Key highlights

- Nigeria under President Buhari has attracted the least foreign investment in comparison to the previous administration, with a total of $89.4 billion compared to $98 billion.

- The decline in foreign investment can be attributed to Nigeria’s challenging business environment, including high budget deficits, capital controls, corruption, insecurity, and a fall in oil prices.

- Foreign investors have preferred debt over equity-linked investments in Nigeria’s economy, resulting in significant public debt from external sources and implications for economic growth and development.

The administration of President Muhammadu Buhari is on track to end as one of the worst on record when it comes to attracting foreign investments into the country.

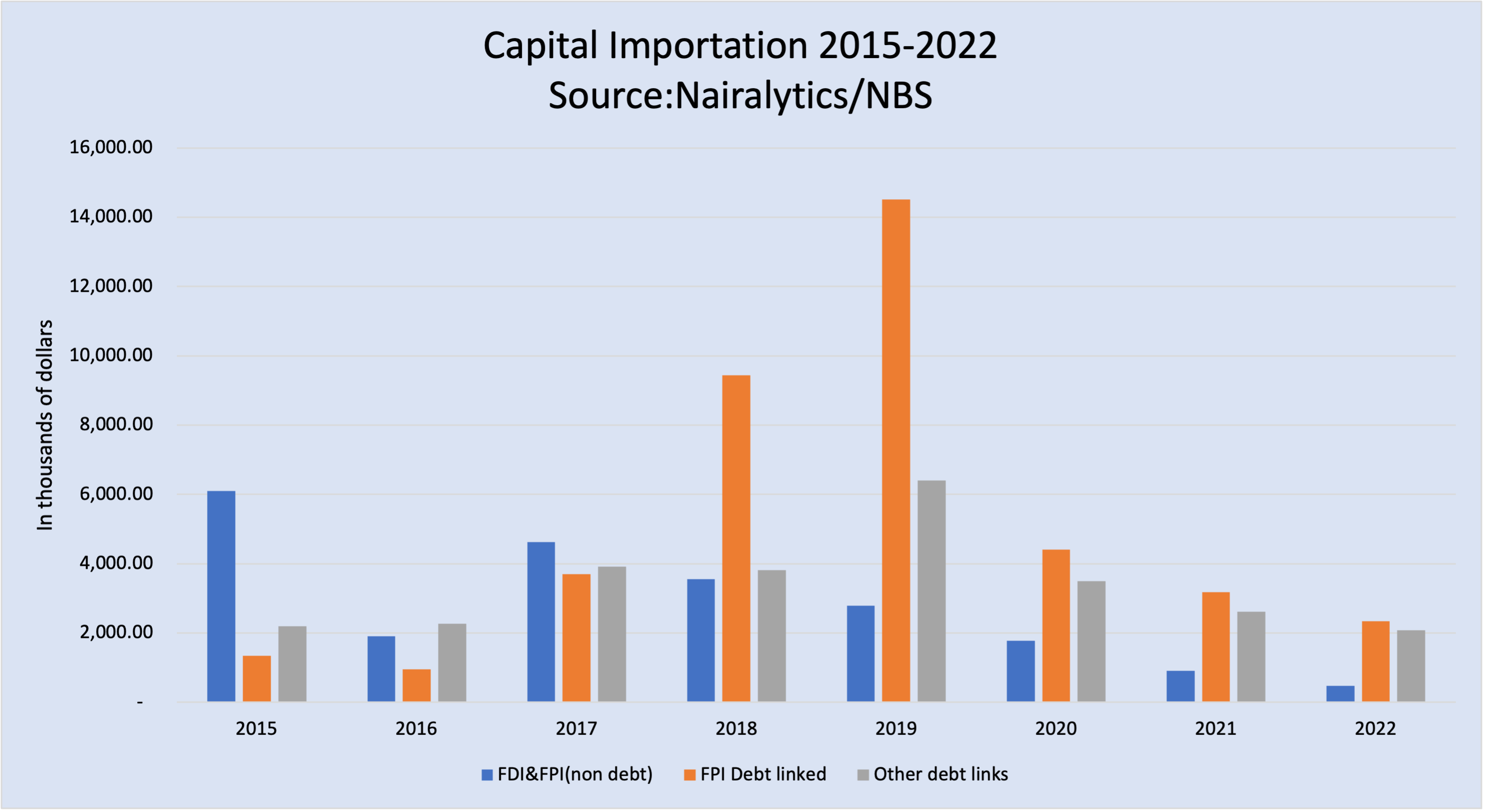

Available data on Nigeria’s capital importation between 2015 and 2022, when Nigeria’s 4th democratic president since 1999, shows a massive decline in capital importation (another term for foreign investment inflow).

