Lendsqr, a lending-as-a-service company, powering over 1,000 lenders with the data and technology required to run a lending business successfully, was keen to find out what borrowers really want from lenders. To this end, Lendsqr conducted a survey amongst borrowers; the results of which are contained and explained in this article. The goal is to help lenders understand how best to meet the needs of the borrowers they serve.

Methodology

This survey was conducted online in Nigeria between August 7 and August 8, 2022 by the Lendsqr Growth team. The survey had a total of 3,685 Nigerian respondents; adults aged 18 and older. This sample majorly consisted of repeat borrowers from lenders on the Lendsqr platform who had made loan requests in the past few months.

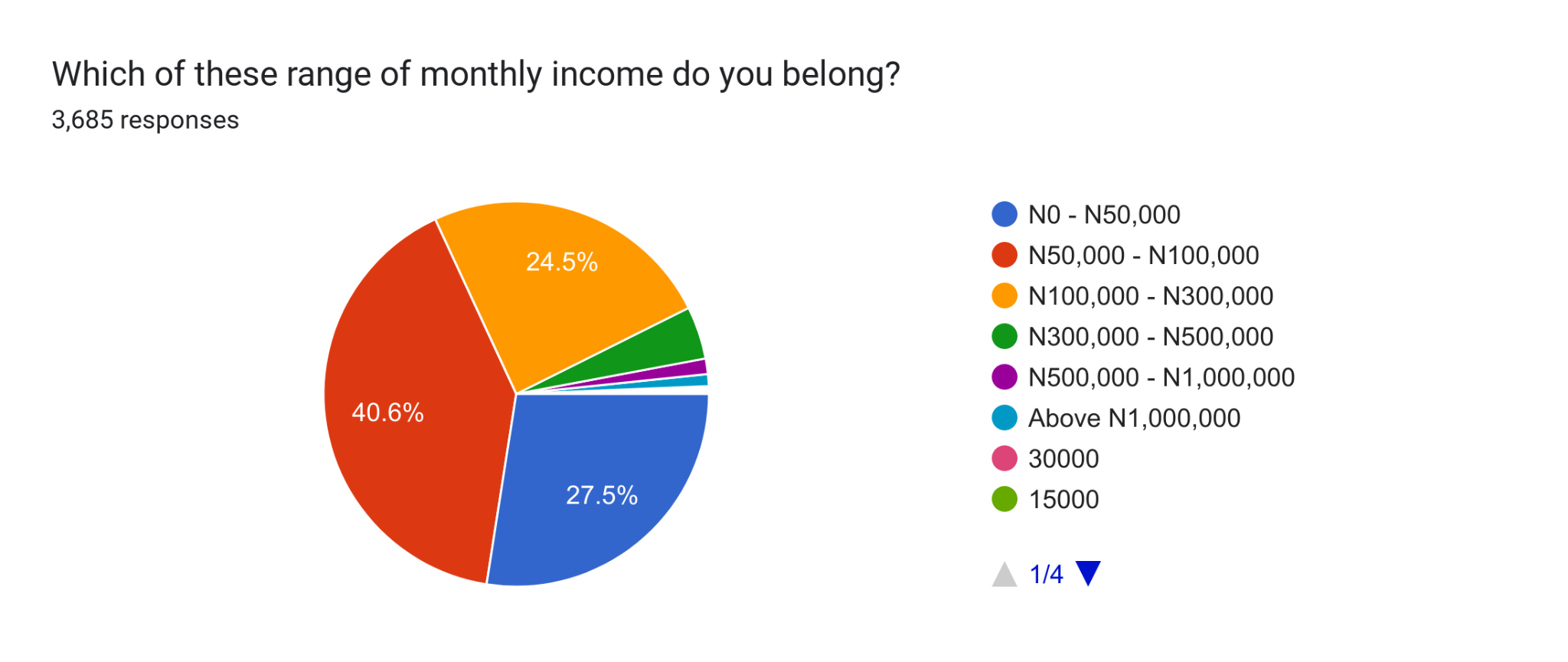

The composition of the sample population used for the survey was structured to reflect demographic characteristics that match those of the general Nigerian population. 61.5% of our respondents are single, and 36.8% are married. 90% of respondents are involved in some form of employment, with over 90% earning below N300,000 per month.

