In a rapidly evolving financial environment, the need for seamless, globalized fintech solutions has never been more paramount. Platnova, a groundbreaking fintech platform, aims to address this gap by providing comprehensive financial solutions tailored to the demands of today’s interconnected world.

Founded by Benjamin Oyemonlan, an esteemed recipient of the UK Global Talent Visa, Platnova emerges as more than just a financial app it represents a shift in how we perceive global financial transactions.

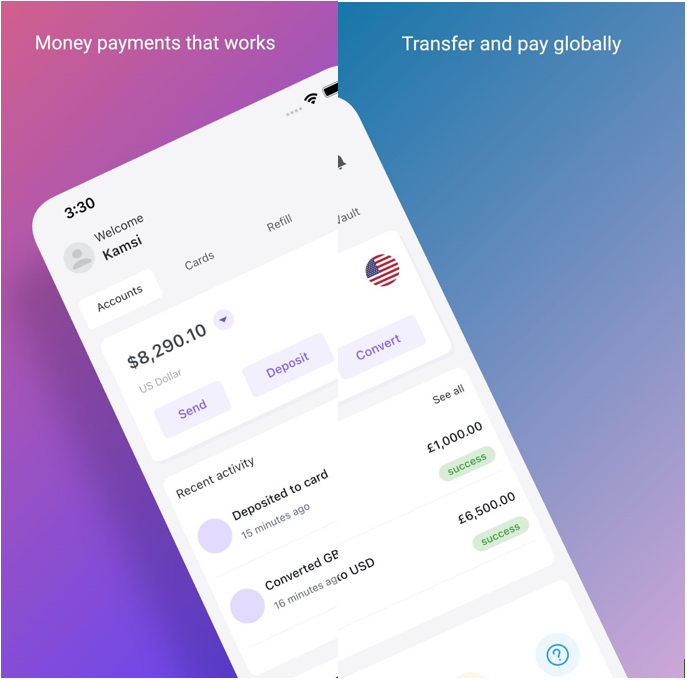

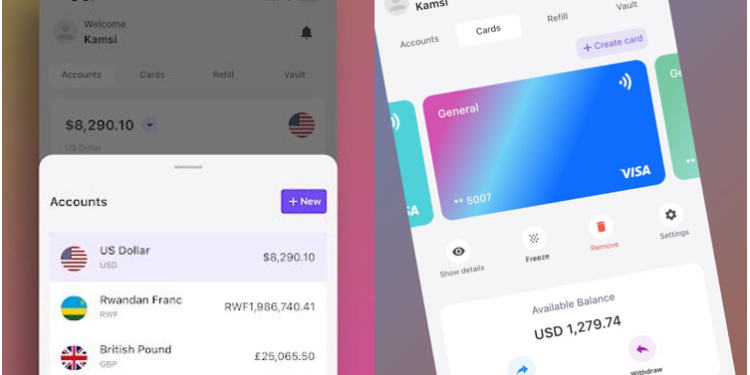

With an extensive array of features such as swift multi-currency payments, simplified bill payments, the ability to create and fund virtual cards, and convenient processes for purchasing gift cards and paying international tuition fees, Platnova positions itself at the cutting edge of fintech solutions.

At the heart of Platnova’s mission is a commitment to regulatory compliance and user security.

The platform boasts operations across the UK, US, Canada, Rwanda, and Nigeria, each region adhering to its respective financial regulatory standards.

This includes FINCen regulation in the US, MSB registration in Canada, a partnership with an FCA-regulated entity in the UK, and collaboration with a CBN-regulated partner in Nigeria.

- “In an increasingly globalized world, the need for a cohesive financial platform that caters to multiple regions and currencies is pressing. With Platnova, we aim to bridge this gap and offer users a seamless financial experience irrespective of borders,” shares Benjamin Oyemonlan.

The fintech sector stands on the brink of a new era, with solutions like Platnova leading the charge. As businesses and individuals alike seek more streamlined, globalized financial solutions, platforms like Platnova are poised to reshape the future of finance.

this news isnt enough who.is.the CBN regulated partner