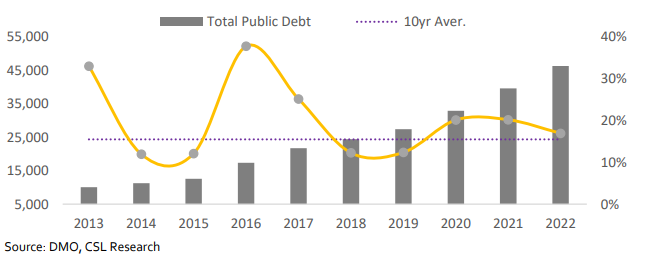

According to the Debt Management Office, Nigeria’s public debt stock stood at N46.25 trillion (US$103.1 billion) as of December 31, 2022; when the N22.7 trillion to be securitized is included, total public debt climbs to N77.8 trillion.

Nigeria’s external debt has continued to climb, despite shrinking revenues. External loans have nearly quadrupled in the last five years, increasing from US$25.7 billion at the end of 2018 to US$46 billion at the end of 2022, with debt servicing consuming about 96.3% of Nigeria’s earnings according to the World Bank.

Given present economic realities, which we do not expect to improve in the short term, debt levels are expected to continue to soar.

Nigeria’s debt-to-service ratio has been on the rise in recent years amidst Nigeria’s dwindling revenues. Nigeria’s debt service to revenue ratio was reported to be 80.7% in 2022 according to the Minister of Finance. The World Bank, however, estimated that Nigeria’s debt-to-revenue ratio was 96%, higher than what was reported by the Ministry of Finance.

Nigeria’s total debt stock rising to N77.8trn will take the country’s Debt to GDP ratio to 38.4%. This is close to the 40% benchmark contained in the medium-term debt management strategy paper and will likely reach that level in 2023 given that actual borrowing may likely exceed planned.

We expect the country’s fiscal space to remain tight in the short to medium term. The revised government expenditure for 2023 was estimated at an all-time high of N21.8 trillion. Revenue projection of N10.5tn will likely underperform estimate, however, we expect the continued economic recovery to support tax revenue. We forecast that the budget deficit will come in above the government’s deficit target of N11.3tn.

Recurrent spending will likely overshoot targets while capital spending will be lower than planned, in our view, oil revenue will still fall short of target, but non-oil revenue will outperform budget estimates. We expect Increased borrowings on the domestic market either though additional bonds or Ways and Means to finance the larger shortfall. The fiscal deficit has surpassed the target by an average of c.65% over the last 5 years due to ambitious revenue estimates and volatile crude oil prices.

Nigeria’s Public Debt (₦bn)