Our Survey Findings

Upon completion of the survey, we dived in to analyze the results and found some interesting outcomes:

Short-term Financial Goals

The majority revolve around the establishment and expansion of businesses; 44% of the respondents want to grow their current business, while another 40% want to own a business. 37% want to generate multiple sources of income, while 25% want to take up investment portfolios. Surprisingly, only 10% reported leaving Nigeria as a part of their short-term plan.

Of the respondent categories, respondents outside Lagos and Abuja highlighted growing and expanding their own business as their primary short-term goal; while millennials and gen z’s highlighted having and expanding their own business as their primary short-term goal.

Knowledge and Use of Financial Institutions

In our assessment of the type of financial institution Nigerians prefer to turn to for their loan needs, digital lenders represented the highest proportion in our survey. 35% answered that they took their most recent loan from digital lenders, while 23% and 18.6% took loans from microfinance banks and commercial banks respectively. Additionally, 10.8% of respondents take their loans from informal lenders (Ajo and Cooperatives).

The fully employed respondents highlighted commercial banks as the primary financial institution from which they have taken loans, as against digital lenders which were more dominant with self-employed and student borrowers. These results are consistent with the reality that commercial banks are more likely to benefit from established relationships with borrowers via their employers.

The fully employed respondents highlighted commercial banks as the primary financial institution from which they have taken loans, as against digital lenders which were more dominant with self-employed and student borrowers. These results are consistent with the reality that commercial banks are more likely to benefit from established relationships with borrowers via their employers.

However, through active prospecting and engagement, digital lenders can drive greater penetration amongst employed 25 – 34 users.

Reasons for Taking Out Loans

The majority of the borrowers recorded taking loans for meeting their short-term cash needs and expanding their businesses (47.6% and 34.8% respectively). This was followed by 22.5% who recorded starting a new business and medical reasons for taking out loans. 17.8% stated they took loans to meet medical emergencies.

With 11.8% of respondents highlighting school fee payments we discovered that there is an opportunity for lenders, especially small lenders to penetrate and service the sizable market for education finance in Nigeria, which is presently underserved.

Only 2.1% and 1.4% of respondents stated that they had taken loans for purchasing a house and car respectively.

Respondents who indicated having financial dependents also indicated meeting the immediate cash gap and expanding their business as their primary reasons for taking on loans; inclusive of their extra responsibilities.

Challenges With Taking Loans

The results showed that 59% of the respondents highlighted high-interest rates as their biggest challenge with taking out loans. This was followed by 42.6% of those put off by loan application requirements, while 27.6% of respondents find the risk of getting into debt most challenging.

This introduces a possible hypothesis that Nigerians will take more loans if the interest rates of loans are more affordable.

