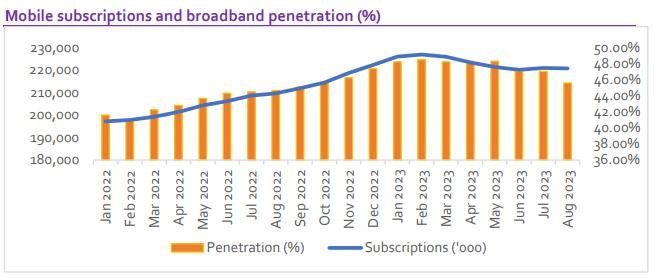

Based on new industry data from the Nigerian Communications Commission (NCC), Nigeria’s active mobile subscriptions decreased marginally by 0.07% to 220.71 million in August 2023 compared with 220.86 million in July 2023.

This indicates that the country’s mobile subscriptions decreased by 145,026 in August. This decline follows a modest uptick in July following four consecutive declines; 0.5% in June, 1% in May and April, and 0.4% in March.

A 335,744 decrease in the number of MTN subscribers, the largest operator by subscriber number, dragged down the overall industry numbers.

This brought MTN’s total active subscriptions down to 85 million from 85.3 million recorded in July 2023.

Globacom remained the second-largest operator in terms of subscriber numbers in August 2023, gaining 38,015 new subscribers in the month to reach 61.39 million overall subscriptions, up from 61.35 million in July.

Airtel, the third-largest operator by subscriber base, added 85,139 new subscribers in the month under review, to 60.1 million from 60 million in July while 9mobile added 36,543 new subscribers, bringing its total active linked lines to 13.79 million, up from 13.75 million in July.

Given the decline in active connected lines recorded by the telecom operators, the country’s teledensity, which measures the number of active telephone connections per 100 inhabitants living within an area declined to 115.63% from 115.70% recorded in July.

The slight decline in mobile subscriptions also led to a decline in broadband penetration to 45.57% from 47.01% in July.

Despite the marginal month-on-month declines in the number of subscriptions, we reiterate our positive outlook for the telecoms sector as we believe the declines will not have any material impact on the sector in the long run.

An increasing shift towards more advanced technologies, a relatively untapped internet market, an underserved rural population, and favourable demographics are all factors that suggest the Nigerian telecoms market still has untapped potential and will likely retain its foothold as Africa’s largest mobile market for some time to come.