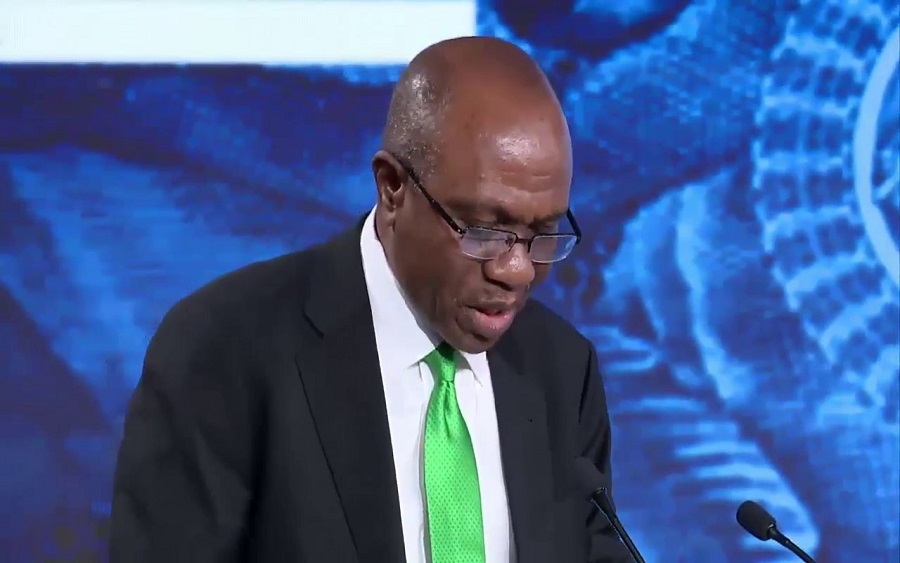

The House of Representatives has again given two days ultimatum to the Governor of the Central Bank of Nigeria (CBN), Godwin Emefiele, to come and explain the new policy of cash withdrawal limit.

NAN reported that the house gave the ultimatum in Abuja on Tuesday, after reading a letter by Emefiele, explaining why he could not appear during plenary.

In his letter to the house, Emefiele stated that he was regrettably unavailable because he has other official engagements.

House Resolution: Femi Gbajabiamila said the House should resolve to invite the CBN Governor, to brief on the cash withdrawal limit on Dec 22nd, or invite his deputy to do that in his stead.

- “The earlier date is today, at 10 a.m. And just yesterday, the clerk received a letter where it was stated that the Governor was regrettably unavailable because he has other official engagements,” he said.

- The speaker pointed out that said it is important for the house to get a proper briefing based on the law.

- Ndudi Elumelu, however, stated that if the CBN governor fails to show up before the House on Thursday, Dec 22nd, when the lawmakers have scheduled to go on Christmas and New Year break, their resolution on suspension of the policy still stands.

In case you missed it: Last Thursday, the house had rescheduled the appearance of Emefiele after a letter from him informing the House of his unavailability.

In the letter addressed to the Speaker of the House, Femi Gbajabiamila, on Thursday, he informed the lawmakers that he is part of President Muhammadu Buhari’s entourage to Washington DC, United States, hence, requesting another day. The letter signed by Deputy Speaker Idris Wase read in part:

- “We refer to your invitation to the Governor of the CBN, Godwin Emefiele, to brief the House of Representatives on recent policies of the Bank on Thursday, December 15, 2022.

- “We respectfully apprise you that the CBN Governor is a member of the delegation of H.E. President Muhammadu Buhari currently attending the USA Africa Summit in Washington D.C. Consequently, the Governor will not be able to honour your invitation on Thursday, December 15, 2022.”