With the steep rise of inflation in Nigeria and even around the world, it is no longer news that people need to invest if they must protect their money. However, there are certain principles that they must take into cognizance when investing. Therefore, we have put together 5 tips to help you start investing profitably in Nigeria.

1. SET A PERSONAL FINANCIAL GOAL: Establishing a goal makes it clearer and even easier to achieve. In doing this, you can have a short-, mid-and long-term goal, making it less tedious for you and more enjoyable, as you can have some fun today while building for the future. For instance, a short-term financial goal could be a trip that you could invest in, and a long-term goal would be being able to afford the schools you would like to see your kids attend. A mid-term goal would be to raise the initial capital you need to start a business or further expand your business. At every point in one’s life, it is important that we set personal financial goals, which also determine the kind of investments we can undertake

2. RECOGNIZE YOUR RISK TOLERANCE: There are several factors that go into ascertaining one’s risk tolerance. Due to the peculiarity of everyone, we typically advise that individuals seek counsel from an investment manager who has the expertise to better examine one’s risk tolerance and advise on how best to invest. Notwithstanding, people tend to view risk in one of these 3 ways.

- Risk averse- A risk-averse individual typically avoids risk. They Favour certainty and security over higher interest on their investments.

- Risk-seeker: This category of persons is more concerned about the returns on the investment. They are more adventurous with their investing.

- Risk-neutral individual: This individual is in between the averse and the seeker and is typically more logical before making an investment decision.

3. CONDUCT YOUR OWN RESEARCH: There is a proliferation of investment schemes, some of which have proven to be an avenue for con artists to scam unsuspecting individuals from their monies. Therefore, bodies like the Securities and Exchange Commission help to curb this. Ultimately, it lies on the individuals to carry out their due diligence. You can check the website of the Securities and Exchange Commission to see the companies that are regulated. Investments like the SFS Fund, it is also listed on FMDQ.

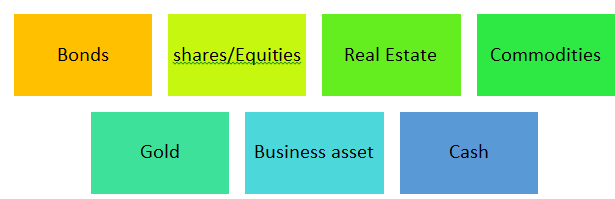

4. DIVERSIFY YOUR PORTFOLIO BY INVESTING IN A VARIETY OF ASSET GROUPS,

including

Most of these may sometimes require a great deal of capital to invest. Hence SFS Fund is a great entry point as it allows you to accumulate funds such that when you see an opportunity that requires huge capital, you have something to fall back on.

5. INVEST REGULARLY: Develop the habit of investing by allocating a portion of your income for investment activities as you receive it; doing so will help you reach your long-term objectives. As an aggressive investor, you may want to think about reinvesting any capital received from investments or dividends back into your investment portfolio unless you are seeking a certain amount of periodic income from your investment. Sometimes, it is preferable to make smaller, more frequent investments than larger ones but as a one-off. To achieve this, the SFS fund allows you to top up your investment at any time using various channels; bank transfer, USSD, etc. You can basically track/monitor your investment in your comfort zone by simply downloading the SFS Fund App on your phone. And you can also automate your investment on the app.

The importance of a qualified and seasoned Investment Manager cannot be overemphasized as they have been exposed to years of experience and understand how best to manage your money, ensuring that you get the best out of your capital. This is where the multiple award-winning SFS Capital comes in. With over a 100billion Naira in Asset Under Management, the firm has continued to maintain a laudable track record with the AA-rated SFS Fund (SFS Fixed Income Fund), paying out dividends on a quarterly basis to investors since the launch of the fund in 2014. To begin your investment journey, download the SFS Fund App to get started.