choices in order to raise enough money to lower the budget deficit.

This was the minister’s opening statement to the joint Senate Committee led by Senator Sani Musa who is examining the 2024-2026 Medium Term Expenditure Framework and Fiscal Strategy Paper (MTEF-FSP) on Thursday.

The minister insisted that increasing investment in revenue-generating infrastructure was essential if Nigeria was to meet its annual budget obligations.

He added that the developed nations have raised interest rates in an effort to curb inflation and stabilize their economies.

He argued that it would be too expensive for a developing nation to gain access to foreign loans.

What the Minister says

Edun said:

- “Clearly, the environment that we have now, internationally, as well as nationally, we are in no position to rely on borrowing.

- “We have an existing borrowing profile. Our direction of tariff is to reduce the quantum of borrowing or intercepting deficit financing in the 2024 budget.”

The minister added:

- “As we know, we have all the figures and debt servicing and cushioning 98 per cent of government revenue.

- “The last thing you can think of is to pile up more debts. Government needs to not just maintain its activity, it needs to spend more.”

More insight

The MTEF/FSP 2024-2026 showed that the Federal Government will take fresh loans of N26.42tn between 2024 and 2026.

The document also indicates that debt payments will devour N29.92tn in three years.

Based on these numbers, the government of Nigeria anticipates borrowing N7.81tn in 2024, which is slightly less than the N8.84tn planned for the same year in the previous MTEF/FSP.

The Federal Government anticipates raising N6.04tn from domestic lenders and N1.77tn from foreign creditors in 2024.

Nigerian government’s planned borrowing of N8.54tn by 2025 is lower than the N10.62tn planned for the same year under the previous Medium-Term Economic Framework and Federal Spending Plan.

Also, the Federal Government expects to borrow a total of N6.42tn from domestic lenders and N2.12tn from overseas creditors in 2025.

Between domestic loans of N8.94tn and foreign debt of N1.13tn, the Federal Government expects to borrow a total of N10.07tn by 2026.

The document also indicates that the Federal Government is gradually losing its taste for international financing in favour of borrowing from domestic sources.

The Debt Management Office reported recently that Nigeria’s total public debt reached N87.38tn by June 2023.

This is a 75.29% rise from the N49.85tn reported as of the end of March 2023, a difference of N37.53tn.

The devaluation of the naira, which added nearly N13.38 trillion to the country’s external debt, and the Central Bank of Nigeria’s Ways and Means Advances to the Federal Government were the primary contributors to the rise in debt.

Recently, President Bola Tinubu stated that his administration is committed to stopping the vicious cycle of over reliance on borrowing for public spending and the resulting stress on the management of scarce government resources caused by debt service.