The Central Bank of Nigeria’s (CBN) inability to maintain Nigerians’ interest in Africa’s first digital currency, the eNaira, has created space for Bitcoin and other cryptocurrencies to thrive.

This is based on data acquired from a Google analysis of Nigerian interest trends over time seen by Nairametrics.

Not surprisingly, from October 24, 2021, to October 30, 2021, Nigerians’ interest in eNaira momentarily outpaced that of cryptocurrencies, indicating that the eNaira launch had a broad appeal and that most Nigerians were eager to see what the CBN could offer.

However, after the launch of the eNaira on October 25, 2021, interest in Nigeria’s digital currency quickly started to trend downwards rapidly. While interest in Bitcoin and cryptocurrency consolidated around the same period.

What Google data is saying

- Google Trends is a valuable search trend feature that displays how frequently a specific search phrase is entered into Google’s search engine in comparison to the site’s total search volume over a specified period.

- According to the data, interest in the eNaira has fallen to historic lows, similar to regions before the announcement of the eNaira.

- October 24-30, 2021, according to data, interest in the eNaira was at 43, while interest in cryptocurrencies was at 41.

- However, the interest on eNaira as of March 20-26, 2022 was at less than 1 index point compared to the 43 index points had on October 24-30, 2021.

- Yobe, Kano Adamawa, Zamfara, and Jigawa states are currently the most interested in eNaira. While Ebonyi, Anambra, Enugu Kano, and Akwa Ibom led the way in cryptocurrency interest.

- However, the flagship cryptocurrency, Bitcoin, continues to pique Nigerians’ curiosity above searches on eNaira and cryptocurrency searches. Anambra, Delta, Bayelsa, Edo, and Ebonyi were among the states that were interested in bitcoin.

CBN attack on cryptocurrency

- Trading in cryptocurrencies and enabling payments for cryptocurrency exchanges are unlawful, according to the CBN directives to Deposit Money Banks, non-bank financial institutions, and other regulated financial institutions.

- In January 2017, the CBN issued a circular titled “Circular to Banks and Other Financial Institutions on Virtual Currency Operations in Nigeria,” citing concerns about virtual currencies’ unregulated and anonymous nature, as well as the risk of criminal abuse.

- Even though the CBN did not outright ban cryptocurrencies, it did prohibit regulated institutions from aiding or participating in crypto transactions. All financial institutions in the country have been told to identify and cancel any cryptocurrency dealers’ and exchanges’ accounts.

- Also, in a circular dated 5th February 2021 and distributed to regulated financial firms, the apex bank of Africa’s largest economy warned and reminded local financial institutions against having any transactions in crypto or facilitating payments for crypto exchanges.

- The Nigerian Central Bank took further steps and locked the bank accounts of some fintech platforms, including RiseVest, in August.

