FairMoney, a leading Fintech in Nigeria, has recently launched an updated version of their mobile banking app homepage that promises to make banking easier and faster for the busy, modern lifestyle.

The new app features a sleek and intuitive interface that allows users to access all important information about their accounts and bank services with just one glance.

This means that busy professionals and active socialites can now stay on top of their finances while on the go, without having to navigate through endless menus or wait in long lines at the bank.

Speaking on the FairMoney app homepage revamp, Head Marketing and Branding, FairMoney, Nengi Akinola stated,

“We understand that our customers have busy lives and that time is a precious commodity. That’s why we’ve worked hard to create an app that is not only functional but also aesthetically pleasing, with a user-friendly interface easy to navigate. We believe that managing your finances should be hassle-free, and that’s exactly what the new FairMoney app offers,” says Nengi. “We’re confident that this app will be a game-changer for busy individuals who want to stay on top of their finances without sacrificing their precious time.”

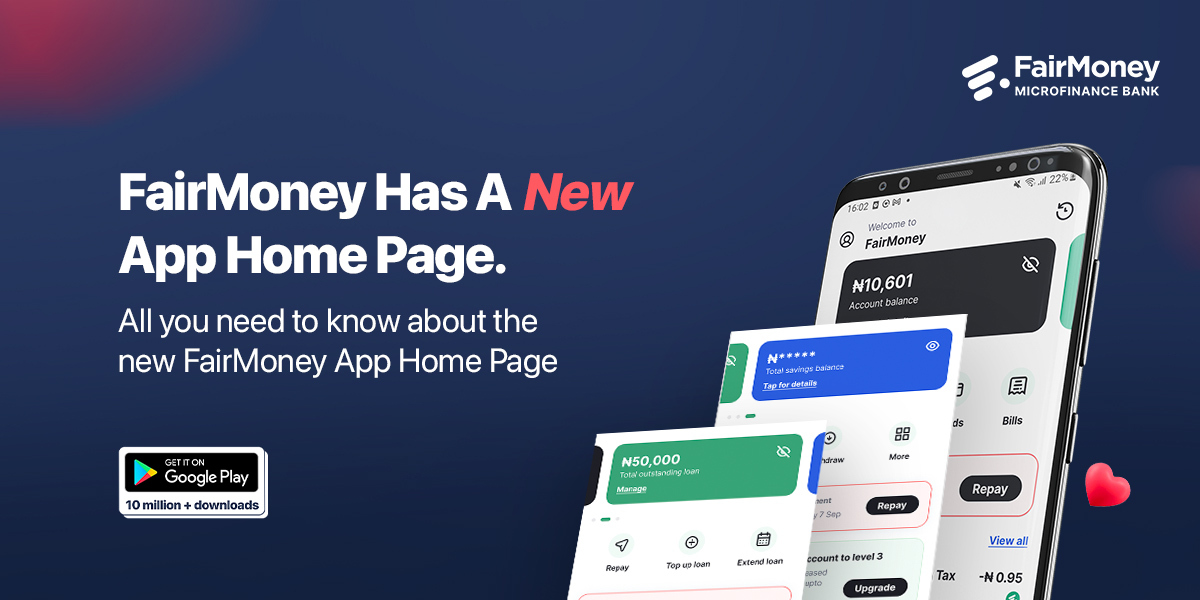

One of the most significant changes to the app is the new home page, which now displays all essential features at a glance. Customers can easily check their account balances, outstanding loan balances, and savings with just one tap.

Additionally, the app’s new service shortcuts feature allows customers to transfer money, fund their accounts, request an ATM card, and pay bills in just a few clicks.

The revamped app also features a loan homepage that shows customers their current loan details, with options to extend or top-up their loans, making the loan process even more seamless.

Additionally, the savings homepage puts customers’ savings in one tidy place at the bottom right corner of the screen, allowing them to access their FairSave or FairLock accounts with just one tap.

The app’s new information bar also keeps customers up to date with all the latest discounts and deals, ensuring that they don’t miss out on any exciting offers.

The FairMoney app is available for download on Google Play Store.

About FairMoney

FairMoney is currently the Most downloaded fintech app in Nigeria with over 10 million downloads and the #1 digital lender in Nigeria. Our goal is to become the leading financial partner serving underserved consumers in large emerging markets.

The company offers a range of digital financial products including, near-instant digital loans 24/7, investment products, savings, payments, and cards directly via its mobile app. The digital lending product offering covers loans in tenors from 15 days to 24 months to MSMEs and consumers.

The end-to-end application to loan offer process takes 5 minutes and is fully digital with no physical touchpoints. The company aspires for its over 6 million digital bank users to have a wholesome banking experience from P2P transfers and lending to debit cards, current accounts, and investment products amongst other products.

For more information, visit www.fairmoney.io