Article Summary

Black tax can be managed by taking the following steps:

- Have a budget: Allocate a percentage of your income to black tax and stick to it.

- Learn to say no: Not every request for money is necessary, learn to say no to those that don’t add value.

- Invest in your relatives: Invest in their education or business to limit handouts in the long-term.

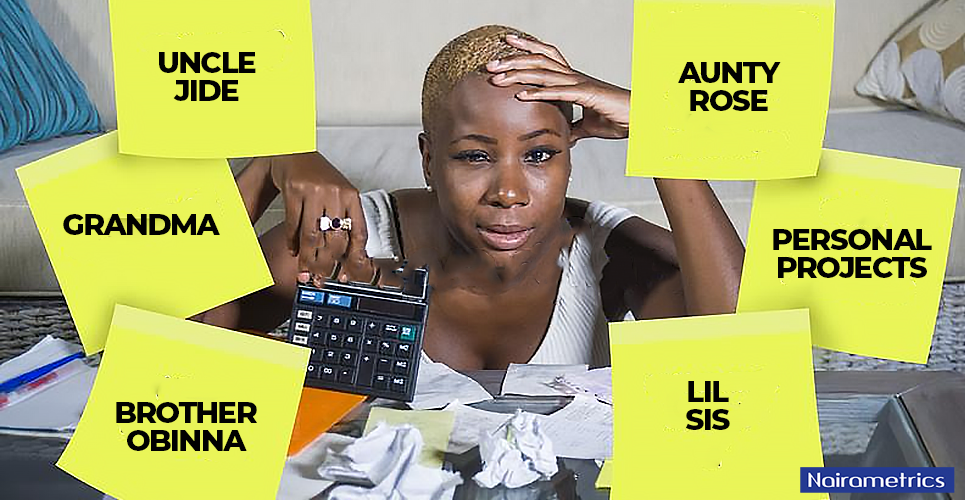

It is the first day of a new month, and the first message that greets you is from your younger sibling: “Good Morning Ma, How’s work?” You automatically know that this message is not about your work but an invitation to periodic “billing,” as Nigerians would call it. You’re not surprised because you know it’s a monthly thing; that’s black tax.

Black tax is a term that originated in South Africa. It simply describes the financial obligations of an individual towards their immediate family and, to some extent, friends and acquaintances. Black tax is said to be an age-long practice that found its footing when migration to other parts of the world became a thing, especially due to economic reasons. People migrate for different reasons, but at the top of the list includes securing a future, good pay, and education, among other factors.

Black tax is prevalent among Africans, especially those who are in the diaspora; this explains why the term “Black” is used to describe it. Recently, black tax is no longer a diaspora thing but for young individuals who are gainfully employed or entrepreneurs living in the best part of a country, state, local government, or even area. It is usually common among individuals who are more financially stable and are from middle or low-income families. It comes in different forms and could be a support for payment of fees or contribution towards a project, but it’s mostly in financial form.

A show of support or burden?

There’s actually a thin line between different things in the world, and black tax is not exempted.

There have been several conversations on black tax on what it truly is, especially for individuals who are outside the shores of their country and continent. Black tax is now a feature in the budget of an average Nigerian because “billing” will always come. For some people, it’s a thing done out of free will, empathy, and the joy of helping others, especially family members. However, for others, it’s a thing of compulsion that affects not just the finance but also the mental health of such a person.

Black tax, to some people, is a way of paying back a good deed that was done to them. For some individuals, moving out to a place to better their lives are the collaborative effort of people who contribute to making that happen. With this, the person owes a sense of gratitude whenever a financial obligation is made to those individuals.

For some, it’s a way of lifting others like the famous “we rise by lifting others” mantra. Black tax, to them, is investing to ensure that the next person also gets equipped and will be able to stand on their own, thereby lessening the demand on them. Also, some see it as a way of helping others whom they know do not have the same financial or earning power as them.

On the other hand, black tax is a burden. Individuals living abroad, most times, must work extra hard and work extra hours just to pay their bills and other expenses. For some, working extra hours is a way to cover up for black tax at the end of the month, as there’s a general notion that people who move abroad are always rich.

For a very long-time black tax has also created a sense of entitlement for some individuals, especially among family members. They go as far as demanding money even for some inappropriate things that they could cover for themselves. Individuals living abroad would sometimes take to social media to talk about black tax and be terrified once the month is about to end due to the numerous messages and calls that will follow.

A Way Out?

While it is important to help one’s family and others, it’s also important to take care of oneself and know when to take a break. Some individuals spend as high as 40% of their monthly income on black tax, among other expenses. The following are ways one can deal with black tax:

Have a budget

A budget for black tax is essential for anyone. It helps an individual to know what percentage is to be spent every month. Besides having a budget, it’s important for one to always stick to it, as budgets are mere projections and will only be a true reflection when the individual sticks to it. A budget is also similar to setting boundaries. An individual who budgets 5% of their income for black tax is setting boundaries and knows that once exhausted, it’s until the following month.

Learn to say NO

In some instances, black tax is used for things that don’t add value to the individual and the receiver; some persons only want money because “They live abroad.” When you learn to say no to some things as an individual, it helps you to save and invest your money.

Black tax, in its entirety, is not about billing, but the scope in recent times has changed, and some have used it as an avenue to stifle people of their personal growth.

Invest in your relatives

Investing in some sort of business or education would limit, in the long term, the number of handouts you give them. Teaching them how to fish rather than giving them fish helps in the long term but understandably costs more in the short term.