What people are saying about eNaira

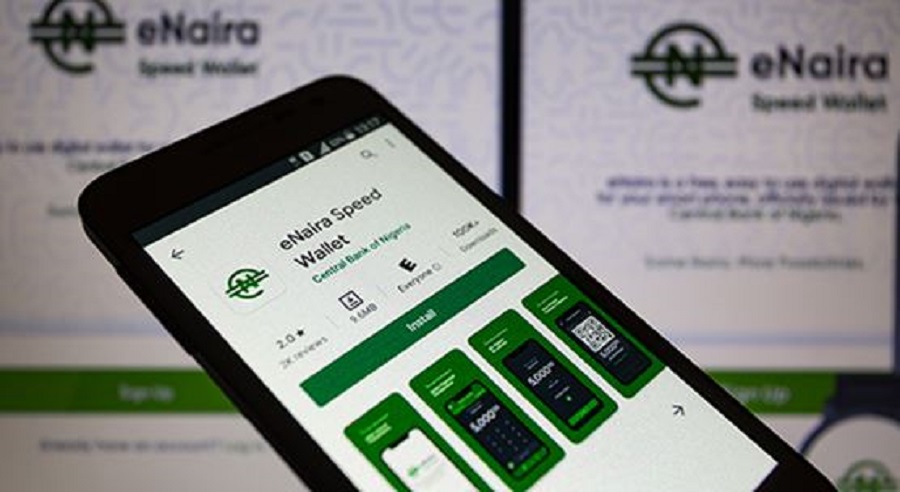

In terms of adoption and technological implications, there have been several setbacks that may be linked to the loss of interest by Nigerians. Some Nigerians who have used the app have had the following to say about it:

Nyakno Udoette expressed dissatisfaction with the platform’s implementation and capacity to gain public trust. He said, “I think there should have been a beta testing phase where a few selected persons would have been onboarded to test the eNaira platform. I’m sure all missing items and bugs would have been identified and fixed before being launched for the use of all. Now, this app is getting more negative comments than positive reviews and this will impact negatively on the psyche of intending users. It’s a financial application and should be built in a manner that will earn the trust of its users.”

He however, applauded the implementation and said the CBN needs to do more.

“For me, it’s a noble idea to create CBDC as it will help to reduce the hassles in financial transactions. I urge the CBN to make usage of this app seamless as I encourage everyone to download the app and make good use of it. Blockchain is the future of financial services, eNaira for me is the government’s one leg in testing the distributed ledger technology (Blockchain),” he said.

Precious Ajuru had similar complaints about the technology front. She said found it difficult to sign up and has tried several means at different times all to no avail. She has however given up on her attempts to sign up to the platform.

“After downloading the app and trying to register, I was told a mail has been sent to my email address for confirmation. There was no mail. Then I went back to try logging in and was told I was attempting with an incorrect username/password. To re-register again, I was told ‘too many trials with BVN, please contact support’. What’s worse is that there’s no email or phone number to direct you to support. Just you and the app in the dark. I feel like the app was so developed in a hurry that even the very basic things an app should have weren’t factored in. Not impressed one bit. Nigeria can do better.”

Why exactly should we be interested in eNaira, the value the naira alone isn’t even good enough; at home we toil like elephants and eat like ants, the level of security is a case study of it’s own, what exactly works in our beloved country?

And then CBN comes out with this when all systems are broken! Please..

Please don’t compare crypto currency with e-naira …. crypto currency is na access a tradeable commodity.

You seem to lack an understanding of what cryptocurrencies are. If you understood, then you wouldn’t compare the eNaira with Bitcoin. Cryptocurrencies like Bitcoin are tradeable digital assets. They can be traded like stocks or forex. However, they can also be used to transfer funds when hedged against stable coins. Stable coins are digital currencies, or the digital equivalent of currencies. An example of a stable coin is USDT, which is a digital dollar stable coin. Stable coins don’t get traded because they maintain their value without moving up and down… the same value as their cash equivalent. So in this sense, you would be better off comparing the eNaira to stable coins like USDT and BUSD. However, because the CBN has made the fatal mistake of criticizing the crypto market in general, the eNaira cannot be used as a hedge against cryptocurrencies the same way USDT is used as a hedge. That defeats the purpose of the eNaira and turns it into nothing more than another bank transfer method. All the eNaira is good for is to transfer funds from one individual to another… much like one can already do with their bank app. So what exactly is the need of the eNaira when there are already so many transfer options in Nigeria’s banking sector? This makes the eNaira duplicitous, redundant, and unnecessary. Before the eNaira launched, many were hoping that it could serve as a stable coin on cryptocurrency platforms to make trading and international money transfers easier. If that was the case, the eNaira would have gained massive support and perhaps even helped keep the Naira afloat. However, after its launch, we now know it is nothing more than another domestic interbank and intrabank money transfer option. Clearly the CBN needs to educate themselves on crypto to truly understand where the world is going so that we don’t get left behind as usual.

murtala