If you are reading this article and still have investments in cryptocurrencies, US stocks or even Nigerian equities, then my bet is that it’s a sea of red.

The global financial market is in turmoil and for a damn good reason. The fear of inflation has forced countries across the world to increase interest rates hoping it will help curtail demand as the world continues to deal with global commodity shortages.

To make matters worse, the outlook about inflation rates remains gloomy with ultra-high shipping costs, rising energy prices and the war between Ukraine and Russia blowing up hopes of any immediate revival. This inflation rate will remain sticky for some months if not years and as a result, influence the need to keep rates high.

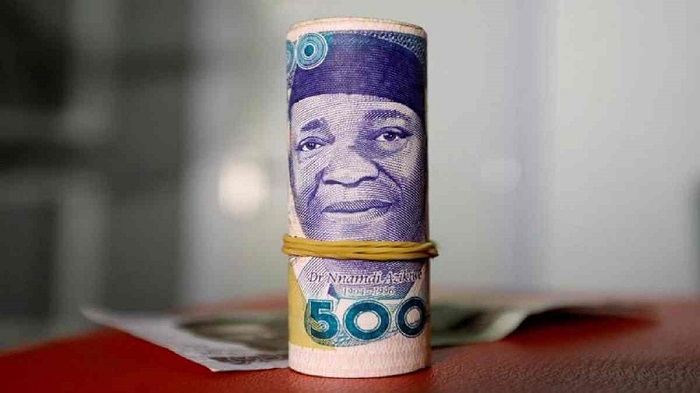

With interest rates high, there is palpable fear that we could be headed for another global recession and one that could last for some time. This is why the markets are in turmoil and assets are now selling at bargain prices. Anywhere you look, it’s as if stocks are on sale. No one cares about fundamentals or any exotic technical analysis. The only fundamental thing today is cash.

Once again, cash is king and it is those who hold it and deploy it smartly that will win. In every market turmoil, new winners are made and this won’t be different. We have seen this happen severally in the last decade and a half. Even in Nigeria, we have seen equities crash in 2008, 2011, 2015 and 2019. Like the rest of the world, stocks also crashed in the early pandemic months of 2020.

Yet after every crash, we have seen a major bounce back and it is those who hold cash and deploy it better that end up winners. However, things might be different this time around. It could take a few more months before everything unravels. Equity prices could still drop further and cryptocurrencies could well crater below their $20k prices which it breached over the weekend only to climb back up. Real Estate is also cooling gradually after years of record-high property prices, especially in developed countries.

If interest rates continue to rise, house owners may struggle to meet up with their mortgage payments. Unlike in 2020 when the government bailed out most house owners, no one will dare do that this time. Not with inflation this high. If house prices fall then we could see another round of sell-offs that will even see asset prices fall further.

Nigeria is often thought to be decoupled from the global economy when it comes to equities. This fairly recent conclusion is drawn out of the lack of foreign investor participation in recent years. However, the panic is real and as we have seen over the last few weeks investors are gradually selling off. Some are afraid that there could be a contagion while others already look to the fixed income market for succour. The over-subscribed treasury bills auction result of last week was a warning signal that investors are exiting and fleeing to cash or quasi-investments.

In investing, the greater fool theory supposes that people buy assets when the prices are going up because they believe there will always be a greater fool they will sell to when the price appreciates higher than they bought it.

Well, the same applies to those selling to people who are buying now because they think they are buying the dip. The “fools” are probably the ones buying thinking they are buying the dip when the signals are that the sell-off could persist and so your losses could be deeper than the dip you paid for.

The smart thing to do could be to avoid being the greater fool and just hold cash, at least for now.

Thank you for this. Well written!

what happens to dollar cost averaging ? The fact is that the stocks always rebound so if you invest money for a long time in the stock market you never lose. Never try to time the market. Avoid invest for short time .Invest in ETF and mutual funds for 20yrs or more and you will be fine .

Thanks for this. I’m keeping the little cash I can scrape up

After evaluation, I came to the same conclusion a week ago that Cash is safe for now while still watching the market &thanks for the update.

Cash in naira or usd

Cos exchange rate Keeps soaring and that’s affecting the cash

Excellent well researched article, thank you for this clarification. To those thinking of buying the dip, wait please, the canyon gets much much deeper. Ever notice how whales jump in to save Bitcoin from eminent disaster? It’s happening right now, they are flooding the arena with cash to prop these non-tangible assets above the 20K point. There’s much bigger corrections ahead, more players will deflate to zero. A correction is needed, the survivors will be leaner and meaner. Is the canyons bottom 10K or is it ZERO?

This is not the place for your “crypto analysis”. The world’s financial system and the scope of this article is broader than crypto

I really lant alot from you guys keep it up thanks

Please what’s the advice, is to wait with the cash idle or to invest in mutual funds or dollar fund.please advise and educate us. thanks

He’s right tho

Thanks so much for this wonderful opportunity e one’s more i really lant a lot from this nice program and i can assure you the fact that is amazing

Cash is really difficult to keep, it’s better invested. Give us tips on how to hold on to the cash.

Halp me please iintarastet

Hmmmm. You continue to keep cash and you see inflation eating the purchasing power of the cash so fast. Give us a tip as to when to smartly apply the cash one is holding. The situation is really getting dire by the day.