- Agents working for loan apps such as Palmcredit, Easybuy, Xcrosscash, and Newcredit have alleged that their employers force them to disburse loans to people who never applied for loans.

- These agents are given daily conversion targets, ranging from 20 to 35 people, and are provided with 270 potential borrower phone numbers each day.

- The agents also claim that borrowers often face undisclosed high-interest rates and misleading promotions on loan apps.

Some agents working for loan apps, which include Palmcredit, Easybuy, Xcrosscash, and Newcredit, have shared some sordid tales of how their employers allegedly made them start disbursing loans to people that never applied nor requested loans and would later begin to harass them for repayment with interest.

The mandate from their employers is to get loans disbursed to as many people as possible on a daily basis and by all means.

And that comes with a target that must be met: For some daily conversion is 20, while others have it as high as 35 and the target often becomes higher as the need arises, according to the agents.

Conversion in the loan app parlance means the number of people each agent disbursed loans to on a daily basis.

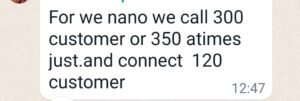

To arrive at the conversion, each agent is given 270 mobile numbers of potential borrowers every day, the first target is to achieve at least 90 connects, this means that out of those 270 phone numbers, some of which may be switched off or no longer in use, they must be able to talk to at least 90 people, from which they must get at least 20 people to disburse loans to.

Consequences of failure

According to some of the agents who spoke to Nairametrics under the condition of anonymity for the fear that the company might come after them, latching onto the high unemployment rate in the country, the operator of the apps stipulates termination of employment as the consequence of failure to meet the conversion target.

They, however, give agents the opportunity of being trained 3 times to learn more about how to cajole people into taking loans before being booted out if the targets are still not met.

- “Each day, we are assigned 270 numbers to call and we are expected to connect at least 90, that is, have communication with at least 90 customers. Some of the numbers could be switched off, and there could be hang-ups due to poor network, but you have to connect 90. The worse is the conversion rate target is not static, this week you could be asked to have a conversion rate of 35-40, and the next week it could be 45. Conversion here means the number of people who took loans through you,” one of the agents told Nairametrics.

Another agent whose daily conversion target is 20 said:

- “I am in the nano department that handles Palmcredit and Xcrosscash. We are expected to achieve 20 conversions daily and this sums up to 120 conversions in a week. If you missed your target in a week, you will be sent for training, if you missed another week, you will be trained again until the third time. If you miss the target a 4th time, your appointment will be terminated.

- So, to meet this target, agents most times do disburse loans to people that did not apply so far they have the loan apps on their phones and had taken a loan before. This is possible because we have access to the customers’ accounts on the apps. Again, on the apps, there are some settings that require the customers to stop automatic loans, but many don’t see it, which means that their account can be credited with loans at any time even when they did not apply.”

Shady interest rates

For these loan apps, it is not just about pushing out the loans, the motivation is the high-interest rates attached which the borrowers must pay. Curiously, the loan apps are not open when it comes to the rates charged on their loans, which often led to some borrowers getting stuck in the process of repayment.

One of the agents narrated:

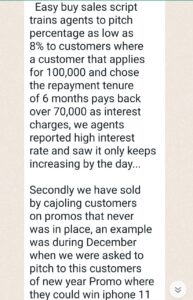

- “Easybuy sales script trains agents to pitch a percentage as low as 8% to customers whereas a customer that applies for 100,000 and chose the repayment tenure of 6 months pays back over 70,000 as interest charges, which is 70%. We have complained about the high-interest rate as it is also affecting us in getting conversions, but it only keeps increasing by the day.

- “Secondly, we have sold by cajoling customers on promos that never were in place, an example was during December last year when we were asked to pitch a New Year Promo to the customers, where they could win iPhone 11 pro max, but there was nothing like that. Maybe some people can win tomorrow anyways.”

Below are screenshots from the responses of agents( image attached)

Protest and appointment termination

Tired of the working conditions and what they described as unrealistic targets being set by their employer, some of the agents decided to stage a protest to demand better working conditions.

