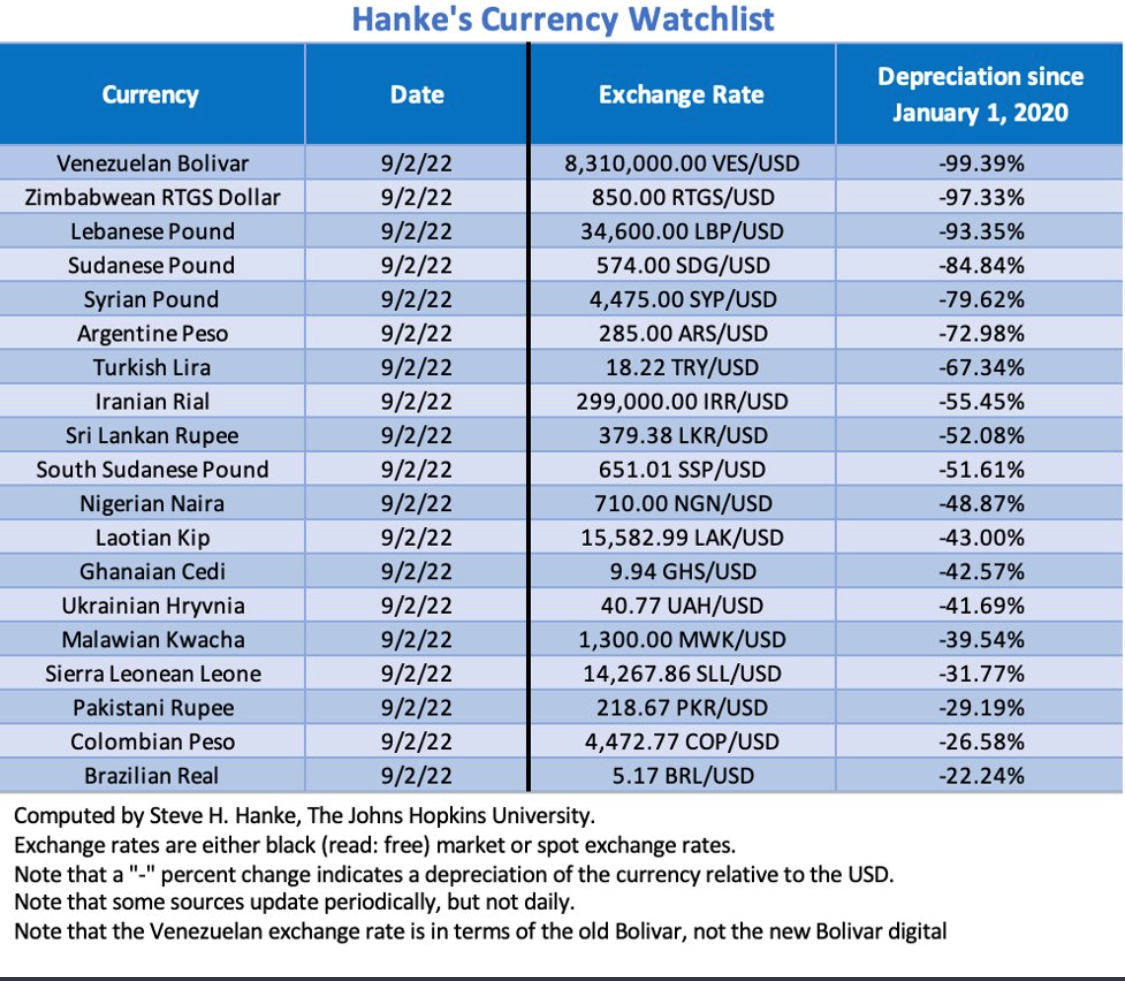

The Naira, Nigeria’s currency ranks 11th worst-performing currency against the US dollar, according to Hanke’s Currency Watchlist.

The data shows that as of September 2, 2022, the Naira had lost 48.87% of its value against the US dollars compared to its value in January 2020.

The data also reveals that the Zimbabwean RTGS dollar, which has lost 99.33% of its value against the US dollars, is the second worst-performing currency in the world. The Venezuelan Bolivar was the worst-performing currency with a depreciation rate of 99.39%.

What you should know

- Steve H. Hanke a professor of Applied Economics expressed his displeasure about how the Nigerian government is handling the Naira.

- He said “In this week’s Hanke’s #CurrencyWatchlist, Nigeria takes the 11th place. The naira has depreciated against the USD by 48.87% since Jan 2020. With Sleepy Buhari at the helm, the Nigerian naira is tanking.”

- The exchange rate between the naira and the US dollar has plummeted from N565/$1 to N705/$1, representing a N140/$ loss year to date in the black market.

- However, the Central Bank of Nigeria (CBN) has maintained artificial stability in the official forex window by selling foreign exchange from its reserves. The official exchange trades at around N430/$, expanding the gap between the official market and black market.

- Consequently, Nigeria’s external reserves shrank by $1.496 billion year to date. The drop in reserves is even more concerning given the recent spike in crude oil prices.

- International organizations have continually advised the CBN to abolish the official window; recently the World Bank Group President, David Malpass in a meeting with Vice President Yemi Osinbajo of the Federal Republic of Nigeria advised Nigeria on exchange rate unification.

- President Malpass emphasized to Vice President Osinbajo that a unified exchange rate will significantly improve the business-enabling environment in Nigeria, attract foreign direct investment, and reduce inflation. President Malpass and Vice President Osinbajo also discussed the importance of increasing domestic revenues through broadening Nigeria’s tax base and increasing the efficiency of tax administration.

Again, chasing shadows instead of substance…smh

Who would care about the exchange rate of the Naira against the US Dollar, if we are not LAZILY importing things that we could easily produce in Nigeria (and even export to other countries), such as petroleum products, maize, wheat, tomato paste, rubber products, chocolate, steel products, etc.

In fact, if we built a productive economy (instead of being obsessed over rent-seeking and sharing the windfall of what is mostly produced by foreigners), then a WEAK Naira would be an ECONOMIC ADVANTAGE because our exports would be cheaper and more attractive in international trade.

To the point.

Good Point.

Unproductivity, high rate of corruption and poor leadership seem to be the common denominator in all the countries on this list.

I know one day, we’ll be out of this list. But then let’s stand on our ground because only we can change all the problems.