Remember how the wake-up call for Nigeria’s economic diversification has been the main topic of discussion since the covid-19-induced disruption in 2020? Well, I am here to bring you some good news. According to the National Bureau of Statistics’ most recent GDP report, real GDP growth rate printed at an annualized rate of 3.98 % in Q4 2021, the fifth consecutive quarter of economic expansion, despite the oil sector’s continued lackluster. That, however, is not the good news. “Hold my cup.”

The fourth-quarter growth rate brought the full-year rate to 3.4 % y/y, exceeding both the IMF’s (3.0 percent) and World Bank’s (2.4 %) forecasts to record the highest growth rate since 2014. The non-oil sector was largely responsible for the record performance, which was aided by outperforming sectors such as Finance and Insurance, Trade, and Information and Communication.

“Non-oil Sector: don’t worry I am about to take overrrrr”

In the review period, the non-oil sector recorded a real growth rate of 4.73 % y/y, up 3.05 % and down 0.71 % relative to the rates recorded in Q4 2020 (1.69 %) and Q3 2021 (5.44 %), respectively. The sector is still benefiting from sustained growth in areas that were resilient during the pandemic-induced recession, as well as recovery in sectors that fell sharply in the base period. Financial and insurance, transportation and storage, trade, and information and communication are the underlying sectors that supported non-oil growth in Q4 2021. The non-oil sector contributed 94.81 % in the review period, higher than its contribution in Q4 2020, which stood at 94.13 %, and higher than the 92.51 % recorded in the third quarter of 2021.

Oil Sector: “I get coconut head, I no dey hear word”

Oil Sector: “I get coconut head, I no dey hear word”

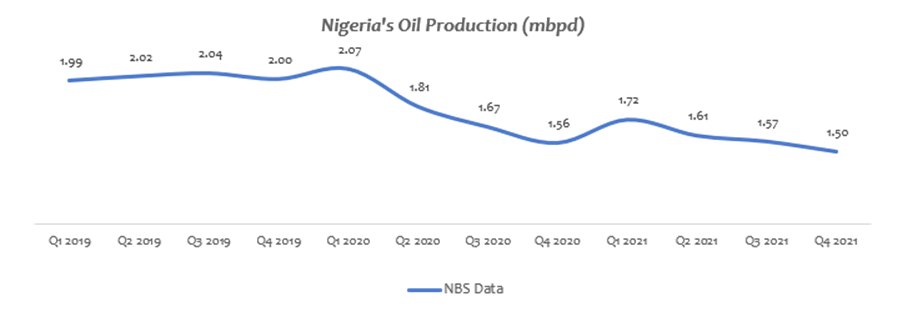

In the fourth quarter of 2021, the oil sector maintained its contractionary trend, with a real growth rate of -8.06 % y/y. The negative growth rate seen in the oil sector in Q4 2021 represents an 11.71 % improvement compared to the rate seen in Q4 2020 (-19.76 %) and a 2.68 % increase relative to the rate seen in the third quarter of 2021. (-10.73 % ). Despite the overwhelming bullish bias in the international oil market, the oil sector contracted for the seventh time in a row. Brent Crude, the benchmark crude for Nigeria’s Bonny Light, averaged $79.66/bl during the review period, an increase of 8.78 % and 76.01 % from the average pricing in Q3 2021 and Q4 2020 ($73.23/bl and $45.25/bl, respectively).

Average oil production fell further to 1.50mbpd in Q4 2021, compared to OPEC’s assigned quota of 1.68mbpd and the 2021 budget benchmark of 1.86mbpd. We anticipate that the oil sector will continue to be a drag on overall GDP, owing to the risk of vandalism and the delay in PIB implementation.

While the non-oil sector is expected to maintain its current trend of recovery due to minimal Covid-19-related restrictions, service sector components such as information and communication will act as major catalysts to non-oil growth regardless of the direction Covid-19 takes. However, our optimism regarding the non-oil sector still recognizes the existence of Covid-19 downside risks, although less predominant.

Don’t get carried away!!!

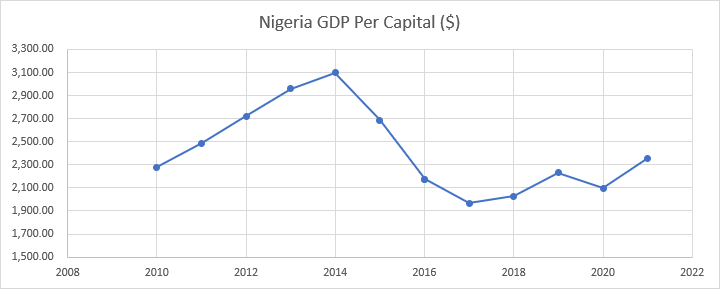

While nominal GDP has improved, we still have a long way to go in terms of GDP per capital, which measures living standards. While we recognize fiscal and monetary policy efforts to support the economy, infrastructure remains a critical area that requires improvement. We anticipate that additional capital investment in critical infrastructure will be the next big step.

Lest I forget,

Where is the Money?

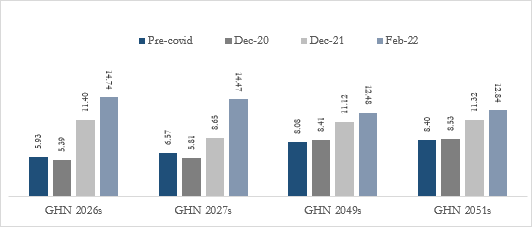

Ghana Sovereign Curve (%)

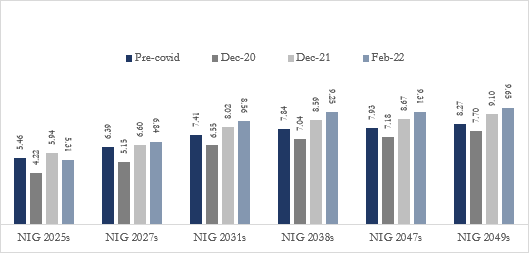

Nigeria Sovereign Curve (%)

A good trade is primarily determined by the entry point, and the recent sell-off seen in the SSA space as a result of rising tensions in the Russia-Ukraine conflict has created good entry points throughout the SSA market. We believe now is a good time to focus on papers with attractive yields, but we advise caution.