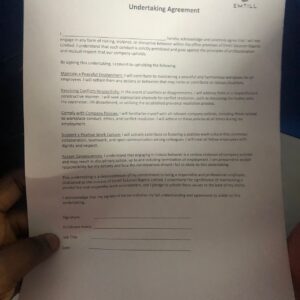

According to them, the management of the company handling the loan apps, Emtill Solutions Limited got wind of the plan and hurriedly issued an undertaking to be signed by all staff.

Part of the undertaken, a copy of which was sighted by Nairametrics, read:

- “I will contribute to maintaining a peaceful and harmonious workplace for all employees. I will refrain from any actions or behaviors that may incite or contribute to riotous situations.

- “I understand that engaging in riotous behavior is a serious violation of company policies and may result in disciplinary action up to and including termination of employment. I am prepared to accept responsibility for my actions and face the consequences should I fail to abide by this undertaken.”

While some of the agents refused to sign the undertaking and went on to stage the protest within the premises of the company, 7 of them were handed their employment termination letter the following day. A copy of the termination letter dated August 4, 2023 reads:

- “We are sorry to inform you that your appointment with EMTILL SOLUTION LIMITED as SALES AGENT is terminated with immediate effect, which is also your last working day. You are hereby required to hand over any company material, equipment, and documents in your possession to the Human Resources Department.”

When contacted, the Human Resource Manager at Emtill Mr. Olurankinse Oludotun confirmed that indeed that the agents were sacked for protesting.

According to him, they were made to sign an undertake which forbid them from staging any protest.

- “The content of the undertaken does not suggest that they cannot complain about the work, but it says they cannot make a protest while at work. What we are saying is that if there is a need for them to complain, they should use the official means to complain, not protest,” he said.

Company denies allegations

While denying the claims by the agents that the working condition in the company was bad, he admitted that “there is always room for improvement.” Oludotun also described every other allegation levelled against the company as ‘untrue’.

When asked why the company encourages the disbursement of loans to people that did not request it in order to meet targets, Oludotun said:

- “Well, you will agree with me that employees have a way of badmouthing the company. For an employee to say they are being mandated to push loans to people that did not request, it is very wrong.”

On the claims that the agents are being given unrealistic targets that force them to be pushed out loans by all possible means, the HR Manager said: “That is not correct.”

Between Emtill and Newedge Finance

While the apps operated by the agents are owned by Newedge Finance Limited, a loan app company fully approved by the Federal Competition and Consumer Protection Commission (FCCPC), the agents were employed by Emtill Solutions Limited, a company that prides itself as “a leading contact centre in Nigeria, that provides both inbound and outbound multichannel customer service.”

This suggests that Newedge Finance outsourced the management of its apps’ sales services to Emtill.

The agents, however, insisted that they were working for Newedge because all the customers they were dealing with were made to pay into Newedge finance accounts.

When contacted, the CEO of Newedge Finance Limited, Ms. Jessica Ugwuoke, denied any knowledge of the employees that were sacked but was evasive about the company’s relationship with Emtill.

- “Emtill is a totally different company, we are Newedge Finance Limited, that is all I can say,” she told Nairametrics.

On the list of approved digital lenders just released by the FCCPC, Newedge Finance has three loan apps registered to its name. These include Palmcredit, Easybuy, and Newcredit.

Loan apps users continue to lament

Aside from the issue of harassment and defamation of borrowers by loan apps which prompted the FCCPC in collaboration with other sister government agencies to come up with the registration framework for digital lenders, many Nigerians have continued to lament different atrocities of loan apps in the country.

Now common across several loan platforms in the country is the practice of forcing loans on people.

Unfortunately, this is not peculiar to unregistered loan apps as many of the currently registered apps are also found guilty of this sharp practice.

Sharing her experience with one of the loan apps, a victim, Joseph Oluwakemi, said:

- “I was a victim of Hen loan last month. They paid a loan I never requested into my account, I complained and they took back the money. After the seven days lapsed they started threatening me for the interest. The agent tagged my picture with my BVN and sent it to all my contacts, describing me as a criminal.”

Borrowers are also lamenting the high-interest rates being charged by these loan apps, which oftentimes, are not fully disclosed before the loans are taken.

Many often realize in the course of repayment that they have to pay more than the interest rate stated before they took the loan.

