HSBC UK Bank Plc has acquired the UK arm of the collapsed Silicon Valley Bank (SVB) for £1 in a move to protect the interests of depositors in the collapsed bank.

HSBC in a statement on Monday said the transaction “completes immediately” and the acquisition will be funded from existing resources.

The UK government, which facilitated the deal said customers and businesses who have money deposited in SVB UK will be able to access it and other banking services as normal. While assuring that all depositors’ money with SVBUK is safe the Bank of England, according to a report by the Guardian said the sale to HSBC this morning has been taken to “stabilize SVBUK.”

The UK central bank said the deal would ensure the continuity of banking services, minimize disruption to the UK technology sector and support confidence in the financial system.

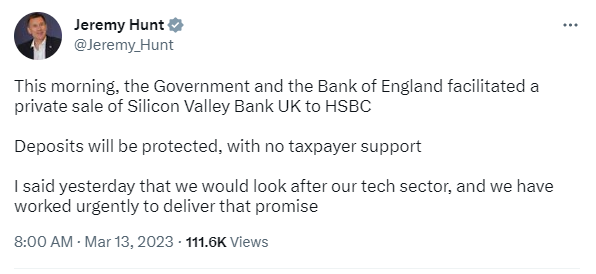

No taxpayer support: Also confirming the acquisition via a Twitter post, UK’s Chancellor of the Exchequer, Jeremy Hunt, said:

- “This morning, the Government and the Bank of England facilitated a private sale of Silicon Valley Bank UK to HSBC. Deposits will be protected, with no taxpayer support.

- “I said yesterday that we would look after our tech sector, and we have worked urgently to deliver that promise.”

While there have been calls for the protection of depositors in the SVB U.S., who are mainly tech startups, the acquisition of the UK arm came as a huge relief for tech companies in the UK who feared an ‘existential threat’ to their businesses if they had lost their funds at the collapsed bank.

U.S. Federal Reserves assures depositors: Meanwhile, for the depositors in the SVB U.S., the Federal Reserve issued a pair of statements on Sunday assuring them that all depositors of the bank, both insured and uninsured, will receive help in a manner that will “fully protect” all.

The statement said depositors “will have access to all of their money starting Monday, March 13. No losses associated with the resolution of Silicon Valley Bank will be borne by the taxpayer.”

- “After consulting with the boards of the Federal Reserve and the Federal Deposit Insurance, as well as a consultation with President Biden, Treasury Secretary Janet Yellen approved actions to enable the FDIC to complete its resolution of Silicon Valley Bank in a manner that fully protects all depositors, both insured and uninsured,” the statement reads.

The statement, released by Yellen, Federal Reserve Board Chair Jerome H. Powell, and FDIC Chairman Martin J. Gruenberg, also said that the Federal Reserve is prepared to address any liquidity pressures that may arise.

For €1 haba 😅