Article Summary

- The Monetary Policy Committee (MPC) of the Central Bank of Nigeria (CBN)

raised the Monetary Policy Rate (MPR) by 50bps to 18.5% from 18.o% at its 3rd

Monetary Policy Committee (MPC) meeting for the year 2023. - However, the MPC decided to retain all other parameters, keeping the

asymmetric corridor at +100/-700 basis points around the MPR, the CRR at

32.5%, and the Liquidity Ratio at 30%. - We retain our view that the continuous hike in rate will keep constrain the

country’s fragile output growth while having a minimal effect on inflation and

attracting foreign inflows.

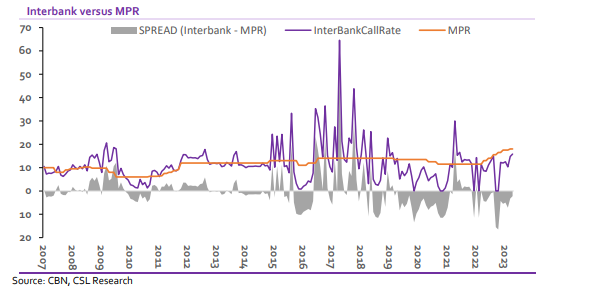

At the end of the third Monetary Policy Committee (MPC) meeting of 2023 yesterday afternoon, the MPC raised the MPR for the seventh consecutive time by 50bps to 18.5% from 18% previously.

The CBN Governor noted that the decision to continue its contractionary monetary policy approach remains to stem inflation. Headline inflation rate was up 18bps to 22.22% in April 2023 from 22.04% in March 2023.

The committee noted that loosening its monetary policy stance was not considered because it would

compound the inflationary pressure and trigger further macroeconomic instability.

According to the CBN, empirical counterfactual evidence of a ‘do-nothing’ approach projected the inflation would have been 30.48% instead 22.22%. We however retain our view that the impact on growth appears worse than the impact on reducing inflation.

High inflation

Inflation continues to play a major part in the decision of the MPC to retain its hawkish monetary policy approach. In this May MPC meeting, the MPC noted the marginal rise in headline inflation (year-on-year) in April 2023, to 22.22%, from 22.04% in March 2023, an 18bps increase.

This increase was attributed largely to a continue rise in the food component to 24.61% in April 2023, from 24.45% in March 2023, while the core component also rose to 20.14% in April 2023, from 19.86% in March 2023.

On a month-month basis, headline inflation increased to 1.91% in April from 1.86% in the preceding month. The committee noted that while the continued rise in headline inflation remained a significant problem confronting the economy, other macroeconomic variables are moving in the right direction, despite observed

headwinds.

The committee opined that headline inflation remained high with increased expectations of price growth, due to the perennial scarcity of PMS and ongoing discourse around the removal of fuel subsidy by May 2023.

Nigeria’s headline inflation rate recorded its first moderation in December 2022, with headline inflation (y/y) declining to 21.34% in December 2022 from 21.47% in November 2022, driven by a decline in food inflation (-39bps).

In our view, we reiterate that the continuous rate hike will further hamper growth. We expect the hike in MPR rate to continue to have little effect on inflation numbers, as issues relating to the supply factors that continue to pressure inflation numbers remain largely unattended to.

Capital flows

The challenge of capital flight has remained a key concern for the committee. The elevated interest rates by global central banks have continued to reinforce flight to safety as foreign portfolio investors shed their investment portfolio in emerging markets and developing economies in favour of safer haven advanced

economies.

We note, that concerns around foreign exchange stability and liquidity will continue to weigh on foreign portfolio inflows. No fresh foreign capital inflow, just few dividend re-investments.

Economic Growth

Nigeria’s real Gross Domestic Product (GDP) grew by 2.31% in the first quarter of 2023 compared with 3.11% in the corresponding quarter of 2022 and 3.52% in the preceding quarter (Q4 2022).

The economy moderated on its current recovery trajectory, posting positive, albeit lower growth, for the tenth consecutive quarter, in spite of a multitude of headwinds to its full recovery.

The committee acknowledged the consistent growth in the non-oil sector, particularly services and agricultural sectors; progressive uptrend in economic activities across several subsectors; and sustenance of broad-based support by the Bank in growth enhancing sectors.

According to the CBN, projections showed that output growth recovery is expected to continue reasonably in 2023, given the significant improvements in the Composite Purchasing Managers’ Index (CPMI), which rose to 51.1 index points in April 2023 from 42.6 index points in March 2023.

We however reiterate our position that the aggressive rate hikes will likely hamper the country’s growth negatively in the long run while having a minimal effect in combating inflation and attracting foreign inflows.

Stock Market

We do not expect a negative reaction to the latest hike, given positive corporate actions and disclosures, especially on the heavily weighted stocks that continue to boost investors’ sentiments. we expect the equities market to remain mildly bullish as investors as investors re-invest dividends.

Conclusion: In line with our expectation of a slower rate hike in H1 2023, the CBN has undergone a cumulative 200bps rate hike since the start of the yea