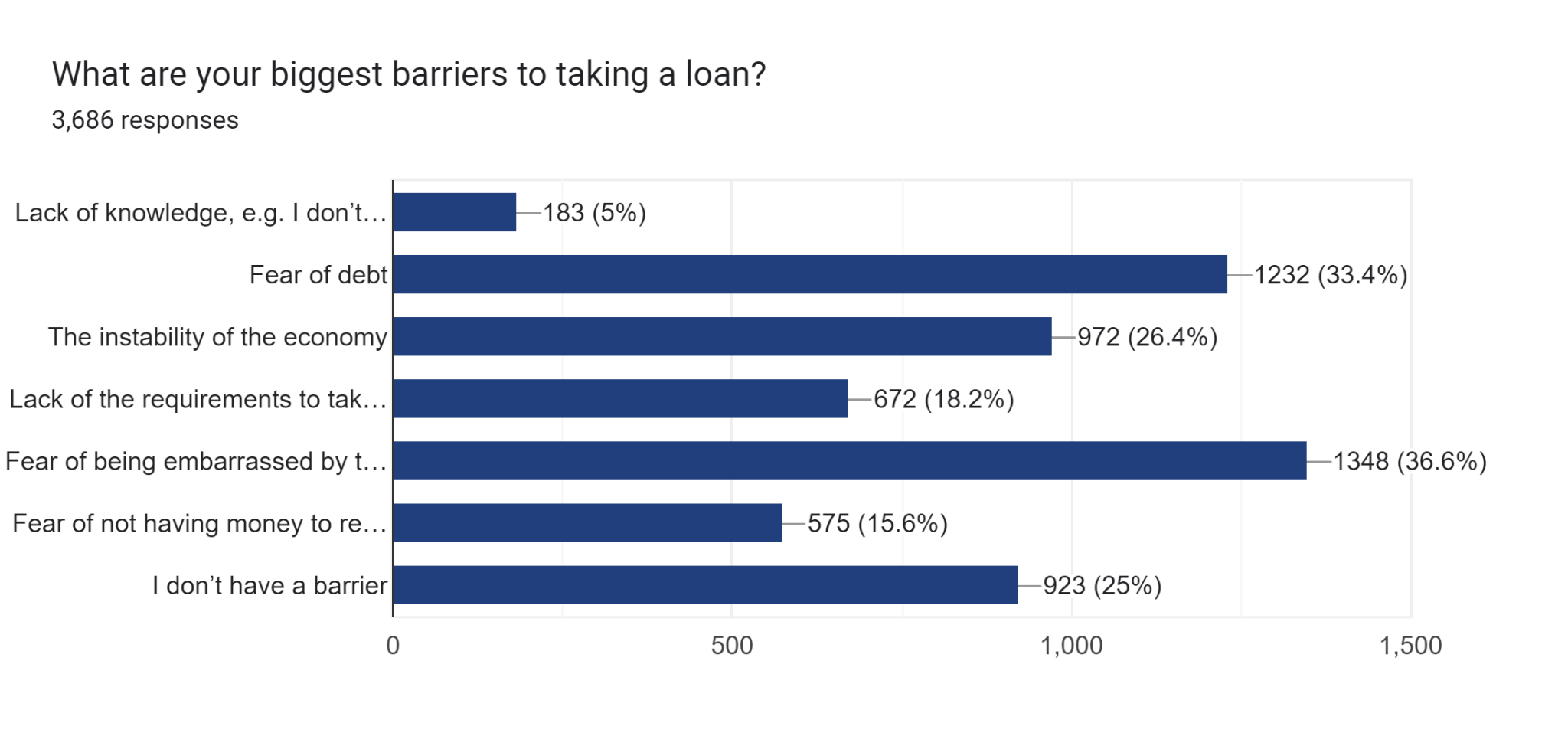

36.6% of respondents highlighted the fear of being embarrassed and harassed by lenders as a barrier to taking out loans. This can be partly attributed to recent unethical loan recovery measures taken by lenders to force repayment from defaulting borrowers; particularly sending defamatory messages to friends and family of those who have defaulted on their loan repayments.

36.6% of respondents highlighted the fear of being embarrassed and harassed by lenders as a barrier to taking out loans. This can be partly attributed to recent unethical loan recovery measures taken by lenders to force repayment from defaulting borrowers; particularly sending defamatory messages to friends and family of those who have defaulted on their loan repayments.

