“Should I buy and hold or trade?” Well, why not do both? I have two portfolios: A “buy and hold” and a “buy to trade portfolio. Let me tell you about them.

My Buy to Hold Portfolio

This “Buy and Hold” portfolio mainly consist of USD dividend-paying US stocks and ETFs like the broad market ETFs (VTI, VO). I buy and hold US assets because the US market for more than 100 years has experienced rises and falls, but the long-term trend is upwards.

US Markets are Volatile

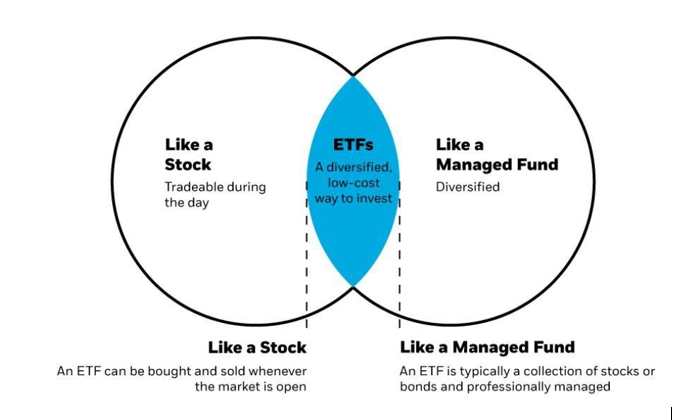

The US market can be measured by the movement in the Standard & Poor index (S&P 500); the S&P 500 tracks the performance of 500 leading publicly traded companies in the US selected based on their market capitalization. If I had bought the S&P in the year 1900, I would have seen slight price movements in twenty-four years from 1900 to 1924; then, my portfolio would have jumped nearly 40% in 1929 before crashing and becoming worthless. However, in 1931, my portfolio would slowly recover, stabilize for nine years up to 1948, then absolutely shoot up and up. I would also experience significant bear markets (stocks falling more than 20%) during black Tuesday on October 19th, 1987, and of course, the great recession in 2008. The Diagram 1 from Motley Fool shows the biggest stock market crashes in US history.

Diagram 1: Biggest US Stock Market Crashes

Long Term Trend of US Stock Market Is Up, So Hold

However, if you look at the long-term trend of returns of the US Market, its unmistakably up. The S&P 500 has posted an average annual return of about 8.2%. When you include reinvested dividends, it’s about 10.5%. This is not an annually return but an average over the life of the index. The Dow Jones Index is a price weighted index of 30 large companies listed in the US States, Chris Kacher, of MoKa Investors, published a graph of the Dow’s performance since 1896, (See diagram 2) Thus, I am investing in this rising US market, by investing via ETFs like the VTI.

Diagram 2: The Dow Jones Index 1896-2016

In 2021, my buy and hold strategy consisting of buying the VTI which returned 10.47% and beat inflation in USD. I have Zenith Bank and the Nigerian focused ETF (NGE) in my buy and hold box as well. I do it to build my passive income cash flow stream.

My trading Portfolio

Why do I trade? Buying an index means I buy all the stocks in that index. If I buy the S&P500, I buy 500 individual stocks simultaneously, so I buy the winners and losers; my return is the average return.

If I trade stocks, I am selecting individual stocks and investing in them, I could theoretically return higher than the index. The flip side is that I can buy individual stocks that plunge in price and return far below the index. Let’s look at Tesla; if I bought the S&P index in 2020, I would have posted a 26% annual gain, However, Tesla as an individual stock returned 743% in 2020. On the flip side, if I bought Tesla in 2016, I would have got a negative annual return of -26%; but the index made 9.54% in that same year. It’s not an exact science; trading means seeking “alpha” or utilizing a strategy to seek excess profits by taking a position in the market and exiting once my internal hurdle rate is reached; it’s strategy, with a bit of luck and leverage.

How to Make Money in Trading

First, how does an investor make money in trading? It’s easy; you buy low and sell at a higher price. The tricky part is determining what price is “low”. A low price is a market price that is below the intrinsic value of the stock. Intrinsic value is measuring what an asset is worth. A stock price is the present value of the future cash flows that stock will earn, discounted back to today with a discount rate. Successful trading is applying quantitative and qualitative means to establish an intrinsic value; then, the rest is easy.

