A wave of consolidation is ongoing in Nigeria’s pension fund industry specifically among pension fund administrators.

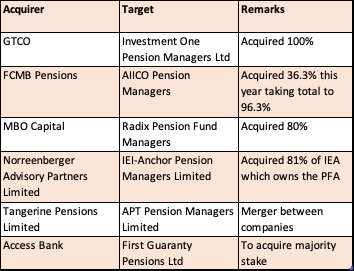

Data from the Pension Fund Commission reveal that there have been 6 mergers and acquisitions in the first half of 2022 alone.

Even more recently, FBN Holdings subsidiary First Pension Custodian announced it had acquired 100% of Access Pension Custodian. This is obviously not the last as we understand another major pension fund administrator is in the concluding stages of being acquired.

These are some of the recent acquisitions on record.

Why are these mergers and acquisitions taking place?

In April 2021, industry regulator, PenCom mandated all PFAs in Nigeria to meet a N5 billion recapitalization threshold; a 5x increase from about N1 billion, within a year.

Chairman of Pencom, Dr. Oluremi Oyindasola Oni explained that the “recapitalization is expected to strengthen the capacity of the PFAs and increase their presence nationwide through the creation of more business outlets and generally improve service delivery to members” while also stating that the capital raise will improve the financial condition and operational efficiency of the PFAs.

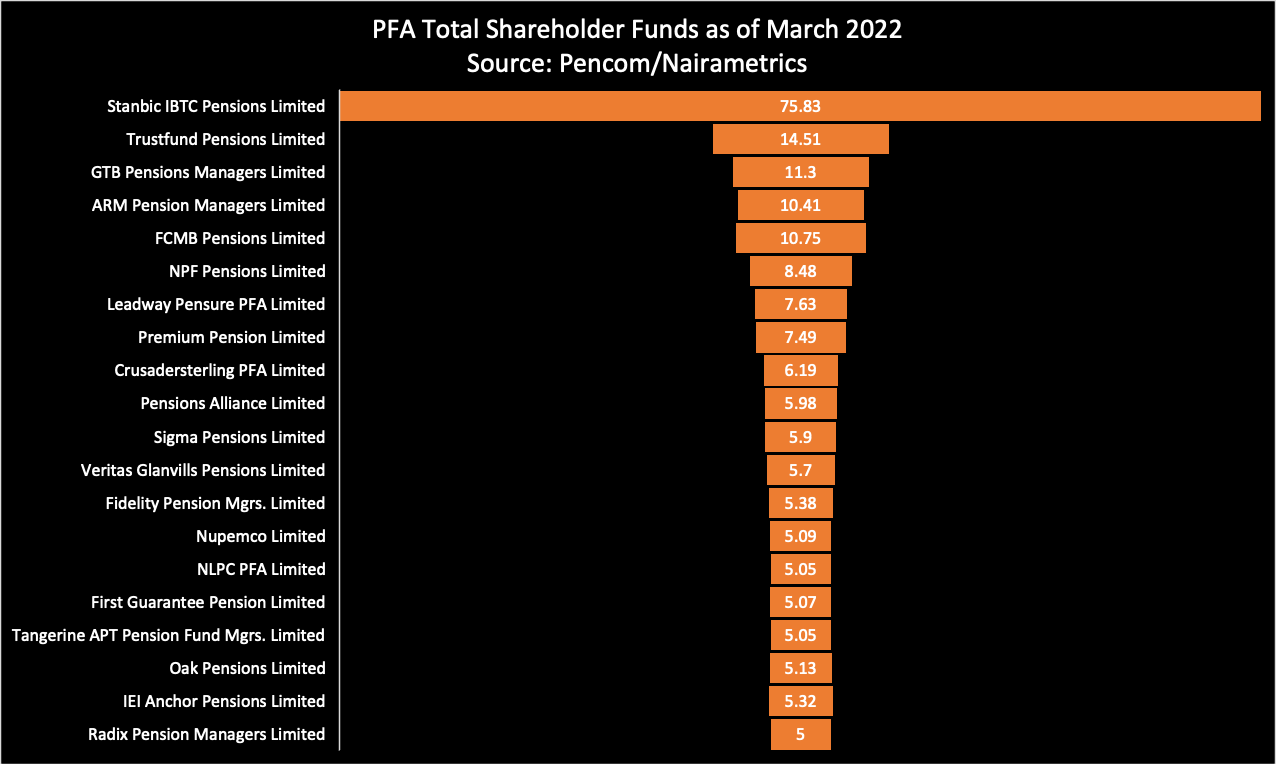

As of July 2022, records show all 20 PFAs on record have met the minimum N5 billion recapitalization targets. Total shareholder funds for PFAs summed up to N211.27 billion as of 27 April 2022 this compares to N169.417 billion and N150.04 billion in 2021 and 2020 respectively.

According to PENCOM data, the top 5 pension fund administrators (Stanbic IBTC, Trustfund, GTB Pensions, ARM Pensions, and FCMB Pensions), make up about 58% of total shareholder funds in the sector. Stanbic IBTC Pension the largest of all has a total shareholder fund of N75.8 billion about 35.9% of the total.

