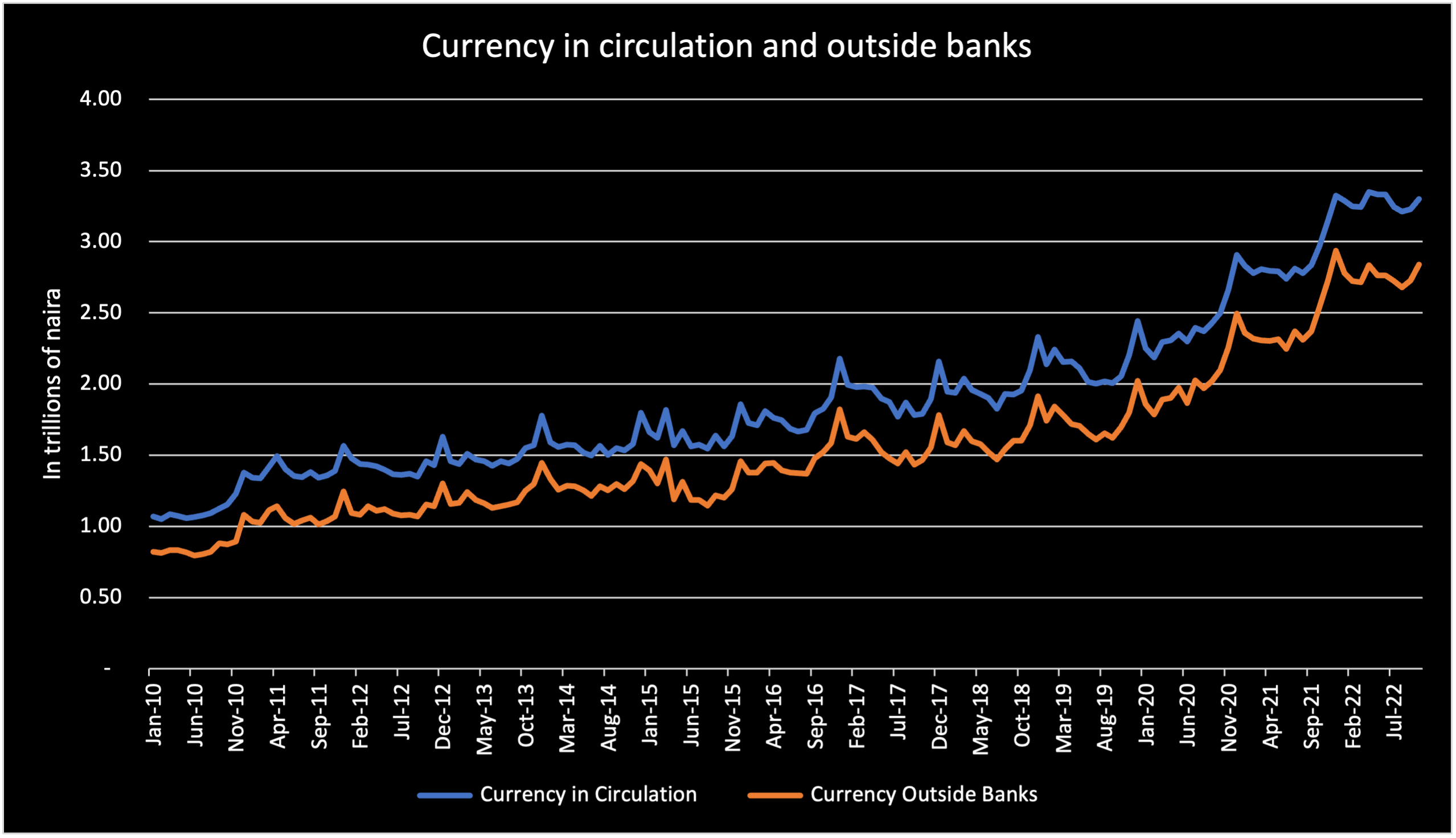

Nigeria’s currency outside banks is a record N2.8 trillion as of October 2022, data from the central bank of Nigeria reveals.

This is against the latest decision by the central bank to replace the N200, N500, and N1000 notes due to the rising spate of currency outside circulation.

However, data from the apex bank shows the rising trend started in 2015 and has doubled over the seven years of President Buhari’s administration.

Data don’t lie: According to the data, currency outside circulation was just about N1.1 trillion in June 2015, the first full month of the current president.

- By the end of his first term on May 29th, 2019, currency in circulation rose to about N1.7 trillion as more Nigerians kept naira outside of banks.

- But between then and October 31st, 2022, the total amount of currency outside of Nigerian banks rose by N1 trillion to a whopping N2.8 trillion.

- A closer look at the chart below reveals the increase started during the Covid lockdown year of 2020 where about N470 billion was additional currency outside banks.

- The figure was N440 billion in 2021 and has been flat this year taking the total to about N910 billion in two years.

CBN Confirmed this: The apex bank also confirmed this in its press briefing on October 17th where it announced the introduction of new naira notes.

- “Significant hoarding of banknotes by members of the public, with statistics showing that over 85% of currency in circulation are outside the vaults of commercial banks.

- To be more specific, as of the end of September 2022, available data at the CBN indicate that N2.73 Trillion out of the N3.23 trillion currency in circulation, was outside the vaults of Commercial Banks across the country; and supposedly held by the public.

- Currency in circulation has more than doubled since 2015; rising from N1.46 trillion in December 2015 to N3.23 trillion in September 2022. This is a worrisome trend that cannot be allowed to continue.”

See chart;

Source: Nairalytics/CBN

Thought bubble: The central bank has alluded to corruption as a major reason for the surge in currency outside circulation. However, they have not provided data to substantiate this claim.

- But a closer look indicates that the major increase in currency outside circulation occurred between 2020 and 2021 coinciding with a period of massive central bank intervention funds which the IMF has advised the apex bank to end.

- We opine this may have triggered the surge in currency outside circulation as over N920 billion out of the additional N1.65 trillion added to currency outside banks since June 2015 is from the years 2020 and 2021.

- We also observe a surge in currency outside circulation in years of massive currency depreciation in the black market such as 2015, 2017, 2020, and 2021.

Did some of the intervention funds end up as cash in the hands of Nigerians who have no incentive to push this back to the banking sector?

The intervention Funds ended up in the Hands of Buhari Cronies and APC member who hoarded it to escape being detected by the public.