Nigeria has about nine companies worth at least one billion United States dollars or above as of November 2022.

In the world of valuation, any company that is valued at about one billion US dollars is assigned unicorn status. This is also because they are hard to find especially in the world of Startups.

In Nigeria, we do have privately owned companies that are unicorns but their valuations are not determined by the market but rather by private investors. For publicly owned companies, we have to adopt a different metric.

Therefore, Nairametrics determines its valuation using the market value of quoted companies operating in Nigeria but listed on any stock exchange in the world. We do not use valuation based on venture capital or private equity.

- All the companies except one are quoted on the Nigerian Exchange while none is valued above a billion dollars quoted in a stock market outside Nigeria.

- The companies also have sizeable Nigerian ownership.

The Nigerian Equities market represented by its All Share Index closed the month of November with a total market capitalization (or value) of about N25.9 trillion or $58.3 billion.

- It was a good month for a lot of stocks as they collectively posted a net monthly gain of about 8.72% a huge reversal from the 10.58% reported in the month of October 2022.

- The gains recorded during the month also spread across some of Nigeria’s most valuable equities (MVE) which includes manufacturing companies, telcos, banks, etc.

- The major driver for the valuation growth was Nigerian companies valued at over one billion US dollars.

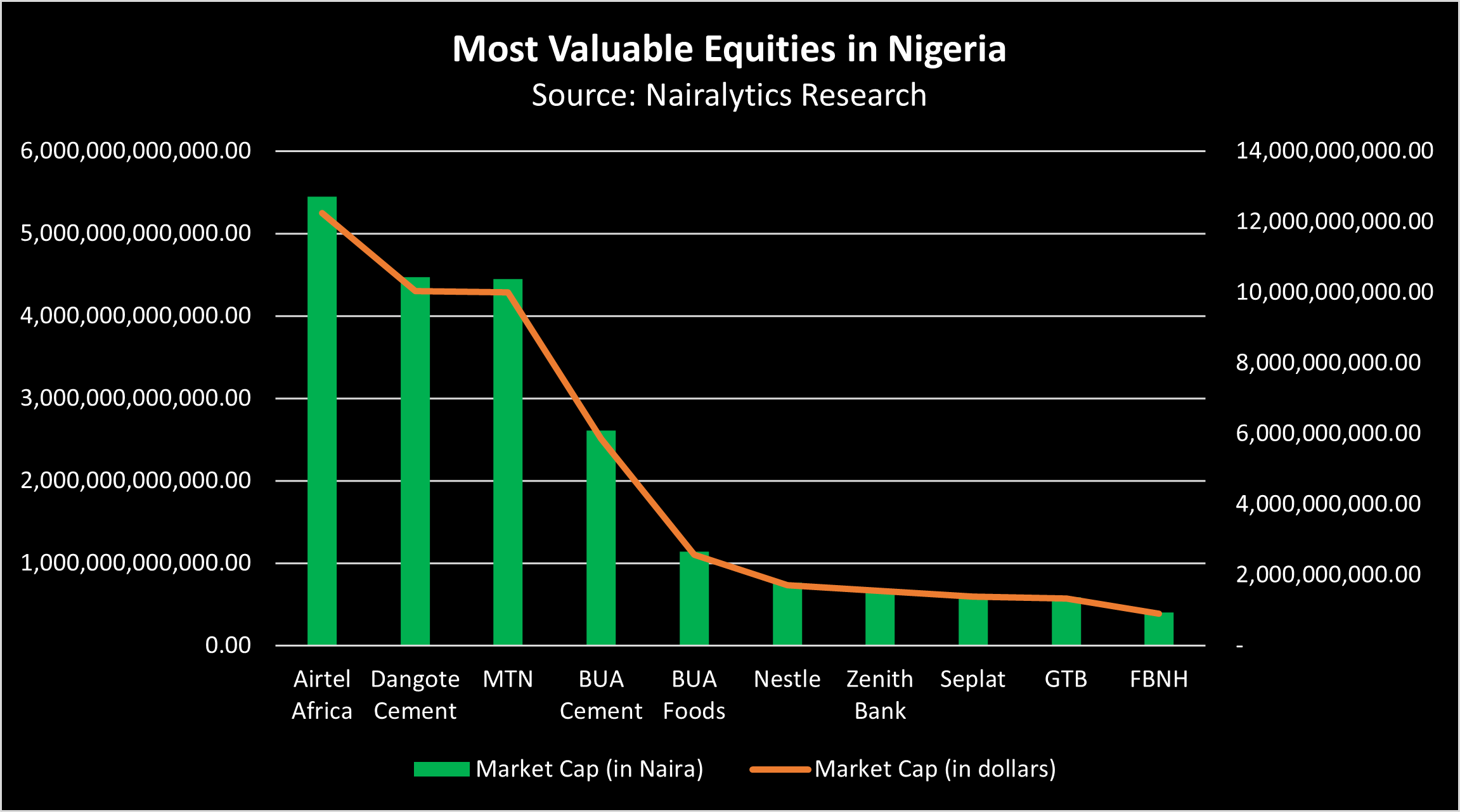

What the data is saying: Nigeria’s top ten MVEs had a combined market valuation of N21.1 trillion or an equivalent of $47.5 billion assuming the official exchange rate of (N445/$1).

- Among them are 5 stocks worth over one trillion which we term SWOOTs at Nairametrics.

- Combined the SWOOTs are worth about N18.1 trillion or $40.7 billion or a whopping 70% of the total market cap of $58.3 billion.

- The SWOOTs are Airtel, Dangote Cement, MTN Nigeria, BUA Cement, and BUA Foods.

- Companies are often revered when they attain unicorn status, which means they are worth over $1 billion.

- Based on our data and using the official exchange rate, all but one of the companies on our list are worth over one billion dollars.

Billion-dollar stocks – Airtel led the pack for another month as Nigeria’s most valuable company posting a valuation of N5.4 trillion or $12.2 billion.

- Airtel alone gained 13.7% in the month of November alone and contributed significantly to the gains posted by the top 10.

- Next, up is Dangote Cement, owned mostly by Africa’s richest man, Aliko Dangote at N4.46 trillion or $10.04 billion. The stock gained 19% in November.

- MTN Nigeria closed the month with a market cap of N4.44 trillion or $9.9 billion. It also posted an 11% gain this month.

- BUA Cement and BUA Foods both owned mostly by billionaire magnate Abdulsamad Rabiu posted a valuation of N2.6 trillion ($5.8 billion) and N1.1 trillion ($2.5 billion) respectively.

Who lost? Nestle and Seplat shed some of their valuations at the end of the month losing 20.7% and 12.5% res[ectively.

- For Nestle, they are now out of the SWOOT list having fallen below a trillion naira in valuation.

- In dollar terms, Nestle and Seplat are valued at $1.7 billion and $1.3 billion respectively.

Others: Zenith Bank, GTB, and FBNH make up the top ten largest companies by market capitalization.

- However, only Zenith and GTB are worth over a billion dollars at $1.5 billion and $1.3 billion respectively.

- All three banks posted gains at the end of the month which helped boost their valuation.

- The likes of Geregu Power Plc, Nigeria Breweries, and Stanbic IBTC are valued at about $731 million, $775 million, and $889 million respectively. They are companies to watch in the coming months.

- Jumia, a company operating in Nigeria but listed on the NY Stock Exchange is valued at $457 million.

See the chart below;

Context: If we used the unofficial exchange rate of around N740/$1 Zenith, Seplat and GTB would not have made the list of billion dollar valuation.