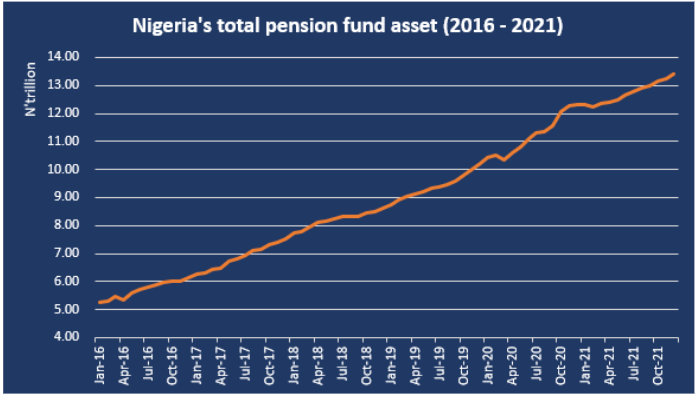

The Nigerian Pension industry recorded another milestone in 2021 as the total fund asset under management gained a sum of N1.12 trillion in the year to hit a record high of N13.42 trillion. In the same vein, the pension penetration rate of Nigeria rose to 14% after PFAs registered 313,339 new contributors.

This is according to analysis carried out by Nairalytics, the research arm of Nairametrics, on data collected from the National Pensions Commission (PenCom).

Notably, the total pension fund asset under management rose from N12.31 trillion recorded as of the end of the previous year to N13.42 trillion as of December 2021. This represents a 9.1% increase when compared to the previous year.

The significant gain in the year under review can be attributed to the significant increase in the contributions under the RSA Fund II categories which is the default fund for contributors who are 49 years and below.

Highlight

- The RSA Fund II category gained N522.48 billion in the year under review to stand at N5.88 trillion as of the end of the year. This fund category accounts 43.8% of the total contributory scheme.

- Also, the RSA fund III, which is a conservative fund with only about 5% to 20% invested in variable income instruments increased by N420.38 billion to stand at N3.54 trillion. This accounts for 26.4% of the total fund assets under management.

- The National Pension Commission introduced two new funds in the review year, Fund VI active and Fund VI retiree, both of which have a total contribution of N221.2 million and N14.45 billion respectively.

- On the other hand, contributions from CPFAs, that is pension schemes in the private sector existing prior to the introduction of the Contributory Pension Scheme (CPS) in June 2004 declined by N34.28 billion.

Meanwhile, the number of RSA registrations increased by 313,339 in the review to over 9.53 million people. When compared to the labour force number of 69.68 million from the National Bureau of Statistics (NBS), it represents a pension penetration rate of 14%.

What happened in 2020

The Pension fund under management gained a record of N2.09 trillion in 2020, surpassing the then N12 trillion threshold, despite the covid-19 pandemic forcing more Nigerians into a lockdown and almost rendering economic activities in the country stagnant.

A cursory look at the numbers shows that the scheme gained N1.58 trillion in 2019, while 2018 saw the pensions fund gain a sum of N1.12 trillion. Meanwhile, the gain in 2020 was rather surprising considering the effect of the pandemic on the NIgerian economy.

However, it is worth noting that the pandemic represented a time of reflection for most Nigerians to pay more attention to their income, expenses, and most importantly, investments. An example is the record-making performance of the Nigerian stock market, printing an annual return of over 50% in 2020.

The PFAs did not miss out on this as they cashed in on the bullish run, whilst increasing their exposure in the Nigerian equities market. Notably, investments by PFAs in domestic ordinary shares rose by N305.57 billion in the year, moving from N552.9 billion as of December 2019 to N858.46 billion as of the end of 2020.

More needs to be done in the Nigerian Pensions industry

The Pension industry continued with the positive trend in 2021, as its total pension fund asset hit the highest level ever in December 2021 at N13.42 trillion, with new contributors added to the list of registrations to reach 9.53 million.

Despite the increase, it is however worth noting that a pension penetration rate of 14% is still significantly below that of other emerging markets, with South Africa printing over 19% and the United Kingdom with 77% penetration rate.

Comparing the nation’s pension scheme to the general economy, we also find that the pension scheme only represents about 8.8% of the national annual nominal GDP, using 2020 figures. This is significantly lower than what is obtainable in South Africa at 66%.

Bottom line

The Nigerian Pension industry is waxing stronger in recent years, with additional funds being created to cater for different ranges of contributors based on their risk appetite. The industry has also grown more competitive, after PenCom opened the transfer window, which has seen over 35,000 contributors switch PFAs between January and September 2021.

However, there is a need to do more to capture more Nigerians into the pension fund basket so as to help secure the future of working-class by the time they retire and can no longer go through the hassle of working.

This is bad

Please how can I share this article on Facebook? Reply ,I will come back to check

not a good one at all

Wow. They have really tried o

Very interesting article, and very educative as well… Thanks for this