Personal Details For Scoring/ Underwriting

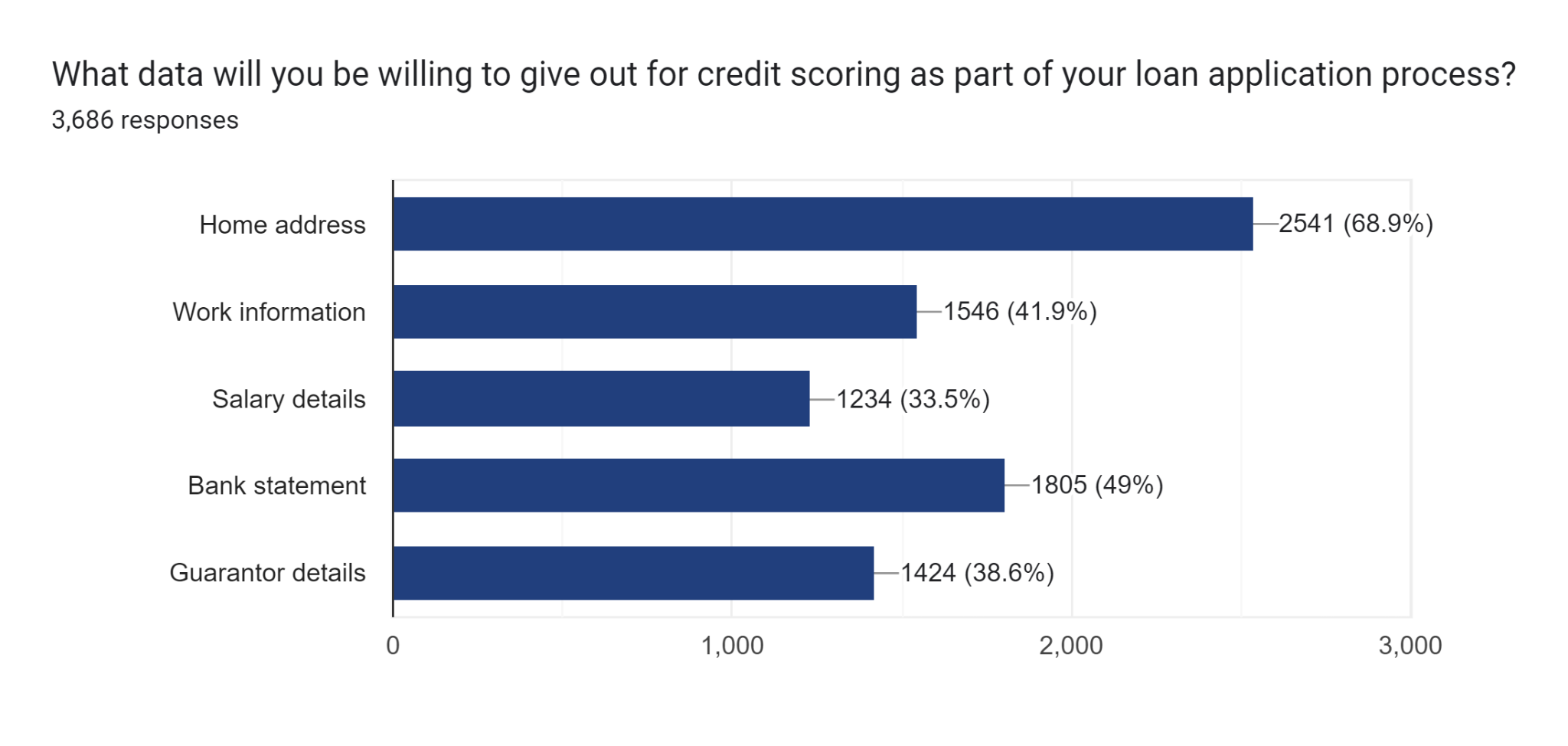

Only 49% of respondents stated their willingness to share their bank statement, while an even lower 33.5% showed willingness to share their salary details. These results pale in comparison to about 69% of respondents who would willingly share their home addresses with lenders. Are borrowers really concerned about the security of their personal details or are they simply reluctant to share their true financial standing to enable lenders to make better-informed risk underwriting decisions? Perhaps these two truths can co-exist.

Contrary to the general attitude towards disclosing financial information, respondents below the age of 34 were more willing to share their work and salary details, with 68.9% indicating willingness within that age bracket. This highlights the greater affinity of the age bracket to actively participate in a credit system that evaluates their creditworthiness on a revolving basis.

Top Qualities Expected of Lenders

Respondents identified interest rates, speed, and security as the top three qualities they look out for in a lender, at 65%, 53%, and 45% of respondents respectively. Agent-led onboarding ranked lower than a digital-led experience (4% to 17%) as a preference for borrowers, highlighting a greater affinity to digital interactions.

Borrowers want to pay reasonable fees and a convenient borrowing experience as indicated by 36% and 34% of the respondents who highlighted fees and customer experience, respectively, as the primary qualities, they consider in making a decision about their potential lender.

The brand and longevity of lenders surprisingly ranked low on the list of qualities prioritized by borrowers when selecting a lender at 13% each. While not neglecting the importance of their brand, new lenders can focus on more financial qualities (interest rates, fees, and charges) while seeking to build traction in the market.

18% of respondents highlighted the presence of financial coaching as a deciding factor for them in selecting a lender. There is room for improvement in financial literacy in Nigeria and lenders can invest in building up learning resources for borrowers to gain their trust.

Preferred Channels

About 76% of respondents registered their preference for taking out loans via mobile applications. The next preferred channel was web application (13%); followed by 8% and 3% of respondents who prefer to get loans from a branch (physical office) and agents respectively. The overwhelming preference for digital channels positions them as a priority for lenders in engaging their customers. Lenders can achieve deeper penetration into the borrowers’ market by expanding their loan distribution channels.

Lending is more nuanced than simply giving out loans to everyone who wants a loan. Lendsqr is in the business of providing lenders with what they need to succeed. This includes knowledge and expertise. You can reach out to growth@lendsqr.com for more insights into the results of this survey and Lendsqr’s solutions.