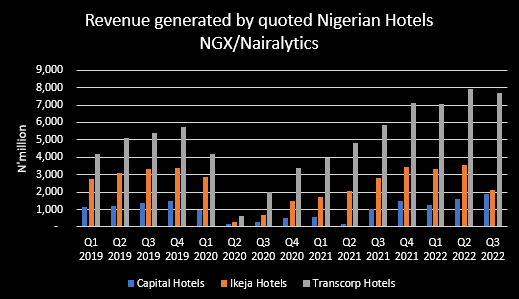

The three hotels listed on the Nigerian Exchange posted a combined revenue of N11.65 billion in the third quarter of the year, a 20.3% increase compared to N9.68 billion recorded in the comparable period of 2021.

This is according to data extracted from the companies financial statements. The three hotels are Transcorp Hotels Plc, Ikeja Hotels Plc, and Capital Hotels Plc.

Hotelling activities in Nigeria are picking up from the contractions recorded in 2020 and 2021 due to the Covid-19 pandemic. Recall the pandemic forced most individuals and businesses to operate from their homes even as events were organised virtually.

In 2020, during the height of the Covid-19 pandemic lockdown, the hotels’ revenue crashed significantly from N27.51 billion generated in the first nine months of 2021 to N12.1 billion. The recent improvement in the revenue generated by the hotels is an indication of the hotel industry’s recovery.

Between January and September 2022, the three hotels made a sum of N36.37 billion as revenue from N22.92 billion recorded in the comparable period of 2021 and N12.1 billion printed in the same period of 2020.

With business operations back to usual and travelling restrictions lifted across the country, hotels are now seeing an uptick in their top-line revenue. Wedding and birthday parties and corporate events amongst other functions have resumed in full and many individuals and organizations are seizing this freedom to organize events, for the gain of the hotels.

Specifically, Nairametrics reported earlier that 17 quoted companies in Nigeria increased their hotel and travel cost by 56.4% in the first quarter of the year, spending a sum of N7.9 billion in contrast to the N5.05 billion spent in the corresponding period of last year.

Highlights

- Transcorp Hotels posted a total revenue of N7.67 billion in the third quarter of the year, which is 31.6% higher than the N5.83 billion recorded in the previous year.

- On the other hand, Ikeja Hotels saw its top-line decline by 25.5% year-on-year to N2.11 billion from N2.84 billion recorded in Q3 2021.

- Capital Hotels, however, recorded an 83% increase in its revenue to N1.87 billion from N1.02 billion.

High operating cost keeps margin down

The sustained high operating costs for companies in the country kept the bottom line of the hotels low despite improvement in revenue. Specifically, the three hotels recorded a total cost of sales of N5.2 billion in Q3 2022, N6.39 billion in Q2 2022, and N5.26 billion in Q1 2022.

- The increase in the cost of operations for hotel companies can be attributed to the general increase in the cost of goods and services in the country. The price of diesel, which is a major commodity used by Nigerian hotels, has gone up significantly in the wake of the Russian-Ukraine war.

- According to the National Bureau of Statistics (NBS), the cost of diesel almost tripled in the country, rising from an average of N289.37/litre to almost N800/litre across Nigeria. Hotels, which rely mostly on the use of diesel to power their generators, have had to spend a fortune this year, which has affected the profitability of their businesses.

- Specifically, the companies printed an aggregate profit after tax of N435.3 million in Q3 2022, down from N725.16 million posted in the comparable period of 2021. The breakdown of the data showed that Capital Hotel posted an N242.38 million net profit in the review period, Transcorp Hotels (N580.65 million), while Ikeja Hotel posted a net loss of N387.73 million.

Festivities are coming in December

Heading into the yuletide period which is characterized by a lot more travelling and celebrations could see the revenue of hotels jump even higher in the fourth quarter of the year. A cursory analysis of the historic data shows that hotels generate more revenue in the fourth quarter of the year compared to the other periods.

- This is not surprising, considering the level of merriment that is usually witnessed during this period. Note that during the yuletide season, many Nigerians in the diaspora visiting the country prefer to lodge in hotels.

- Tourists and families would also travel to exotic locations across the country, leaning on hotels to provide them with accommodations.

- Also, it is worth adding that various entertainment shows are also done during this period, many of which are done in the halls of some of these hotels.