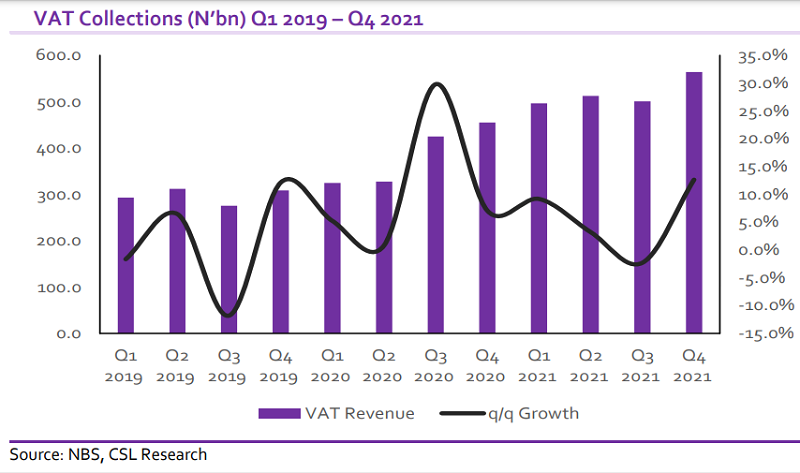

The National Bureau of Statistics (NBS) published data on the revenue generated from Value Added Tax (VAT) collections in Q4 2021. The total VAT collected in Q4 2021 was N563.7bn, a 12.6% y/y improvement compared to N500.5bn in Q3 2021. Y/y, Q4 VAT numbers also rose by 24.0% y/y relative to N454.7bn in Q4 2020.

Cumulatively, the total VAT collected in 2021 was N2.1tn, reflecting a sturdy growth of 35.4% y/y relative to N1.5tn collected in 2020. The government enjoyed the best of both worlds as the economic recovery spurred growth in both VAT and CIT collections.

Further analysis of the contribution to VAT revenue collected solely in Q4 2021 revealed that VAT on locally produced goods (i.e., non-import VAT) alongside Nigerian Customs Service (NCS)-Import VAT and non-import (foreign) VAT increased by 12.8% q/q, 2.5% y/y and 27.4% q/q, respectively. We believe the growth in VAT on locally produced goods (+12.8% q/q and +56.8% y/y) reflects the continued recovery in consumption, post the peak of the pandemic in 2020.

Beyond that, we think the impact of the persistent inflationary pressures on prices of goods and services also aided the growth seen as VAT is deducted by applying the VAT rate on the value of transactions. Notably, save for the quarterly decline in the Arts, Entertainment & Recreation and Educations sectors, all other sectors drove the q/q growth.

Looking ahead, we expect the VAT revenue to continue to benefit from a quickened recovery in consumer spending. The VAT increase to 7.5% became effective in February 2020, leaving only 1 month of lower VAT. Excluding any growth attributable to currency adjustments, we can safely conclude that a huge part of the growth seen is largely due to improving macroeconomic conditions.

CSL Stockbrokers Limited, Lagos (CSLS) is a wholly owned subsidiary of FCMB Group Plc and is regulated by the Securities and Exchange Commission, Nigeria. CSLS is a member of the Nigerian Stock Exchange.