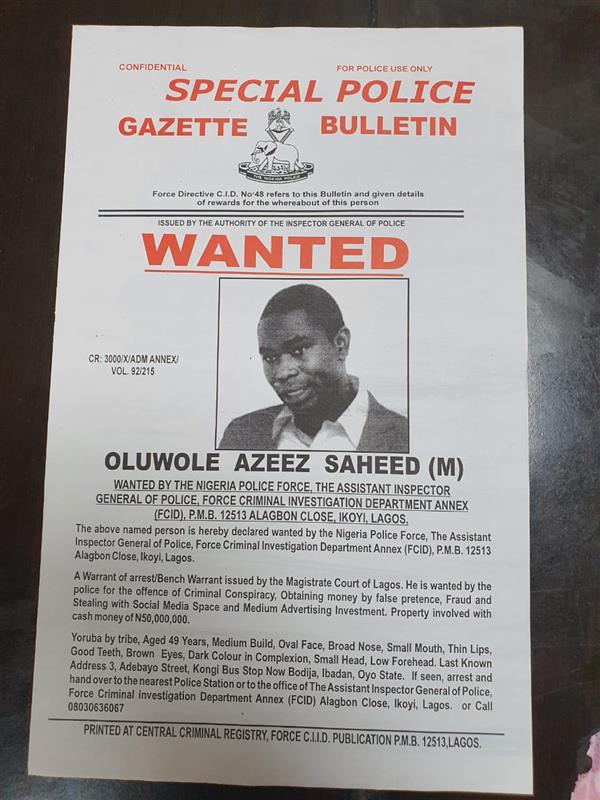

The Nigerian Police Force has declared Oluwole Azeez Saheed, the founder of FarmKonnect Agribusiness Nigeria Limited wanted for investment fraud worth over N50 million.

A special police gazette bulletin shows that following a warrant of arrest/bench warrant issued by the magistrate court of Lagos, he is wanted for the offence of criminal conspiracy, obtaining money by false pretence, fraud and stealing with social media space and medium advertising investment – property involved with cash money of N50 million.

This followed a petition by Chive GPS to place FarmKonnect founder on Interpol global red notice for obtaining money by false pretence and investment fraud.

The petition seen by Nairametrics reads, “We are retained by ‘our clients’ and on whose express instruction we write to lay a criminal complaint of a well-orchestrated theft, fraud, and obtaining money by false pretences against Oluwole Azeez Saheed herein referred to as Azeez, and for him to be placed on a red notice.

“Sometime in 2019, Azeez through FarmKonnect invaded the social media space and other medium advertising for investment and posed as investment mogul that can manage the public’s funds in various agricultural enterprise in exchange for fixed return at a predetermined rate and duration.”

The statement further revealed that subscribers at different points transferred over fifty million to different bank accounts owned by Azeez with the expectation of fixed interest.

It added, “Oblivious of the large-scale fraud ahead, our clients transferred, at various times the sum of Fifty Million Five Hundred Thousand Naira (N50,500,000) into the corporate accounts of Farmkonnect Agribusiness Nigeria Ltd.

“The proposed transaction was packaged and designed to yield fixed interests. However, upon expiration of the investment, the chief mastermind Azeez stopped any form of communications with our clients and have since become evasive, switched off their phones and currently unreachable.

“We believe this may have been a premeditated fraud which was disguised as a legal investment scheme owing to false representations. We believe they may have also swindled thousands of persons of billions of Naira and they may have diverted the funds into real estate and other personal endeavours.”

To prevent Azeez from fleeing the country to South Africa, the petition sought to have him placed on a global red notice.

Meanwhile, we couldn’t immediately confirm this with the police as several calls put through to the Lagos Police PRO, SP Benjamin Hundeyin, were not answered at the time of the report.

What you should know

- Nairametrics had earlier reported how FarmKonnect tied down investors’ capital by holding on to their funds even when the payment date long elapsed.

- The investors said they were drawn to the scheme because of the great endorsement it received from respected personalities.

- A few months after the report, the company stated that its business administration, operations, trade and communication are being handed over to third-party companies going forward, as part of its effort to restructure the business.

- In a statement, it said the company will stop all profit accrual models and work towards refunding of all investments, within the shortest time possible whilst also noting that the CEO will not be available on mobile phone and emails for the next 3 months on health reasons.

Nairametrics help us out about ceepass digital bank please 🙏

Farmkonnect in ibadan also involve in this fraud, am so happy to be reading this wonderful story fraud, since January I can sleep in my house again bcos of Farmkonnect fraud all of my subscribers, they cant allow me to move around again bcos they want there money back. Bcos am one of the Farmkonnect agent

Pls help us in Ibadan this man endangered our lives as field agent working for farmkonnect by refusing to pay customer money and the customer has beaten some injured some as he couldn’t be reach to clear the air on the issue he’s such a heartless man

I am also a subscriber to Farm Connect in Ibadan Oyo State and am yet to receive my money back since last year

Nairametrics, please have you heard of Emeralds farms, Agropartnership, Crowdyvest etc The are also into agriculture tech and have not paid their subscribers, I have not seen any government agency arresting or publishing their names like this.

50miliion is small compared to what the above guys did.

Kindly respond if you have any details. I have my funds with the above guys.

Thank you

The endorsement received from Media houses lured me to the scheme. I would not fall for such again. Recently, he contracted Rehoboth Chamber to mediate in the matter, till now nothing has been heard or done based on drafted agreement.

This is the truth, I work for the company for four month under it’s subsidiary (Afide) which also involve individuals investing but on a daily basis contributions.

We did and majority of our clients are still not paid, close to a year now. I personally still have clients that I repay back monthly.

I invested N2000 for a start in the farmkonnect agribusiness only to sadly realize later (when the time for return on my investment was drawing nearer) that I must have been defrauded!

-Ray Tersoo Jegu,

Gboko , Benue State.

Same thing happened to me,my sis is an agent there too,I got her so many customers nd now dey want there money back frm me.

I am one of the agent for farmkonnect, for months now my subscribers, which are family friends, colleague at work, my friends far and near which have invested large amount of their money have been on my neck pursuing me around for their money, saying they invested with farmkonnect because of good relationship with them.

Stealing under different forms is fast eclipsing Nigeria. Unfortunately those that should checkmate these stealings are also neck deep into it and more painfully too, those that should preach against stealing are fast becoming front liners in stealing. There are too much fears about life in old age so people are stealing to prepare for old age. Until the system is redesigned to give people hope at old age, stealing in different forms shall be on the increase. Whether it is yahoo, looting, corrupt enrichment, whether snakes or monkeys are involved, stealing is stealing. The system is too kwashiokored that earnest and honest surgical operations are needed to heal Nigeria of the the increasing rate of pen robbery.