Nigerian workers living abroad have remitted a staggering $19.8 billion back home in 2022 a slight increase from $19.3 billion in 2021.

This was a 7% increase from the previous year, but still below the 2018 peak of $24 billion.

This amount represents about 5% of the country’s gross domestic product (GDP) and is a vital source of foreign exchange and income for many households.

This figure, obtained from Central Bank balance of payment data for 2022, highlights a significant recovery in remittance inflows and showcases the resilience of Nigeria’s diaspora despite the challenges posed by the COVID-19 pandemic.

The substantial influx of funds from overseas plays a vital role in supporting the country’s foreign exchange reserves and contributing to household incomes. Let’s delve into the details of this encouraging trend.

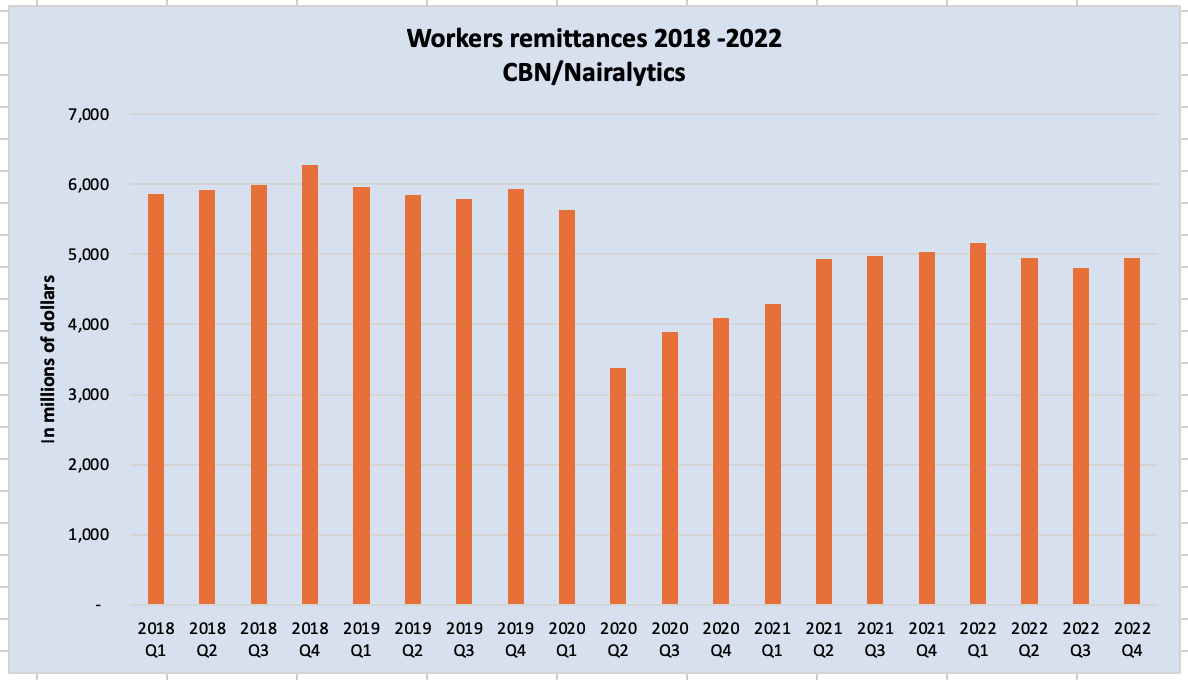

2018-2022

Source: CBN/Nairalytics

Trends in the data

The CBN data shows that remittances fluctuated over the past five years, reaching a peak of $6.3 billion in the fourth quarter of 2018 and a low of $3.4 billion in the second quarter of 2020. ‘

- The decline in 2020 was largely due to the impact of the COVID-19 pandemic, which disrupted global travel and economic activities.

- However, remittances recovered in 2021 and 2022 as the world gradually reopened and vaccination rates increased.

The year 2022 commenced with a remittance amount of $5,159 million in Q1, indicating a positive trajectory from the previous year.

- However, as the year progressed, there was a slight decline in remittances, culminating in $4,948 million in Q4 2022.

- Nevertheless, the cumulative amount for the year reached an impressive $19.8 billion, reflecting a substantial recovery compared to the previous year.

The main sources of remittances for Nigeria are the United States, the United Kingdom, Canada, Saudi Arabia, and other countries in Europe, Asia, and Africa.

- The CBN data does not provide a breakdown by destination, but according to the World Bank, about 60% of remittances to Nigeria come from the US and the UK.

- These two countries host the largest Nigerian diaspora communities, estimated at over 5 million people.

Why remittances may be falling

The remittance market, like many other sectors, experienced significant disruption due to the COVID-19 pandemic.

- In 2020, remittances took a hit, plunging to as low as $3,384 million in Q2. Lockdowns, travel restrictions, and economic uncertainties worldwide contributed to this decline.

- One of the reasons for the lower inflow was the exchange rate depreciation of the naira, which reduced the value of remittances in local currency.

- Another factor was the capital controls and other unpopular policies of the Central Bank of Nigeria (CBN), such as the Naira4Dollar scheme and the restriction of mobile money operators from receiving remittances.

- These policies were meant to encourage the use of official channels and boost foreign exchange reserves, but they also discouraged some Nigerians abroad from sending money home.

As a result, some of the remittances may not have been captured by the CBN, as Nigerians preferred to remit via other unofficial channels, such as cryptocurrency platforms or informal networks.

- However, as global conditions improved and economies began to recover, Nigerian workers abroad showed resilience by steadily increasing their remittance amounts, ultimately surpassing the pre-pandemic levels in 2022.

- The CBN and other stakeholders have been working to improve the efficiency and affordability of remittance channels, such as mobile money and digital platforms.

- The CBN also introduced a scheme in 2020 to incentivize remittance recipients with an extra N5 for every $1 received. These measures are aimed at enhancing the benefits of remittances for Nigeria and its people.

Why remittance is important

Remittances are not only important for Nigeria’s economy but also for its social and political development. Many Nigerians in the diaspora are involved in philanthropic and humanitarian activities in their home country, supporting education, health care, infrastructure, and entrepreneurship.

- In 2018, the Nigerian government launched the Diaspora Commission to facilitate the engagement and contribution of Nigerians abroad to national development.

- Remittances are expected to continue to grow in the coming years as Nigeria’s population and diaspora expand.

- The japa trend which has seen millions of young Nigerians exit the country is likely to keep remittances as a major source of forex inflow for the country.