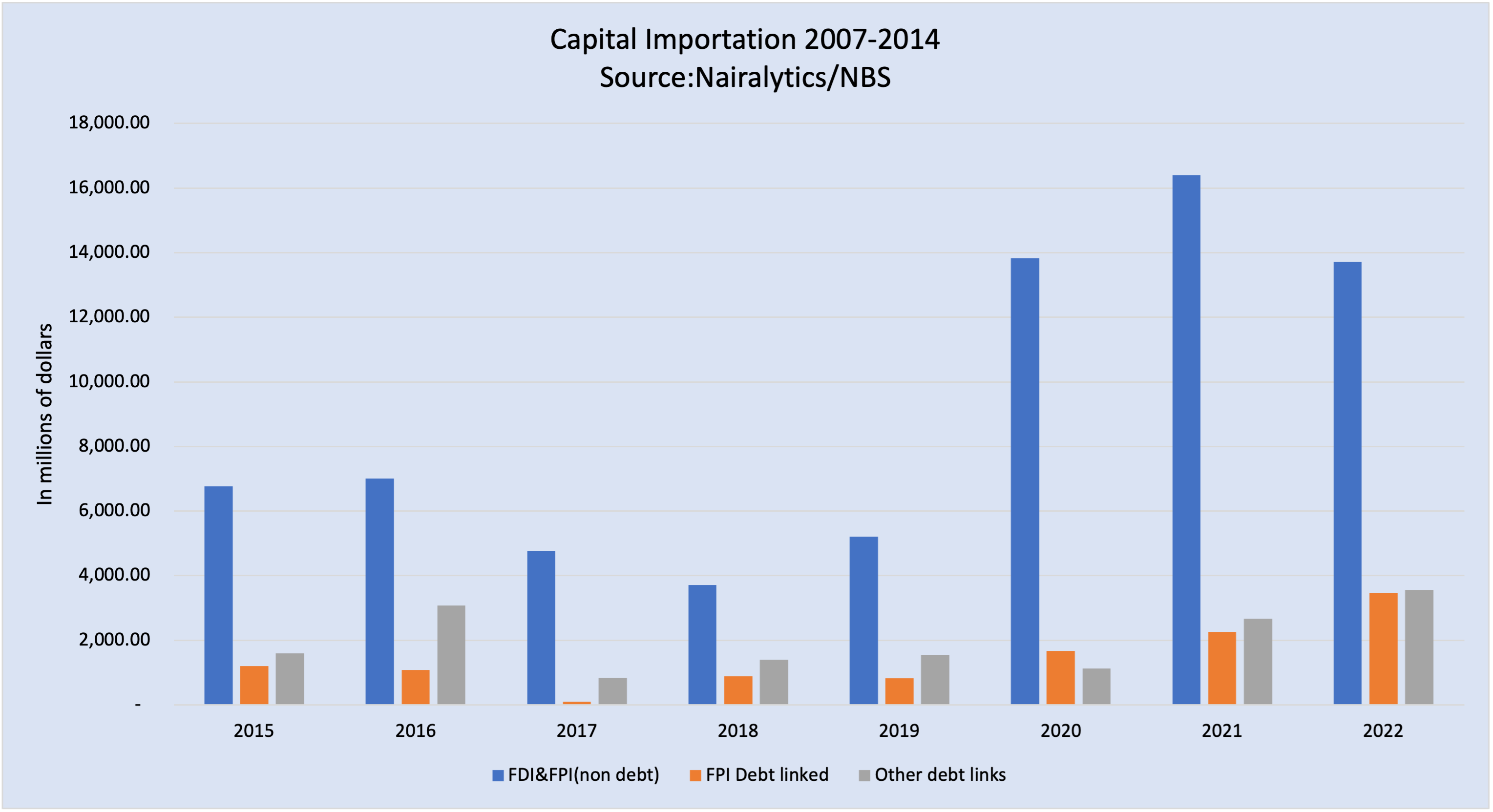

Between the last 8 years, the country has only managed to attract a total of $89.4 billion compared to about $98 billion between 2007 and 2014 which are the years the opposition PDP was in power.

A closer parse of the data also reveals an even grimmer picture of the country’s potency to attract foreign capital during the period under scrutiny. While the prior administration attracted more of foreign portfolios and directive investments, the APC government got some boost from debt capital.

Of the $89.4 billion inflow into the country in the last 8 years about $22.1 billion were from FDI’s and FPI’s taking positions in equity-type investments while the balance of $67.3 billion was in the form of debt-linked securities and foreign loans which Nigeria still needs to pay back.

This compares to $71.4 billion by the PDP government representing about 72.3% (APC is 24.7%) of total capital importation in the 8 years leading to 2014.

Debt over equity

A common recurring theme of foreign investment inflow under the Buhari administration is investors’ preference for the country’s debts over the more preferred equity-linked investments.

Prior to the Buhari administration, foreign investors invested largely in Nigeria’s economy either via the stock market or directly into business ventures. However, as faith in the economy dwindled, investor preference moved towards debt-linked instruments that somewhat guaranteed investors a return on their capital.

A favourite of foreign investors are short-term money market instruments which rose to a whopping $34.4 billion in the last 8 years from just $5.6 billion 8 years between 2007 and 2014.

The Central Bank of Nigeria’s policy to encourage forex retention also played a significant role in the increase in foreign portfolio investments into the money market between 2017 and 2019, leading to over $26 billion being sold as OMO bills (between 2018 and 2020 alone).

The policy was aimed at attracting foreign investments and boosting Nigeria’s forex reserves. While this policy may have been successful in the short term, it also had some drawbacks, such as high-interest payments and subsequently, a significant depreciation of the Nigerian currency in the long term.

