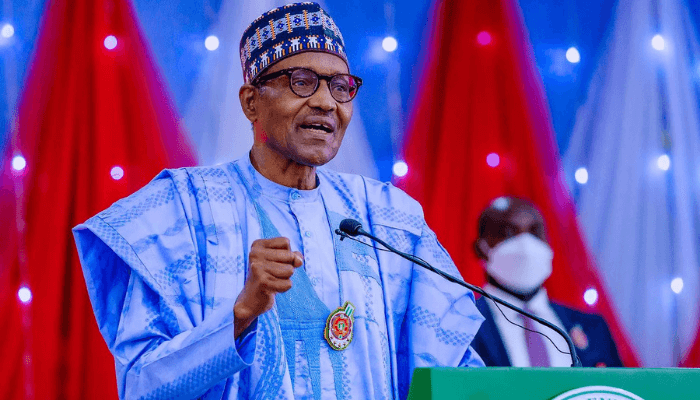

The Special Assistant to President Buhari on Media and Publicity, Femi Adesina, has said that Nigerians have come to the realization that the fuel subsidy regime must change. He said this during an interview on Wednesday, January 4 via Channels Television.

While alluding to the presence of fraud in the fuel subsidy regime, Adesina said that regarding the lingering fuel scarcity in some cities across the country, many Nigerians have woken up to the fact that fuel cannot be scarce while the government is still making fuel subsidy payments.

According to Adesina, the mid-2023 date set to stop fuel subsidy payments was not picked haphazardly, it was planned and it is the way Nigeria must go. He stated further that President Buhari could not remove fuel subsidies during his eight-year tenure because of social factors. He said:

- “We need to balance between economic and social sense. Removing fuel subsidies makes all the economic sense but does it make social sense? President Buhari will always look at the social sense in whatever decision he wants to take beforehand. Each time there is an effort to fight the fraud in the subsidy regime, you have to contend with labor and the people.”

Backstory: On Wednesday, January 4, the country’s finance minister, Zainab Ahmed announced that only N3.36 trillion has been set aside for fuel subsidy payments in the country’s 2023 budget.

- The implication for this is that the new administration that will come in 2023 will have the responsibility to stop the fuel subsidy payments as planned.

- However, the social factor which prevented the Buhari administration from removing fuel subsidies for eight years could still be a hindrance for the incoming government in 2023.

Rising poverty as a social factor: Kristalina Georgieva, managing director of the International Monetary Fund (IMF) recently said that the year 2023 would be tough for hundreds of millions of people across the world. She said; “We expect one-third of the world economy to be in recession. Even countries that are not in recession, it would feel like a recession for hundreds of millions of people.”

- In 2022, Nigeria’s National Bureau of Statistics (NBS) released its poverty report stating that 133 million Nigerians are multidimensionally poor. It is in this situation; the government is expected to remove fuel subsidy payments.

For the record: According to the December 2022 Development Update by the World Bank, Nigeria’s oil revenues continue to slide as production falls and subsidy deductions reduce oil revenue transfers to the Federation Account, despite oil prices increasing substantially.

- In the update report, the World Bank advises that if Nigeria should restore macroeconomic stability, the country must remove fuel subsidies. The report states:

“Fuel subsidy imposes a massive and unsustainable fiscal burden (2.7% of GDP in 2022), and an even greater opportunity cost. By maintaining an inefficient price control on PMS, Nigeria is forgoing productivity-enhancing investments in essential public goods and services.”