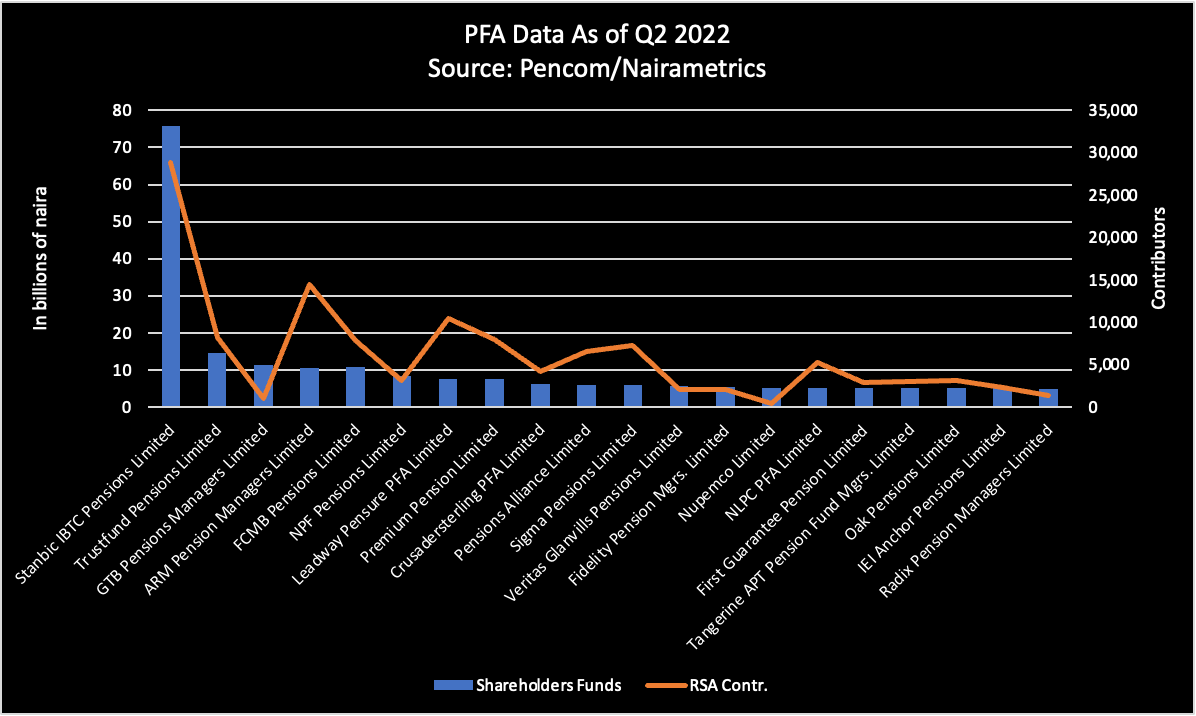

In terms of RSA Registration count by PFA, the top 5 made up of Stanbic IBTC Pension Managers Limited, ARM Pension Managers (PFA) Limited, Leadway Pensure PFA Limited, Trustfund Pensions Limited, and Premium Pension Limited make up 58% of total contributions.

- Also, Ranking of PFAs by the value of contributions received, the top five ranked PFAs received 69.76% of the total contributions as of the end of Q2 2022.

We also see a similar trend with the most important measure of all, Asset Under Management. According to our findings, 5 of the PFA manage over 66% of the total asset under management based on active Funds I, II, III, and IV as of December 2021. Again, Stanbic IBTC led the pack with a whopping N3.9 trillion in net asset value of assets under management. ARM, Premium Pensions and NPF come a distant second, third and fourth respectively.

- This begs the question of why there is a long tail of 20 PFAs when most of them can’t compete.

With over N14 trillion in total assets under management, PFA’s in Nigeria now wield so much significance in the economy, they are the most powerful force when it comes to seeking mid-to-long term patient investments. More importantly, PFA earns lucrative fees mostly determined by the size of the assets under their management.

For example, Stanbic IBTC Pensions earned N46 billion in revenues in 2021 alone contributing 27% to group revenues. The pension business also made a profit of N21.8 billion in 2021 contributing about 38% of group profits. This is what some of the big banks like GTCO, Access & FCMB are seeing resulting in a spree of acquisitions that are running through the sector.

The message is clear here; to compete with the big 5 PFAs in a very lucrative market, smaller PFAs will need to consolidate via mergers and acquisitions. There is no pathway to the top relying only on aggressive market share and capitalization.

- Notably, efforts at instigating competition via the transfer system are yielding fruit, only about 14,821 RSAs were transferred to new PFAs along with their associated pension assets, which stood at N50,218,505,218.53.

- This is not even scratching the surface and it is likely the top 5 also gained contributors.

Consolidation is also important for the sector that is often chastised for delivering meager returns for pension contributors. Whilst more PFA’s provide competition, it will not happen if the gap in shareholder funds remains as wide. We need stronger Pension funds that can leverage their economies of scale to increase the number of contributors. Stanbic Pension has obviously taken this business seriously from the start.

With a shareholder’s fund of over N75 billion (15x industry required N5billion), it has a solid base to keep growing on all fronts. No surprise it also leads the largely untapped micro pension space with 43.8% of the fund AUM as of Q2 2022.

Nigeria’s banking sector provides a useful guide to what could happen with the PFAs. In the same way, we have FUGAZ, 5 tier-one banks dominating the entire banking sector, there will likely be 3-5 Super PFAs within the next 5 years.