Amid the proliferation of loan apps in Nigeria, discerning Nigerians could differentiate between the unlicensed loan sharks and the regulated ones who conduct their businesses in line with set out rules and guidelines by the Central Bank of Nigeria. Umba, which prides itself as a leading digital bank in Africa, belongs to the latter category.

With its app, Umba allows users to apply, drawdown, and repay loans directly from their smartphone or desktop computer. Once an individual is verified, it makes lending decisions based on an assigned risk rating.

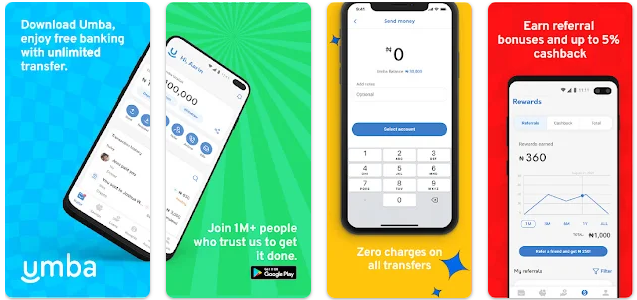

Umba claims it offers a better banking experience without the usual hassles that come with physical banks. It’s an easy-to-use digital banking app that helps you manage your finances and perform all transactions seamlessly. Borrowers can even increase their loan limit once they have proven their ability to repay on time.

It has a maximum and minimum duration of 62 days and borrowers can get credit amounts of between N2000 to N30,000 with a maximum annual interest rate of 10%, zero commission, and zero VAT.

For example, for a loan of N10,000, there is a 10% interest rate (N1000). So, at the end of the term of 62 days, you will be required to pay N11,000. There are no late fees, rollover charges, or origination fees.

The app at a glance: Rated 3.8 stars on Google Play Store and 2.7 on the Apple Store, the Umba app has a simple user interface that makes navigation on the app easy. At 21 MB download size on the Play Store, the app is of average size and may not give users any trouble with space.

Key features of the app: On the Umba loan app, users can do the following:

- Pay bills

- Transfer funds

- Make payment

- Top-up Airtime

- Apply for credit on the go.

- No paperwork and collateral are required.

- Loans are approved and disbursed in minutes!

- No late charges or roll-over fees.

- Get access to bigger loans, lower fees, and flexible payment terms as you repay on time.

Focus on users’ reviews: With over 1 million downloads on the Google Play Store alone, the Umba app is, no doubt one of the most-popular loan apps in Nigeria.

While users’ reviews indicate that the app offers one of the best rates on loans, some users are frustrated by the difficulty they often face when linking their bank accounts to the app.

For Walla Amos, the app has met his expectations except for its lack of room for part re-payment of loans. He said:

- “Good so far, just that they don’t accept part payment if you obtained a loan for 28 days. Accepting part payment before the due date will help your customer. If you are consistent in paying your loan, they will always give you an offer. And they don’t disturb me with calls and messages. Just good emails.”

Thelma Okere is another user of the app who is satisfied with the quick disbursement and convenience offered by the Umba app. She said:

- “Sincerely I love this app. Easy to apply once u have the required documents, no stress. You get a higher amount and low interest with long tenure. The disbursement is so fast and it is a very convenient app. Money is disbursed in less than 5 minutes and no debit card fee as other loan apps do. You can bank and save also with them.”

Arewa Emmanuel gives the app a pass mark even though some features on it are not functioning. He said:

- “I remembered I rated this app 2 stars before, but I am topping up to 4. The app is good and smooth, the interest rate is not too much and what they did that I loved most is that when I was a day late in making payment, they didn’t add an extra fee. The reason for not giving you 5 stars is because of your other features like buying airtime and paying bills that are still not functioning.”

For Olaniyan Peter, the experience on the app for Olaniyan Peter has been very smooth. He said:

- “Umba app gets my 5-star rating because of my experience with them. I think I have gotten up to 3 loans from them to date. The experience has been smooth and seamless ever since I started using the app. The charges on interest are okay, and when your loan is due you’ll be notified in a respectable manner or means. I recommend the Umba loan app.”

Bolanle Odumeru is also satisfied with the interest rate on Umba. According to her;

- “Umba is the best loan app I’ve ever used with the lowest interest rate compared with other apps. I was given N40,000 to repay N46,800 after one month. Highly recommended for salary earners. I’ve been using Umba for some months and I’m very satisfied with their performance.”

Wuraola Olorunyomi was, however, not finding it easy to link her account to the app. This is what she had to say:

- “It takes forever to connect my bank account in determining my credit score, I’ve been on it for the past two months now trying everything possible on my part but all to no avail. Best app indeed.”

Similarly, Lawal Habeeb also expressed his frustration after several attempts to link his account to the app. He said:

- “What a very bad and frustrating app, trying to link my account and it has been telling me ‘Connection error’, even when I’m using a 5G network. I am fed up”

Here’s Umba’s response: Addressing the issues raised by users, especially the one concerning account linking, Umba said it is working to solve the problem. Beatha Technology, the owner of the Umba app stated:

- “We are always looking for ways to improve at Umba and we are doing everything to ensure our customers have a great experience.”