This is certainly one question that is sure to evoke several answers in a nation where Premium Motor Spirit, otherwise known as fuel remains an opium of sorts. PMS is subsidized in Nigeria, in spite of several indices that show the intended benefits have not materialized for Nigerians. On the contrary, many have argued that it appears to be double jeopardy considering that people have to pay out-of-pocket to access basic healthcare, education, transportation and security, among others, with no apparent cushion from the subsidies.

This special report is by no means a finger-pointing or blame-seeking article. The quest is simply to highlight, using recent trends and data from the government and operators, that it seems inevitable that Nigerians may have to pay more for the product in the near future. The body language from the government suggests the subsidy regime may very well be nearing its end due to dwindling national fortunes. Are Nigerians prepared for what this might bring in terms of the pump price of petrol?

Nigeria continues to witness perennial bouts of scarcity of PMS (petrol) as the pendulum swings endlessly around the continued debate about what the true petrol pump price should be. Regardless of whether we have enough fuel for 200 million Nigerians, it appears the main issue should be: “At what Price”. This is what ensures sustainability.

- Huge subsidy payments have been made over the years with no apparent level of transparency. In 2019, the total subsidy payment was between NGN1.5 million and NGN1.71 trillion.

- Now, in 2022, the proposed under recovery as it is called today will be over NGN4 trillion Naira. This should be a grave cause of concern for the nation and needs to be addressed in the best interest of Nigerians. With the deterioration of the security situation and the continued impasse between the government and the Academic Staff Union of Universities (ASUU), industry experts say that the removal of subsidy or under-recovery by the government will free up the about NGN4 trillion to improve those sectors of the economy that would create greater economic wellbeing for all.

From various statistics and economic indices, as well as an increase in the volume of petrol consumed daily in Nigeria, “SUBSIDY/UNDER-RECOVERY” is certainly neither sustainable nor healthy for Nigeria. A review of data between August 2021 and August 2022 sourced from information in the public domain and operators clearly shows the sector and Nigerians by extension, might benefit more from deregulation.

- For example, in the Guardian Newspaper of December 23rd, 2021 – Nigerians consume 19.535 billion litres, N2.563tr petrol in one year, it is reported that Nigeria’s petrol consumption for 2021 was a staggering 19.535 billion litres of petrol, which brings about an average monthly consumption of about 1.628 billion litres of petrol across the country. Using the information to extrapolate consumption between August 2021 and December 2021 at the average pump price of NGN165/litre, we consumers paid NGN1.343 trillion for petrol and a potential under-recovery of about NGN744.392 billion which is an additional 55% of consumer spending from other sources of revenue, making a total of NGN2.087 trillion during that period. This under-recovery is actually still borne by Nigerians and could have made huge differences if applied to critical sectors like health and education.

- In contrast, according to a Daily Trust report of January 2020, Nigeria imported over 18bn litres of petrol in 2019, it was reported that the 2019 petrol consumption was 18.624 billion litres. As such, during the same period in the pre-Covid-19 year, the country’s monthly consumption was 1.552 billion litres of petrol at a cost of NGN1.128 trillion and an under-recovery cost of NGN670.833 billion for the same period as in 2021 (August – December 2019). This amounted to a total of NGN1.799 trillion in consumer spending directly and indirectly.

- For example, when you compare the amounts paid as under-recovery paid between August and December 2019 (NGN670.833 billion & NGN744.392 billion) and 2021, ASSU’s demand for NGN220 billion to be injected into the tertiary education system, it represents 32.8% and 29.6% respectively of the individual years’ payment and 15.5% of the total amount of NGN1,415.225 trillion for the period August to December for both years. It also stands to reason what the huge under-recovery can do to the nation’s powers sector, especially the transmission part of the value chain. That would mean potential improvement in power supply that will give impetus to socio-economic development.

- Also, according to the Vanguard Newspaper, the consumption of petrol rose from about 72 million litres per day in the first quarter of 2022, to about 74 million litres per day at the beginning of the second quarter of the year.

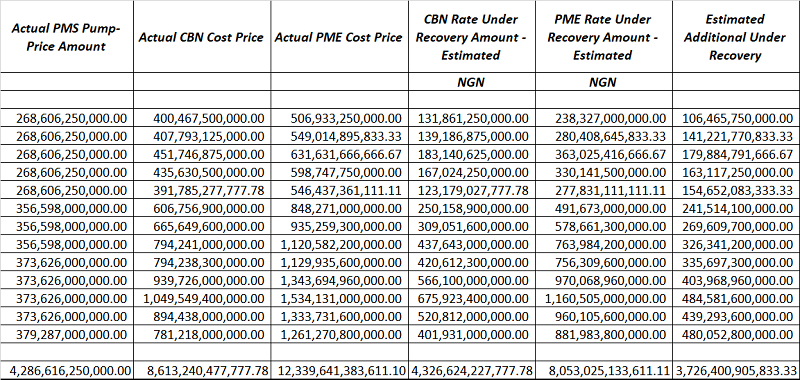

The issue here is, how much did the country bear in terms of under-recovery? Table 1 below shows the exact monthly landing cost price and the differentials using the official and parallel market exchange rates when compared to the average pump price of petrol.

Following the above, Table 2 highlights the period between August 2021 and August 2022.

