Shareholders of Vitafoam Nigeria Plc have endorsed the company’s proposal to cancel 1,149, 155,936 unissued ordinary shares of 50 kobos each.

The shareholders approved this during Vitafoam’s Extra-Ordinary General Meeting (EGM), in compliance with a recent adjustment to the law regulating companies in the country.

Recall that President Mohammed Buhari had on 7th August 2020 signed into Law the amended Companies and Allied Matter Act (CAMA). Section 124 stipulates that starting from 31st December 2022, all companies operating in Nigeria should have only issued shares as against the current system of operating issued and authorized share capital.

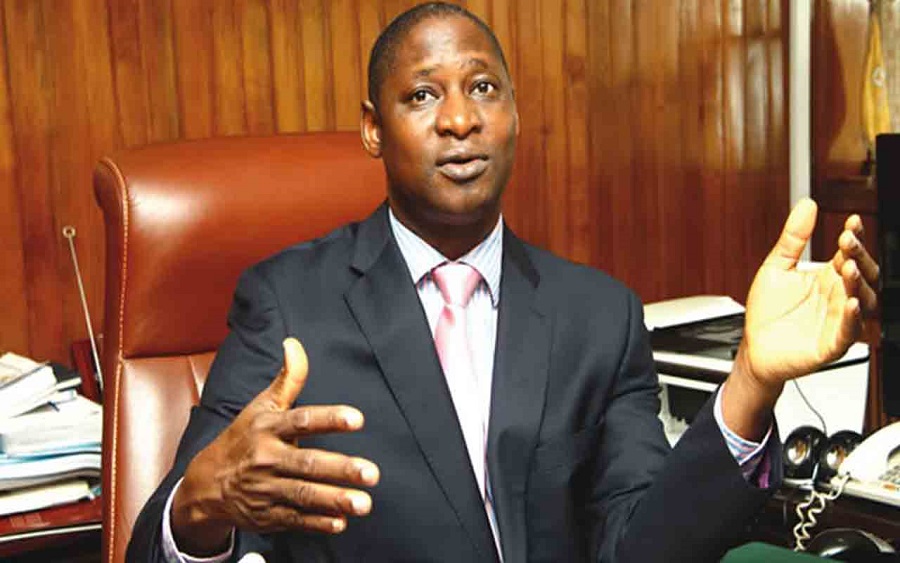

Need to comply: Vitafoam’s Chairman, Dr Bamidele Makanjuola, told the shareholders at the EGM that Vitafoam had no basis to issue new shares to the shareholders and that cancellation of the shares was the best option after evaluation.

He also underscored the need to comply with the government’s directive ahead of the deadline. Makanjuola said:

- “After a careful evaluation of the various options, the Board decided that cancellation of the unissued shares is in the best interest of the company at present as there is no basis to issue shares. It is based on the foregoing that this Extra-Ordinary General Meeting was convened to seek your approval to cancel all the company’s unissued shares in compliance with the provisions of section 124 of the Companies and Allied Matters Act (CAMA 2020) and the Companies Regulation 2021 and to also amend some provisions of the Memorandum and Articles of Association of the company accordingly.”

Shareholders’ decision: Although some shareholders pleaded that the company should convert the unissued shares to bonus issues, others believed that the timing was too short. However, the cancellation of the unissued shares was approved at the EGM.