Article Summary

- Mutual fund unit holders in Nigeria showed steady growth in 2019, with dominance by money market funds, followed by equity funds and bond/fixed income funds.

- The year 2020 saw a shift in investor behavior due to uncertainties, with money market funds and bond/fixed income funds attracting more unit holders, while equity funds experienced a slight decline.

- In 2021, the mutual fund industry rebounded, with a renewed sense of confidence. Money market funds remained popular, and real estate funds experienced remarkable growth.

In the dynamic world of investing, numbers often reveal compelling tales. Behind every statistic lies a story waiting to be explored and understood. In this article, we delve into the fascinating journey of mutual fund unit holders, observing their rise and fall over the years.

2019: The Year of Steady Growth

In 2019, the total number of mutual fund unit holders in Nigeria stood at 430,768. Money market funds, with an impressive 220,608 unit holders, offered stability and liquidity and dominated the landscape.

- Equity funds stood at 55,838 unit holders, reflecting the market’s confidence in stock investments.

- Bond/fixed income funds, with 31,794 unit holders, provided a safe haven for those seeking secure returns. The stage was set for a promising future.

2020: An Unexpected Turn

The year 2020 brought unforeseen challenges that reverberated across the global economy. Despite the turbulence, total mutual fund unit holders grew, reaching 441,265. However, this growth was not evenly distributed among the different fund types.

Equity funds experienced a slight decline to 53,818 unit holders, as uncertainties caused investors to adopt a more cautious approach.

Money market funds surged ahead, attracting 235,208 unit holders seeking stability amid the market volatility. Bond/fixed income funds also witnessed a significant increase to 45,264 unit holders, as investors sought refuge in safer investments.

2021: The Resilient Rebound

As the world gradually recovered from the disruptions of the previous year, the mutual fund industry regained momentum in 2021. Total mutual fund unit holders climbed 12.09% to 494,600, signalling a renewed sense of confidence.

Despite a slight decrease in equity funds to 53,748 unit holders, other fund types displayed promising growth. Money market funds attracted 240,222 unit holders, reflecting their continued appeal as a safe harbour. Bond/fixed income funds, with 43,107 unit holders, maintained a steady position.

Surprisingly, real estate funds experienced a remarkable surge, expanding from 8,717 to 36,787 unit holders, suggesting a growing interest in this asset class.

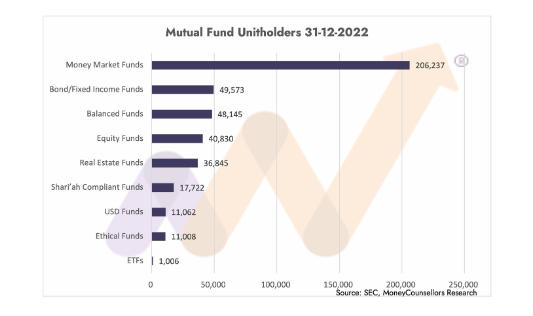

2022: A Tale of Challenges and Adaptation

While the year 2022 witnessed a 14.59% decline in the total mutual fund unit holders to 422,428, it served as a reminder that the investment landscape is ever-evolving.

Equity funds experienced a significant setback, dropping 24% to 40,830 unit holders, reflecting heightened market volatility. However, other fund types were not spared. Whilst money market funds remained popular as investors stayed in the safety of stability amidst uncertain times, the total number of unit holders dropped 14% to 206,237 unit holders.

Bond/fixed income funds rebounded 15% to 49,573 unit holders, reaffirming their appeal. Real estate funds held steady, showcasing stability with 36,845 unit holders. With the second year of data available, unit holders in USD fixed income funds surged 31% to 11,062 from 8,418 unit holders and balanced funds unit holders fell 40% to 48,145 from 80,906.

Beyond the Numbers

Looking beyond the statistics, these fluctuations tell a deeper story. Investors are dynamic beings, constantly adapting to market trends and navigating through economic cycles.

The shifts in total mutual fund unit holders demonstrate the impact of external factors, such as global events, investor sentiment and the challenges in the Nigerian economy. It is crucial to recognize that investment choices are influenced by numerous variables, from economic indicators to individual risk appetites.

In conclusion, the journey of total mutual fund unit holders over the years encapsulates the ebb and flow of the investment landscape. From a seemingly steady growth of 2019 to the unexpected challenges of 2020, followed by what seemed a resilient rebound in 2021, and finally, the adaptability showcased in 2022, this narrative highlights the ever-changing dynamics of the mutual fund industry. Yet figures have struggled to cross the 500,000 unit holder mark.

While Money market funds, with their stability and liquidity, have consistently attracted a significant number of unit holders, indicating their enduring appeal, bond/fixed income funds also offer a safe haven for risk-averse investors, and their popularity fluctuates based on market conditions (though we add a caveat – currently there is limited transparency in the valuation methods of Nigerian bond/fixed income funds).

Real estate funds, often overlooked, have shown significant growth, reflecting the increasing interest in this alternative asset class. And due to the increased volatility and depreciation of the local currency, UDS fixed-income funds have leaped.

The one stand-out showing consistent growth has been Shari’ah-compliant funds which have grown consistently over the last 4 years from 15,625 unit holders in 2019 to 17.722 unit holders in 2022.

Beyond the numbers, this story emphasizes the importance of understanding the underlying factors that influence investment decisions. Global events, economic indicators, and individual risk appetites all play a role in shaping the investment landscape. Investors must stay informed, adapt to changing circumstances, and make informed choices that align with their financial goals.

As we move forward, it is crucial to recognize that investment journeys are not solely defined by unit holder numbers. They are also shaped by the quality of fund management, transparency, and investor education. By focusing on these aspects, the mutual fund industry can continue to attract and retain investors, fostering a robust and resilient ecosystem.

View the chart movements of unit holders for all sectors here