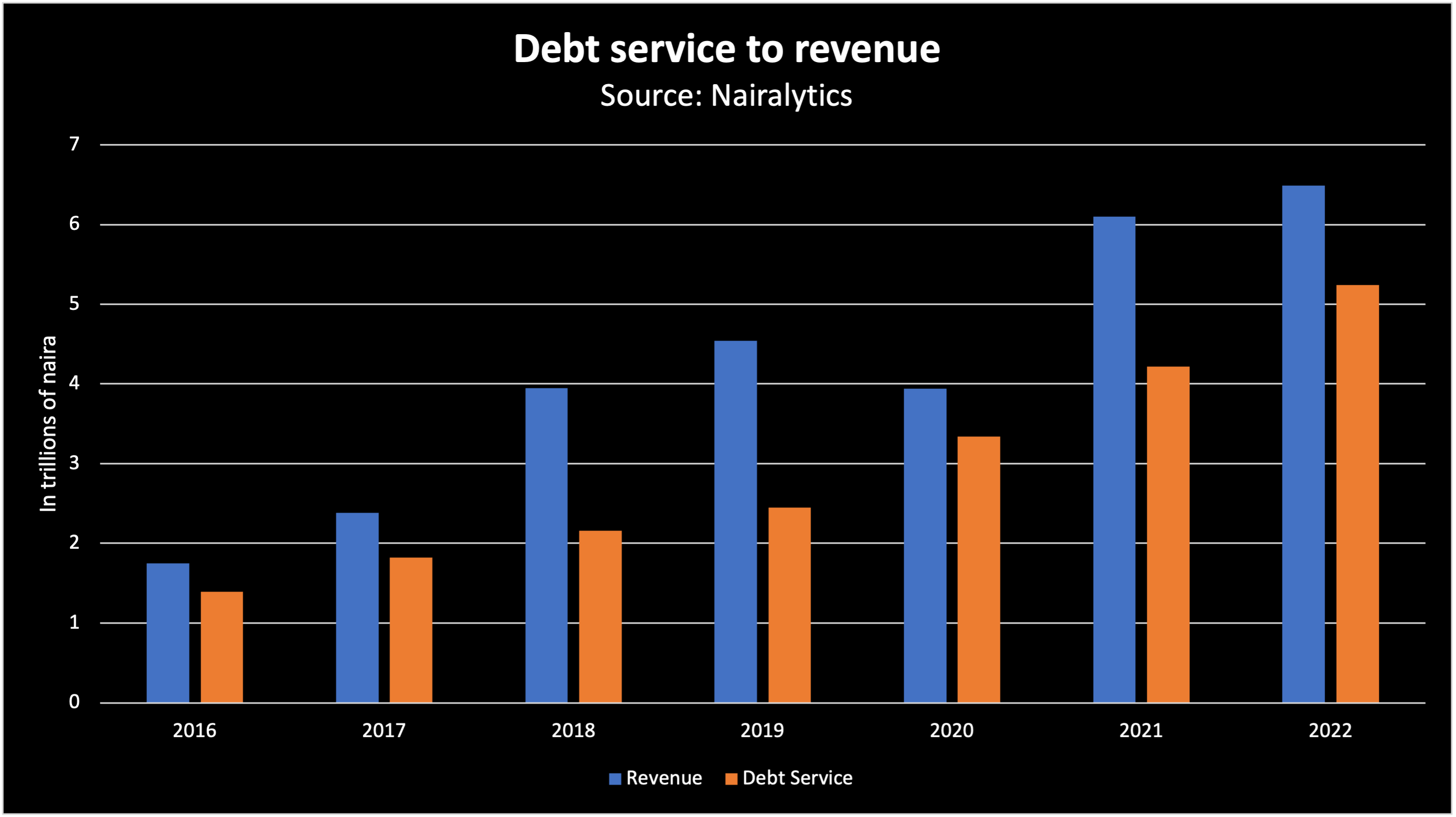

Nigeria’s debt service to revenue ratio is reported as 80.7% according to the information contained in the 2023 Budget presentation made by the Minister of Finance.

The report reveals a total debt service of N5.2 trillion in the first 11 months of 2022 out of a total revenue of N6.49 trillion.

The debt service to revenue ratio looks at the ability of a country’s revenue to cover its debt service obligations. The ratio has been on the rise in recent years as Nigeria faced a dwindling in its government revenues while government expenditures have increased.

Revenue challenges: Between 2016 and 2022 the Nigerian government failed to meet its revenue targets due to falling oil prices and rampant oil theft that has decimated the federal resources.

- For example, in 2021 the government targeted revenue of N8.1 trillion but was only able to generate N6.1 trillion leaving a revenue shortfall of N2 trillion. However, its total debt service incurred for that year was N4.2 trillion.

- In the first 11 months of 2022, it has only generated N6.4 trillion in revenues compared to the prorated target of N7.4 trillion. However, the government has also incurred about N5 trillion in non-debt expenditures.

Ballooning debt: Nairametrics reported Nigeria’s total public debt is estimated at about N67.6 trillion as of September 2022, representing just 35.2% of GDP.

- But while the government continues to cite the debt-to-GDP ratio as being low when compared to other emerging markets.

- However, the debt service to revenue ratio has constantly breached what are acceptable standards.

- To reduce the debt service to revenue ratio, the government will need to increase its revenues, especially via taxes.

- Tax revenue collected in 2021 was N1.79 trillion surpassing the N1.48 trillion budgeted. It is also expected to surpass the 2022 budget.