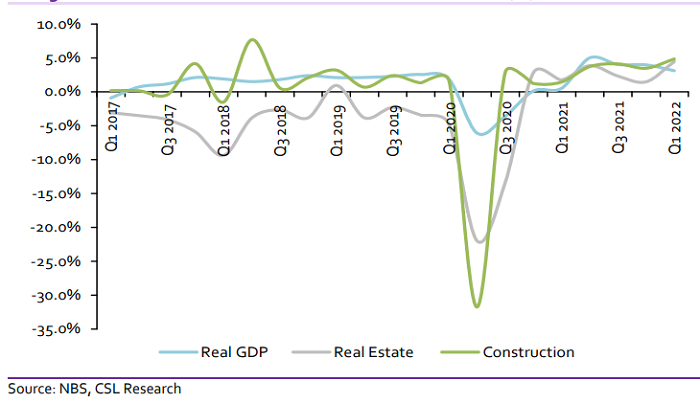

Analysis of the Q1 2022 GDP revealed that the Real Estate sector sustained the upbeat in the last 5 quarters as it started the year 2022 positive, recording a 4.44% GDP growth in Q1 2022 and the highest growth since Q4 2014.

This is in line with our positive expectations as highlighted in our 2022 outlook “In Dribs and Drabs”. Similarly, related sectors such as the construction and cement sectors recorded growth of 4.83% and 9.57%, respectively. It is enthralling to see that despite the extremely low purchasing power of Nigerian consumers, investments in real estate continue to grow.

Reports from a notable real estate advisory firm, Estate Intel, noted that real estate projects in Lagos (one of the largest real estate markets in Nigeria) under construction increased by 19% in 2021. However, some subsectors such as the residential and healthcare have recovered more than others (Office, Hospitality).

Apart from that, the cement players also highlighted the dominance of private sector investments in their performance, a trend that is expected to continue as we expect government spending on capital projects to slow down with an increased focus on election activities and increased election spending.

That said, the moderate real estate growth in Q1 2022 points to the fact that the real estate sector is back from the brink but is not entirely out of the woods. As we had highlighted earlier, we believe the real estate investments narrative will not be far from what was witnessed in 2021, and we believe many projects under construction in 2021 will be completed in the year, ultimately expanding real estate consumption in 2022. However, despite the positive outlook in 2022, we still believe the weak disposable income, and inflationary pressures will continue to fuel sub-optimal growth.

Nigeria’s Real GDP vs Real Estate Growth vs Construction (%)

CSL Stockbrokers Limited, Lagos (CSLS) is a wholly owned subsidiary of FCMB Group Plc and is regulated by the Securities and Exchange Commission, Nigeria. CSLS is a member of the Nigerian Stock Exchange.