The National Economic Council (NEC) has affirmed that the $3 billion emergency loan-for-crude oil that was secured by the Nigerian National Petroleum Company (NNPC) Limited in August would be deployed to stabilize the naira which has crashed in the parallel market and continues to be volatile in the Investors & Exporters’ (I&E) window.

This was made known on by the Nasarawa State Governor, Abdullahi Sule, while addressing State House correspondents after the 136th NEC meeting, which was held at the Aso Rock Presidential Villa, Abuja, on Thursday, September 28, 2023.

Sule said, “So, we are very confident and we still believe very strongly that with the plan that will come out and with all these items that have been listed on the improvement of revenue, the $3bn shall be useful to us down the line.”

What you should know

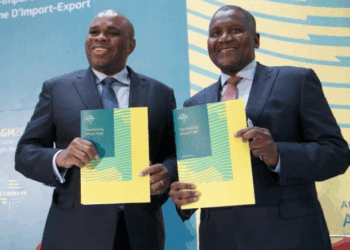

- Recall that on August 16, 2023, the NNPC announced that it has jointly signed a commitment sheet and Term sheet with the African Export-Import Bank (Afreximbank) for an emergency $ 3 billion crude oil repayment loan.

- This is not a crude-for-refined products swap but an upfront cash loan against proceeds from a limited amount of future crude oil production.

- The signing, which took place today at Afreximbank’s headquarters in Cairo, Egypt, was expected to provide some immediate disbursement that will enable the NNPC Ltd. to support the Federal Government in its ongoing fiscal and monetary policy reforms aimed at stabilizing the exchange rate market, as well as assist the NNPC in settling taxes and royalties in advance.

- The funds are expected to be released in stages or tranches based on the specific needs and requirements of the Federal Government.

- Meanwhile, Reuters a few days ago reported that AfeximBank was reaching out to oil traders to finance a $3 billion it pledged to NNPC weeks ago.

- It stated that AfreximBank is actively engaging with oil traders to secure a crucial $3 billion loan aimed at bolstering Nigeria’s state oil company and stabilizing the depreciating naira.

- The foreign exchange market has continued to be volatile with the naira hitting a record N1000/$1 sometime last week.

Sounds like we are borrowing to fight short term fires once again. But before passing judgement, It will be good to find out more about the kind of fiscal policies this loan will help support.

At this point, government has no choice. Emergency economists in Nigeria aren’t looking at long term solutions to our economic woes, but rather, are bent on harassing government on “palliatives”, that are short term. With oil receipts reducing by the day, and no end to the shortage in revenue, everyone is concerned about “give us money now”. It’s really sad, when you encounter people who should know better, talking about how it seems government is clueless

Government is clueless…

Meanwhile, there’s no point in planning long-term if folks cannot survive in the short-term. A SOUND (emphasis added) policy encompasses short- medium- and long-term measures, but perhaps that is by definition asking too much of Nigerian government(s).