- The ASUU President said the recently signed Students Loan Act is impracticable and unsustainable.

- He said more than 90% of students won’t meet the “stringent requirements” to access and repay the loan.

- Osodeke asked President Tinubu to convert the loans to grants for the poor students as they will have a heavy burden of paying back within 2 years or they will go to jail if they fail to do so.

The Academic Staff Union of Universities (ASUU) has dismissed the recently signed Students Loan Act by President Bola Tinubu, asserting that the loan is impractical and unsustainable.

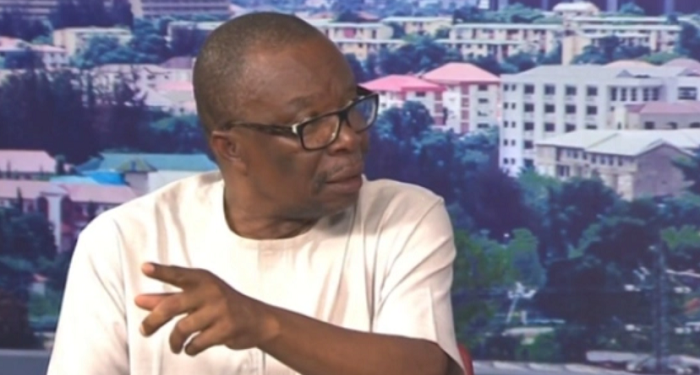

ASUU’s National President, Professor Emmanuel Osodeke, made this known during an appearance on the Sunday Politics program on Channels Television. Osodeke emphasized that with over one million students in Nigerian public universities, the loan scheme falls short of providing adequate tuition coverage.

Not practicable

- Osodeke said, “The idea of student loan came in 1972 and it was in a bank established. People who took loans never paid, you can go and investigate. In 1994, and 1993, the military enacted Decree 50 also set up a Students’ Loan Board. The National Assembly domesticated it in 2004 and within a year, it went off. The money disappeared. We want to see how this one will be different.”

The ASUU President said the conditions for the loan are “not practicable”, adding that more than 90% of students won’t meet the “stringent requirements” to access and repay the loan.

- He said, “We, as a union also did research of countries all over the world, of people who have benefited from this loan, they were committing suicide. Recently, (President Joe) Biden is trying to pay back the bank loans of some who borrowed in the US.

- “It is better to look for alternative means of funding education than to encumber students whose parents earn N30,000 a month with a loan.”

Convert the loan to grant

Speaking further on the Students Loans Act, Osodeke asked President Tinubu to convert the loans to grants for the poor students as they will have a heavy burden of paying back within 2 years or they will go to jail if they fail to do so.

- He said, “This would have been better if we are giving it to those set of students who are very poor, it should be called a grant, not a loan.

- “It should be called a grant since it is coming from the Federation Account and not that (after) these people have access to it and when they are graduating, they have heavy loads behind them and within two years, if they don’t pay, they go to jail. That’s why we’re talking about collective bargaining, you have views from all the sides.”

What you should know

Recall that on Monday, June 12, 2023, President Bola Tinubu signed into law the Student Loan Bill in fulfillment of a promise he made during his campaign.

The Spokesperson for the Federal Government, Dele Alake, who made the announcement, said the funds will be domiciled in the Ministry of Education and will only be accessed by indigent students of tertiary institutions.

The student loan bill sponsored by the Speaker of the 9th House of Representatives, and now the Chief of Staff to the President, Femi Gbajabiamila, which provides for interest-free loans to indigent Nigerian students, passed the third reading at the House, about 2 weeks ago.

The law is to provide easy access to higher education for indigent Nigerians through interest-free loans from the Nigerian Education Loan Fund.

While I like the idea of giving it as a grant, but I foresee a challenge. The challenge is that the children of the poor will not be able to get the grant because of the corruption in the system. The grant will either go to the sons/ daughters of the rich who can afford to bribe government officials, or to children who are related or acquaintances of political party members. The grant will be politicised and if you don’t know people in the ruling party in your local government or state or you are able to bribe your way through, it will be impossible to get your grant approved.

I’m just in support of the ASUU’s view. With the track record of the policy failure, Nigerian students can survive this Loan a review is needed here.

Thank you!

Well, the intended beneficiaries wouldn’t be allowed to access the Loan, therefore it is no effect rather a new Modes of devastating the National Economic within the Small number of bougeousies, As such the Federal Government should have calculate the maximum amount and deposit same as Tuition on behalf of the Students. Other it wouldn’t see the Light f the Day.