The Nigerian banking sector is one of the viable destinations for foreign investors in the country as it attracted over $15.7 billion in foreign investments in the past 5 years, representing one of the most attractive sectors in the Nigerian economy.

This is based on analysis carried out by Nairalytics, the research arm of Nairametrics from data obtained from the Central Bank of Nigeria (CBN).

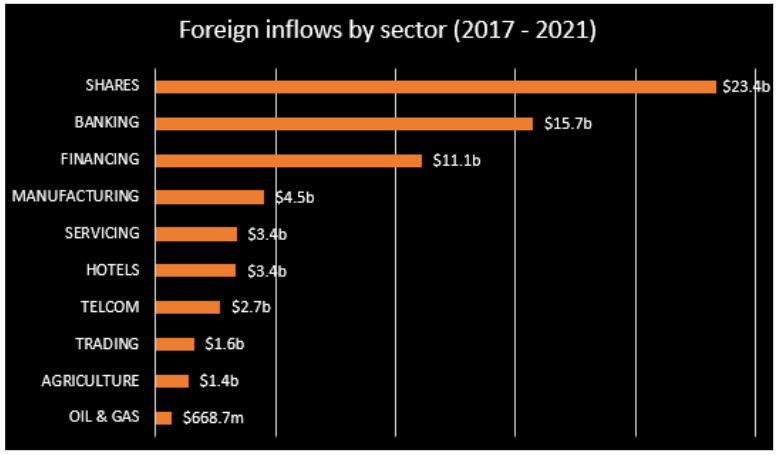

According to the data, Nigeria recorded $68.87 billion in foreign inflows between 2017 and 2021, with the banking sector accounting for over 22.8% of the total capital imported, which was only bested by the local equities market.

The Nigerian banking sector has been growing in leaps and bounds over the years, with several tech startups springing up in the space. A number of these firms have raised significant amounts since they launched operations in the country while some have hit unicorn status (valued above $1 billion).

The emergence of financial technology firms in the country, all competing for market share while disrupting conventional banking methods has increased the level of activities as investors have come to identify the sector as a profitable one.

A further look at the breakdown of Nigeria’s gross domestic product shows that the financial sector has also expanded all through the five-year period under review. Notably, the sector grew by 10.53% in real terms in 2020, which is lower than the 13.34% annual growth recorded in the previous year.

However, the growth recorded in the past two years, outweigh the preceding years. For example, the banking sector recorded real GDP growth of 2.4%, 1.41%, and 1.92% in 2019, 2018, and 2017 respectively. This shows that the sector traction grew significantly in the last two years.

Fintech startups with notable fundraise

A brief glance at the Nairametrics deals book tracker, which collates deals consummated by Nigerian companies across various sectors, shows worth noting deals by Nigerian financial technology firms.

- In August 2021, Nigerian fintech firm, Opay raised a sum of $400 million in a financing round led by SoftBank Vision Fund 2, which valued the company at $2 billion. The fund raised in 2021 is following a $120 million Series B raised in 2019.

- Earlier in the year, African-focused payment company, Flutterwave, announced the close of a $170 million Series C round, which raised the company’s valuation to $1 billion and saw it attain unicorn status.

- In the same year, Nigerian fintech startup, FairMoney also $42 million from a Series B round led by US hedge funds and Investment firm, Tiger Global.

- Amongst others on the list of fintechs that have raised notable funding from foreign companies and investors in the past five years include, Chipper Cash, Mono, Joovlin, Sendbox, TeamApt etc.

Top 10 sectors with the highest foreign inflow

In the past five years, between 2017 and 2021, Nigeria received a sum of $68.87 billion as capital inflows (FDI, FPI, and loans). However, the shares sector accounts for a large chunk of these inflows, with $23.37 billion, representing 33.9% of the total fund.

This is not out of the ordinary, as foreign investors often time go to the Nigerian equities market and other mutual funds to invest.

According to the NGX domestic and foreign portfolio investment report as of February 2022, foreign investments in the local equities market accounted for 24.75% of the total transactions, with a sum of N38.96 billion recorded as foreign inflows between January and February 2022.

The banking sector followed on the list with $15.74 billion, financing with $11.09 billion, while the manufacturing sector received $4.52 billion in foreign inflows in the period under review.

Bubbling under

- Servicing – $3.37 billion

- Hotels – $3.36 billion

- Telecommunications – $2.69 billion

- Trade – $1.59 billion

- Agriculture – $1.36 billion

- Oil & gas – $668.7 million