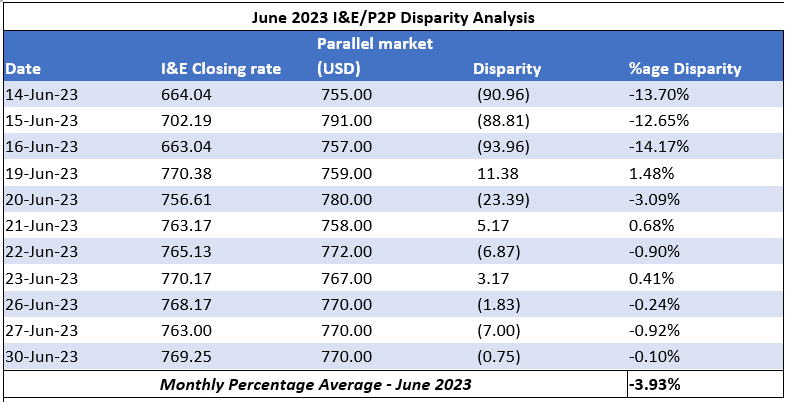

In its bid to harmonize Nigeria’s dual exchange rate system, the Central Bank of Nigeria (CBN) on June 14, 2023, introduced the FX-managed float system as the process of unifying the exchange rate.

The system aims to strike a balance between the official Investor and Exporter (I&E) window and the Parallel Market often referred to as the P2P market.

The move was hailed as a step towards economic stability and transparency.

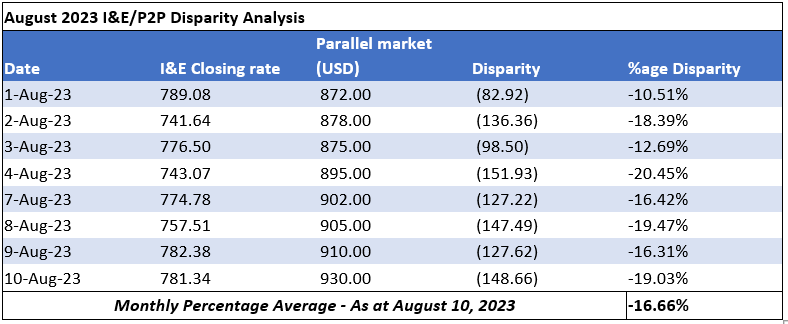

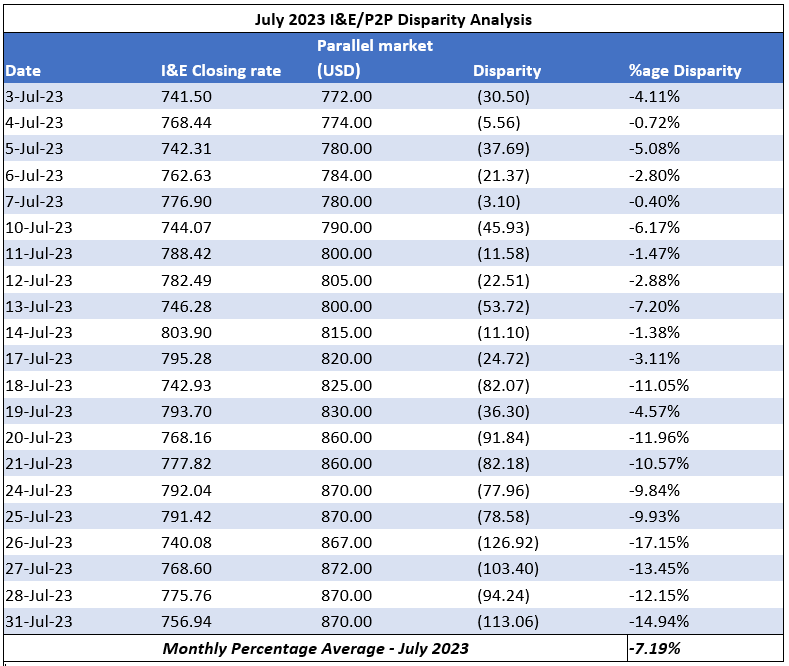

However, just two months into the unification process, several indicators suggest that the exchange rate unification might be facing significant challenges.

One of the primary objectives of exchange rate unification was to bridge the gap between the official and unofficial foreign exchange markets.

However, despite the efforts, this gap appears to be persisting.

The unofficial market rates continue to deviate significantly from the official rates, indicating that the unification process is yet to achieve its intended goal.

Market perceptions

In a market with varying perceptions and realities, the signs suggest that the market’s confidence in the exchange rate unification process is skeptical as shown by the low turnover in the foreign exchange market.

The persistently low trading volumes suggest that investors and market participants remain pessimistic about the market’s unification’s viability albeit in the short term as data from turnover reports bolster this viewpoint.

Despite the presumed benefits of exchange rate unification, it seems Nigerians with legitimate needs for foreign exchange are still encountering difficulties accessing FX from banks.

This raises concerns about the actual effectiveness of the policy in providing equitable access to forex for those who genuinely require it.

On several occasions, individuals’ inability to access forex from banks has come to light.

This underscores some of the limitations of the current system

The challenge of the prevailing low-interest rates in Nigeria’s market also forms part of the issue affecting the exchange rate unification currently.

According to Nairametrics reporting Goldman Sachs in one of its reports pointed out that there was the need to review deposit interest rates for N250 million and above;

- “As we have argued previously, introducing currency flexibility and/or easing restrictions on access to FX would very likely need to be accompanied by higher local interest rates (with prevailing short-term market interest rates currently deeply negative in real terms.” Goldman Sachs

The negative real return, as evidenced by the recent treasury bills auction, is also a deterrent to foreign investors from engaging with the naira.

This scenario is reminiscent of a lacklustre period in 2016 when the country struggled to attract foreign investment due to unattractive interest rates.

Market Realities

When we compare the current state of foreign portfolio investment (FPI) with historical data from stable exchange rate periods, it highlights the concerning trend.

As of today, FPI levels are notably lower than what was observed during times of exchange rate stability in 2014 and 2019, including 2016, which was deemed to be a tumultuous year.

Data from 2016, which was characterized by a similar exchange rate challenge, showed more favourable FPI figures.

Adding to the uncertainty surrounding exchange rate unification are mixed signals emanating from the CBN itself.

For instance, according to the Acting CBN Governor, the CBN is not trying to unify the FX rate, rather they are working to ensure market efficiency which takes time

- “We are not trying to unify the rate, we are encouraging the market to be efficient and that takes time, some of the volatility you are seeing is the market finding its level and reality of pent-up demand as current supply not sufficient, as we ease the demand, we see a more efficient market that runs.”

These types of policy ambiguity can exacerbate market apprehension and hinder effective policy implementation. As such there is a need for policy consistency and updated communication from the Apex Bank.

Going Forward

While there are reasons for concerns from all sides of the economic divide, about the viability of the exchange rate unification approach by the CBN, it is important to acknowledge that the process is still in its nascent stages.

The challenges highlighted above may take time to be fully addressed and resolved.

Expecting all issues and challenges to be addressed and resolved within two months of the operation of the system might seem overly optimistic.

The need for time and concerted efforts are necessary to ascertain the success of the policy shift.

It is only with patience, consistent monitoring, and continued necessary adjustments can Nigeria potentially reap the benefits of a unified exchange rate system that fosters economic stability and investor confidence.

Whenever USD shows strength in front of local currency all imported products including medicines, food and fuel goes high and get unreachable from ordinary people.