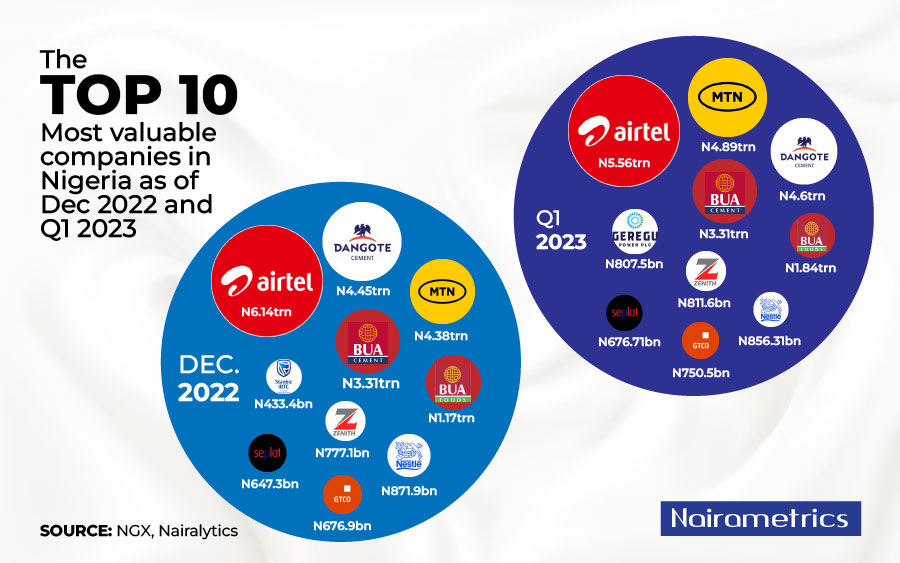

Nigerian telco giants, Airtel Africa, and MTN Nigeria led the list of most valuable quoted companies in Nigeria in the first quarter of 2023, with market capitalizations of N5.56 trillion and N4.89 trillion, respectively.

This is according to data tracked from the Nigerian Exchange (NGX).

The list of most valuable companies also included cement-producing giants, Dangote and BUA Cement, as well as Consumer goods producers, BUA Foods and Nestle Nigeria.

Zenith Bank, Geregu Power, Guaranty Trust Holdings, and Seplat Petroleum rounded up the list of the top ten most valuable companies in the country.

- The elite top ten firms on the NGX accounted for a significant chunk of the equities market capitalization.

- Specifically, the ten companies are valued at N24.09 trillion as of 31st March 2023, accounting for about 82% of the total market value.

In dollar terms, the total valuation of the companies is around $31 billion (using N765/$1). This compares to $51.6 billion using the former exchange rate of around N467/$1.

How the market performed

The Nigerian stock market rallied by 5.82% in the first quarter of 2023, capitalizing on the gains recorded in the previous year (2022: 19.98%).

- The All-Share Index had opened the year at 51,251.06 basis points and closed the review quarter at 54,232.34 points.

- In the same vein, the market capitalization gained N1.63 trillion between January and March 2023 to close the quarter at N29.54 trillion.

- The market had enjoyed a strong positive start to the year, registering an 8.9% year-to-date gain as of the 9th of March 2023, before it began to decline, reaching 5.82% by the end of the quarter.

- The hike in interest rates announced by the CBN against the backdrop of the fall encouraged investors to allocate their capital to alternative high-yielding fixed-income instruments.

MTN overtakes Dangote Cement to 2nd position

Nigeria’s telco giant, MTN Nigeria overtook Dangote Cement as the second most capitalized company in the Nigerian equities market in Q1 2023.

- MTN Nigeria, which was valued at N4.38 trillion ($5.75 billion) as of the end of 2022, recorded a growth of 11.6% to stand at N4.89 trillion ($6.39 billion) by the end of March 2023, surpassing the 3.4% growth recorded in the share value of Dangote Cement.

- Notably, the market value of Dangote Cement increased from N4.45 trillion at the beginning of the year to close the quarter at N4.6 trillion ($6 billion), representing an increase of N153.4 billion, compared to N508.9 billion for MTN Nigeria.

- However, the second position remains heavily contested between the two companies, as they tend to alternative month-in-month-out.

Telcos remain dominant

The two quoted telecommunication companies in the Nigerian equities market remain the most capitalized companies in the country, jointly accounting for 35.4% of the total market.

- The impressive growth in the valuation of the telcos is not far-fetched, considering the increased usage of internet services across the world and in Nigeria after the COVID-19 pandemic in 2020.

- Mobile and internet subscribers have increased significantly in the last two years. According to data from the Nigerian Communications Commission (NCC), total GSM internet subscribers rose to 156.4 million as of February 2023, compared to 125.7 million as of the end of 2019.

- In the same vein, the telcos have also printed impressive numbers in their financials. MTN Nigeria reported revenue of N2.01 trillion in 2022, an increase of 21.6% from N1.65 trillion recorded in the previous year. Net profit also increased by 21.1% to N361.5 billion.

- Airtel Africa also recorded a 12.1% year-over-year revenue increase for the nine months ended December 2022 to $3.91 billion, although profit after tax only increased marginally by 1.7% to $523 million in the same period.

Below are the most valuable companies as of March 2023:

Biggest gainers

In terms of absolute value, BUA Foods gained N666 billion to stand at N1.84 trillion ($2.4 billion), followed by MTN Nigeria, with an increase of N508.8 billion to stand at N4.88 trillion, while Dangote Cement’s market value grew by N153.4 billion to stand at N4.6 trillion.

Geregu Power joined the list of most valuable companies for the first time as its market capitalization crossed N807 billion ($1 billion).

Zenith Bank also joined the trillion naira club, better known as SWOOTs during the week, becoming the first bank to be valued at over one trillion naira. All the companies on our list are worth over one billion dollars.