Union Systems Limited, Africa’s leading trade finance software company, partners with Wema Bank Plc to automate its trade finance operations. The bank selected Union Systems’ Kachasi trade finance software over all other international trade finance software solutions due to its ability to address both the traditional international trade finance processes and the peculiar Nigerian trade finance operations. The selection of Kachasi demonstrates Union Systems‘ leadership, experience, and excellence in the provision of trade finance software solutions.

Wema Bank, the pioneer of Africa’s first fully digital bank, is no stranger to being at the forefront of introducing innovative digital solutions to its customers. Through this collaboration, the bank will join the league of banks around the world that are using technology to change the way trade financing works. This trade finance automation project will significantly reduce trade finance processing turnaround time, improve operational efficiency, and unlock new revenue streams for the bank. It will also improve the bank’s ability to respond quickly to regulatory policies and updates.

Kachasi is the first indigenous trade finance software application built to automate the entire lifecycle of international and domestic trade finance operations. Union Systems brings to this partnership over 20 years of successful development and implementation of trade finance solutions across Africa. This is a significant milestone for the company and proves its expertise in the design and development of trade finance software products.

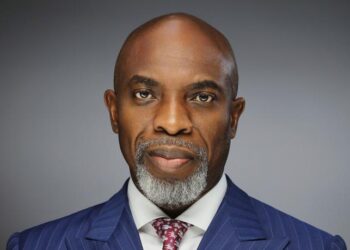

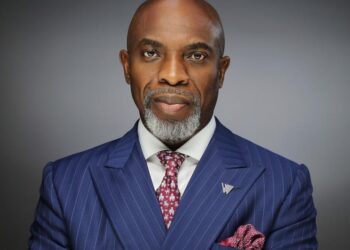

About Union Systems Limited

Union Systems Limited (USL) is Africa’s leading trade finance software company. For over 20 years, the company has been delivering future thinking trade finance software solutions to banks and corporates in Africa to achieve full automation and digitization of their trade operations. Our trade finance software solutions deliver growth, profitability, and regulatory compliance to banks and corporates.

With headquarters in Lagos, Nigeria, the company has a deep understanding of the African market and a team of highly qualified consultants with real-world experience in the delivery of complex software solutions. Union Systems has been named Trade Finance Software Solutions Provider of the Year at the BusinessDay Bank’s and Other Financial Institutions (BAFI) Awards for the second year in a row, in recognition of its innovation and excellence.