Manufacturers Association of Nigeria (MAN) has lamented the difficulty in accessing dollars at official Central Bank of Nigeria rates

This, they said has made it more difficult and expensive to import raw materials and machinery needed for their operations.

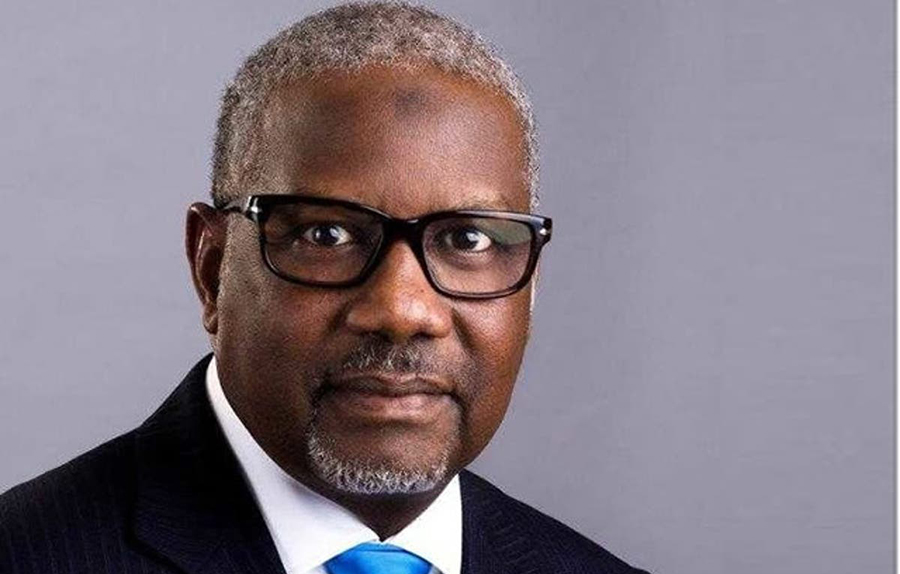

This was disclosed by Mr Mansur Ahmed, National President of MAN and Dr Okwara Udensi, Edo/Delta branch chairman of MAN, at the 36th Annual General Meeting of the association.

What they are saying

Dr Okwara Udensi stated current realities have made it difficult for manufacturers to access dollars at official rates and hence, have had to rely on the parallel market.

“Manufacturing companies are unable to access the dollar at the official rates and they need it for the importation of raw materials.

“They have been consequently going to the parallel market to get the dollar at higher rates.

“The sector is facing numerous challenges and it needs urgent attention of the Federal Government to provide adequate bailout for the sector to avoid total collapse,” he said.

He added that the sector would only be able to contribute to the country’s economic growth if the numerous challenges militating against its smooth operations were tackled. The challenges, he said, are poor electricity, high lending rates, multiple taxes and levies by government agencies, low patronage of made-in-Nigeria products and congestion at the Lagos ports, among others.

“It is our expectation that these identified challenges be addressed by the government to move the country from an import-dependent to a self-sufficient and export-based economy.

“This can only be made possible with consistency in governments’ policies to guarantee the required enabling environment so that manufacturing companies are able to operate at maximum capacity,’’ he said.

Mr. Mansur Ahmed, National President of MAN, urged the CBN to direct commercial banks to process FOREX allocation applications by manufacturers transparently and called on the Federal Government to evolve a strategic response to the disruptive impact of the ongoing Russian-Ukraine war on the global supply value chain.

In case you missed it

- Nairametrics reported earlier that thousands of applicants are facing harrowing experiences as they get their PTA in two or three tranches depending on what is available in the banks’ vault.

- Some get $1,000, $2,000 or more and are asked to access the balance in their dollar debt cards, which are usually not enough for their spending needs abroad because of banks’ spending limits.

- Some applicants for PTA have, however, found ‘smarter’ ways of getting their dollar supply by having multiple applications in different banks thus challenging the effectiveness of commercial bank measures at rationing

- Bank sources confirm that customers spend weeks to get their full allocation of PTA after application and that the banks just can’t help the situation given the rush for PTA and the scarcity of dollars.