Premium Pension Limited, one of the leading Pension Fund Administrators in the Country has grown its Asset Under Management (AUM) to N1.000.41 trillion at the end of 2022 financial year despite increasing economic challenges and stiff competition in the industry.

This represents a growth of N120.93 billion over 2021 year-end of N879.48 billion, representing a year-on-year growth rate of 12.08 percent.

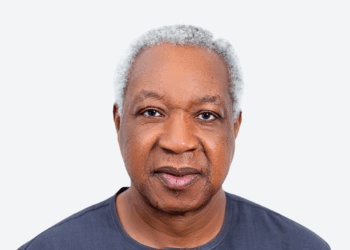

Mr. Ibrahim Alhassan Babayo, Chairman, Board of Directors of Premium Pension Limited made the disclosure at the 18th Annual General Meeting (AGM) of the Company held at its corporate head office in Abuja.

Mr. Babayo in his address to shareholders said the total number of retirement Savings Account Holders (RSAs) registered in both the public and private sector organizations as at 31st December 2022 stood at 774,235 representing 7.85 percent of the industry count of 9,862,129.

According to him, PPL’s revenue rose by 18.34 percent to N10.039 billion from N8.483 billion recorded in 2021, resulting in a Profit Before Tax (PBT) of N3.988 billion, up by 32.99 percent year-on-year, while Profit After Tax (PAT) stood at N2.654 billion, representing 35.51 percent above previous year levels.

In the year under review, Premium Pension paid total dividend of N2.65 kobo amounting to N1.740 billion, representing N1.20 kobo interim and N1.45 kobo final dividends of N788.14 million and N952.833 million respectively.

He also informed shareholders that this dividend represents the 15th consecutive year in which the Company has paid dividends.

“Today, we celebrate a significant milestone of attaining over N1 trillion Assets under Management (AuM), a momentous achievement that demonstrates our resilience, innovation and commitment. Our collective efforts have enabled us to build a solid Company that can withstand market volatility and uncertainty. As we reflect on our journey, the success we have achieved today did not come easy. We have had to navigate challenging economic conditions, disruptive technologies, and changing client preferences. Yet, we have remained steadfast in our commitment.” Mr. Babayo said.

In his remark, the Managing Director and Chief Executive Officer Mr. Umar Sanda Mairami said the Company as a top tier PFA will continue to grow and deliver even greater value to its members, shareholders and other stakeholders through consistent Premium Experience.

The meeting was well attended by Shareholders, members of the Board, Executive Management, representative of the National Pension Commission (PenCom) and Messrs. KPMG Professional Services.

For more info, click this

Aliyu Mohammed Ali

Head; Corporate Communications

Good day.

Pls I want to ask, who are the share Holders in premium pension? The retirees and other rsa holders with premium , are they not part of the share Holders?

If they are, how do you reward them?

Thanks.