Nigeria’s corporate bond issuance also contributed to an increase in capital inflows. The issuance was aimed at raising funds for infrastructure development and other projects. This move was lauded as a positive development, as it provided an opportunity for investors to invest in Nigeria’s economy and contributed to the country’s economic growth and development.

These debt-linked instruments contributed significantly to Nigeria’s public debt from external sources which according to the Debt Management Office has more than doubled to about $41.6 billion.

Why the decline in foreign investments

Nairametrics Research opines one of the significant factors that have contributed to the decline in foreign investments in the last 8 years is Nigeria’s challenging business environment.

The fall in oil prices, high budget deficits, capital controls, corruption, and insecurity have been cited as some of the critical challenges limiting capital importation (especially equity-linked inflows) into Nigeria.

A fall in oil prices typically leads to a decline in the country’s external reserves which then triggers incessant devaluations. Foreign investors assign a high-risk rating to countries with volatile currencies, especially when caused by lower export earnings. In such circumstances, they fear the long-term value of their investments could decline thus abstaining to invest in equities.

In addition to these, they also cite drags to in ease of doing business such as corruption, multiple taxes, insecurity, and lack of infrastructure as other challenges they face when investing in Nigeria.

Worth noting

It is also worth noting that while foreign portfolio investments in Nigeria’s equities market have declined over the years, there have been fluctuations in the market’s performance.

For instance, in 2017, the NGX All Share Index recorded a 42.3% return, while in 2018 and 2019, it recorded negative returns of -17.8% and -14.6%, respectively. However, the market rebounded in 2020, recording a 50% return, and in 2021 and 2022, it recorded returns of 6.1% and 20%, respectively.