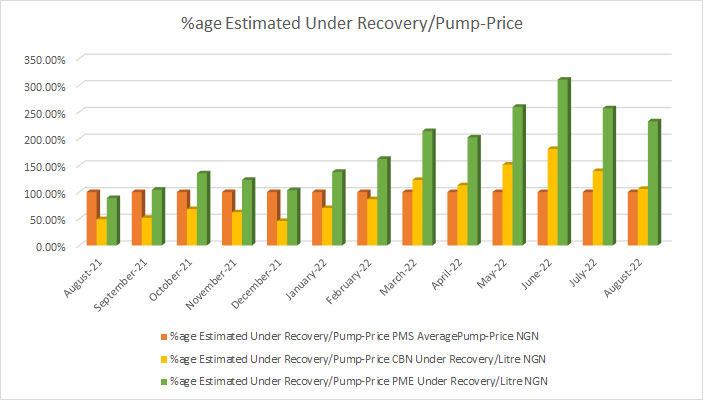

The info-graph below clearly shows the price differential trend lines of pitching the current average petrol pump price against landing costs using the dual average exchange rates available.

Using the data above, it is pertinent to note as shown in Table 3, that under-recovery of petrol during the period in review cost the country about NGN4.327 trillion using the average official exchange rate and a potential additional under-recovery of NGN3.726 trillion using the average parallel market exchange rate. When you add the fact that sourcing monies for payment subsidies have become almost impossible, deregulation becomes the obvious solution.

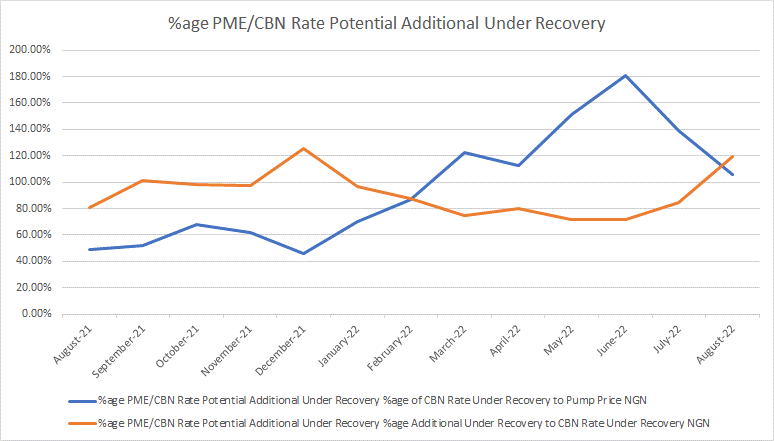

This is better highlighted from the info-graph below

A further analysis of the available data provides greater insights into the monthly percentages of the possible under-recovery amounts when compared to the amount received from consumers for the use of petrol based on the average pump prices. For example, in August 2021, the percentage of under-recovery based on the official exchange rate was about 49.09% of the pump price, whilst it was about 88.73% when compared to the parallel market average exchange rate for that period. This has since increased the average pump price amount in March 2022 to about 122.73% and 214.24% when compared to the dual exchange rate averages, peaking in June 2022 at 180.91% and 310.61% respectively.

In all, there is the need for the full deregulation of the petrol market, like is the case with the Diesel and Aviation Fuel markets by the government. This is because it will free up trillions of Naira that could be put to better use in other areas of the economy. If this happens, then the regulators can better focus on their role as regulators by ensuring that operators meet their obligations of delivering quality products to the market as well as enforce to the letter of the law obligation due from the operators in forms of taxes, penalties for infringement and the needed investments in infrastructure to the sector for more efficiency like is the case of the Dangote refinery.

The government can by so doing provide the necessary amenities that would drive these investments and through various partnerships create plans that would see these investments placed in the right areas for economic and social development.

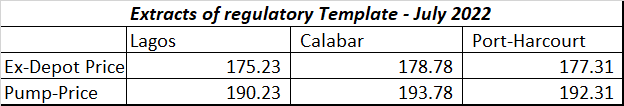

Finally, where the government feels that there is the need for the gradual deregulation of the sector, they can start by putting in place the current pricing modalities as provided in the regulatory pricing template as per the table below.

Though not fully representative of the current realities, it would reduce the potential amounts to be paid out in under-recovery amounts by NGN12.73 with respect to imports from Lagos, NGN16.28 for imports from Calabar and NGN14.81 for imports from Port-Harcourt, this will translate to about NGN99.226 billion monthly and NGN496.13 billion till the end of the year if these new prices are implemented from September 1, 2022. So, the question remains, how much should a litre of fuel cost in Nigeria? Market realities suggest it may well be more than the current cost. Another question: shouldn’t this conversation be held transparently for the benefit of all Nigerians?

NOTE: This is the first of a 4-part series on the oil and gas downstream sector.

A proverbial “million-dollar” question for me is: will the expected forthcoming petrol production by the Dangote mega-refinery be allowed (PPPRA) to sell the PMS at “true” IPP (Import Parity Price)? I dare to answer myself and say the answer is definitely “No”. If, that is the scenario (i.e. sell at current under-recovery rates), then financial sustainability of the Dangote refinery is doomed. What a “national tragedy” premonition would be, if that would materialize.

The concept of celebrity net worth showcases the economic magnitude of the entertainment industry and its stars. It’s fascinating how the talents and skills of these individuals can translate into substantial financial success. However, we should also reflect on the broader implications this has on our society’s values.