One of the world’s most widely used blockchain, the Binance Chain, has burned 1,839,786.261 BNB, the native token of the Blockchain, worth approximately $742 million in Q1 2022. This is the Binance Chain 19th edition of its quarterly token burn program which began in the third quarter of 2017.

Since the Binance Chain and its native token, BNB, launched in 2017, the team has committed to removing a total of 100 million BNB, or half of the total supply from circulation, through a process called burning. The number of tokens removed for this quarter was automatically calculated according to the Auto-Burn formula.

In the last quarter of 2021, Binance introduced and implemented its first-ever auto-burn program last quarter, called the BEP-95, where the number of BNB tokens to be burned is arrived at using a formula based on the total number of blocks produced on the Binance Chain and BNB’s average dollar-denominated price during the quarter.

What are token burns?

Cryptocurrency tokens or coins are considered “burned” when they have been purposely and permanently removed from circulation. Token burning is usually performed by the development team behind a particular cryptocurrency asset. It can be done in several ways, most commonly by sending the coins to a so-called “eater address” where its current balance is publicly visible on the blockchain, but access to its contents is unavailable to anyone.

The practice of burning may involve the project’s developers buying tokens back from the market or burning parts of the supply already available to them.

Burning can be done with different goals in mind, but most often it is used for deflationary purposes: the decrease in the circulating supply tends to drive an asset’s price upward, incentivizing traders and investors to get involved. Another important use case for token burning is to maintain the price peg of stablecoins (cryptocurrencies whose value corresponds to another asset, like the U.S. dollar).

What you should know

- In the past, the total number of BNB token to be burned was calculated based on the tokens’ usage and revenue generated in the Binance centralized exchange.

- As a result of the community’s feedback, the BNB Auto-Burn effectively replaces the previous burn mechanism in favour of a more objective process independent of the Binance centralized ecosystem.

- This is the second quarter the auto burn mechanism has been running and this quarter’s burn was greater in the number of BNB burned. The total amount of tokens burned in Q1 2022 grew by 9.23% against Q4 2021, where 1.68 million BNB was burned.

- However, due to the market downturn seen in the first quarter of 2022, the value burned was less than the fourth quarter of 2021. In Q4 2021, $783 million worth of BNB was burned.

- BNB additionally uses a real-time burning mechanism based on gas fees. A fixed ratio of the gas fee collected is burned in each block, with the ratio decided by BSC validators.

- So far, 34.9 million BNB have been burned since the proposal to burn BNB was implemented in 2017. The current circulating supply of BNB currently stands at approximately 165.1 million BNB.

- BNB is currently ranked #4 with a market capitalization of $69.3 billion as of the time of this writing. At the beginning of the year, it traded as high as $533.37 before going on a steep decline.

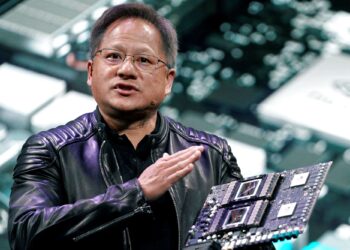

Changpeng Zhao, the CEO of Binance took to twitter to tout about the total amount burned stating, “$741,840,738 worth of #BNB will be taken out of circulation soon. BNB is deflationary. If you don’t know what that means, you lack basic financial knowledge to get lucky in this world. Harsh but true. Time to learn.”