The accusations about xcrosscash owned by newedge is very true they disbursed loan without your knowledge,high interest rate and hidden charges you cannot see..and you get threaten a day to your due date…they should be investigated properly pls

Shebi na una dey pay Dem back 🤣

Newage loan app which operates ocash and opay are the most devilish company on earth. . Heartless set of people. There is no iota of truth in their operations.

Yes o, that was what they did to me too o. I didn’t apply for a loan they started harassing me with calls from different numbers. Please, help us to address this nonsense and put a stop to it all. The government should see to this and curb their foolishness

I’m facing the same challenge now, I used they app once and cleared debt only for a month later I was told I had a loan to repay ,loan 100+ with over an interest of 66,000 .Omo I was lost at first I thought it was a scam because I didn’t have the app so I had no knowledge of any loan ..this people had mind to auto debit my account and still threaten me on top till date,they claim to be licensed by the CBN but I think proper investigation should be done especially on the NEWCREDIT

I have been a victim of PalmCredit. I always advise my friends not to use their apps to get loans—high-interest rates and late charges, hell. I took a loan of 27k from them in June, then on the due date, I partially paid 9k to pay the balance when I get my salary in 10 days. However, I still get threatened via calls from them…And I angrily turned off my phone…then they came on my WhatsApp. I wish I can share screenshots of their messages here. On getting my salary to pay back, I was shocked that my late fee has grew up to 12k in just 10 days! I was so mad!! but I paid for it and deleted their app. But guess what? the next day, they started calling me again that I have a very good offer, I should get the app and take it. I warned the dude not to ever call my line again, then he hung up. A few days later, I got a call from them again, asking me to take a loan, the caller quickly hung up because of my angry response.

I wonder how they manage to still do business in Nigeria. They are a very serious loan shark.

I am their lastest victim. They keep harassing one and the Federal Government is not doing anything tangible

I used easybuy bought itel recently and choose 5 months for repayment. I paid #20,000 down payment out of #46,000 of the price of the phone. I paid first month repayment but because I defaulted to pay for 2nd months, all apps on the phone were locked.

They have threatened and I frankly told on phone, if my call in not unlock, I will not pay any money. I purposely bought the phone for a business.

I will do them shege!!!!

They are useless set of company they use worker like slave and if the person speak the truth they terminate appointments.make them uselsss

Na Una the pay them back 🤨, I no send their papa.. How will you ask me to payback twice the amount you disbursed.

Image one company in control of 4/5 loan app, exhaust money from people in different angles,I am a victim as well,after reading all this I now know am owing 2app from the same company lol.

The funniest part of it is that,when you see the money in the app you can’t adjust the amount and the interest is very very high,all this payment are weekly and you will not see the interest rate review before disbursement(palmcredit,xcrosscash,nairaloan)no matter the amount you collected from them,they want to shock you and if you are not strong enough, you can commit suicide.

There is no crime in collecting loan but this app are killing people gentle and faster in which the FG have not notice this, FG Nigerians needs loan’s but not this killers loan apps thank you.

Well done you have written this exposé shouldn’t you take an active stance? Maybe all of us should form a group to bring Palmcredit DOWN!!

Exactly,one was threatening me and I told him I dint steal,I only took loan which I will pay,that I won’t jump inside lagoon.Their agent are very good with psychological distraughtment,that is if you give them the chance,me I told them to come up with an ease repayment plan to enable commit to repay them,that I won’t Commit sucide.Bring down palmcredit, newcredit, xcrosscash,nairaloan,they are worst than Eagle cash

The Federal Government (ICPC and EFCC) should investigate and prosecute them for financial crime.

Government is not doing enough to deal with this people ,they should create an avenue or a customer service line to report them ,all the mobile phone number by the agents are registered ,they can you that to track the agent, locate the office and sanction them accordingly, Wema bank is a major bankers to them ,CBN should warned them on need to stop assisting with loan collection from the loan shark ….

Wema bank and sterling bank

The truth is that our government is not doing anything to protect its citizens from these apps with their high rate interest loans. How can you give a loan for a week and charge as high as N80k interest for a week.

Very outrageous.

That’s what palmcredit did to me,the first time I applied for a loan on their app the loan was declined but to my surprise after some months I tried again and I was told that I have already take a loan.

Jesus christ

intterest is too cost

Everything here is nothing but the truth. I ones worked with Newedge. They definitely can’t deny it’s not an allegations but the truth