- If the stock price falls below intrinsic value, buy the stock, or buy a call option to buy the stock.

- If Stock price rises above intrinsic value, sell-by buying a put on the stock

If the trader’s intrinsic value calculation is correct, trading is a matter of setting price alerts and limit orders to buy or sell within a predetermined price range. For instance, if I calculate that Tesla intrinsic value is $1,000 per share, and the tesla market price falls to $950, I buy stock on the spot market or buy a call option allowing me to buy Tesla shares in future at $950, e.g., for 90 days I retain the option but not the obligation to buy Tesla at $950 irrespective of market price. The market price always catches up with the intrinsic value eventually, and if the price then moves back to $1,000, where I can sell my stocks or exercise my call option and buy at a $50 discount to the current market price.

However, if the price rises to $1,200, which is above my intrinsic value, I can buy a Put Option; this enables me to “borrow and sell” the Tesla shares today from a broker get earn cash. If the shares fall back to $1,000, I buy back the shares at the lower price and return them to the broker I borrowed them from. If the shares however rise in price, then I lose money as I must buy back those shares I sold at a higher price. I can buy a covered option but that’s a topic for another day.

These were my position for my trading portfolio in Naira and returned in 2021.

- Access Bank

- Dangote Sugar

- Fidelity Bank

- GTCO

- UBA

- Zenith Bank

Best trade in 2021? Zenith Bank 59% (Bought @ N16.14)

Price laggard? GTCO 10.72% (Bought @ N23.17)

With trading, I can profit if the market goes up or down by buying options (not available in Nigerian Markets). Please note this is very risky and volatile, and you should not buy and sell options without a complete understanding of the market.

You Can Also Trade Index Via ETFs

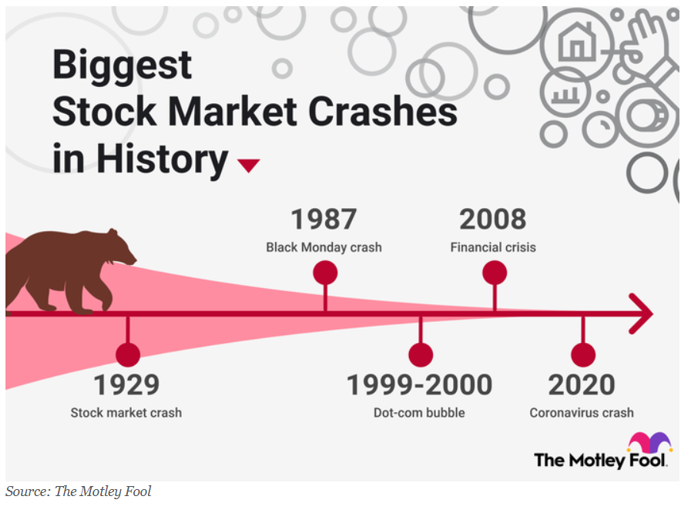

You can also buy and sell Indexes by trading in the Exchange Traded Fund (EFT)space. ETFs are like unit trusts or mutual funds, but a key difference is you can trade ETFs during the trading day just like an individual stock. See Diagram 3

Diagram 3: What is an ETF

ETFs allow you to take positions in sectors or geography or diversify. For instance, if you believe China is emerging from the Covid 19 shut down faster than the West, you can take a position in Emerging Market Stocks by buying the VWO. If I am investing in US property to take advantage of rising home prices, you can also trade the VNQ ETF. Any strategy you can think of in the market has an ETF for that.

ETFs allow you to take positions in sectors or geography or diversify. For instance, if you believe China is emerging from the Covid 19 shut down faster than the West, you can take a position in Emerging Market Stocks by buying the VWO. If I am investing in US property to take advantage of rising home prices, you can also trade the VNQ ETF. Any strategy you can think of in the market has an ETF for that.

Diagram 4 shows the one month, 3yr, 5yr returns for various ETFs. Remember, past performance is not a guarantee for future performance; however, it’s instructive to note that equities via the VTI ETF have posted the highest return in 5 years.

Diagram 4, ETF Returns

Whatever Model You Choose, Seek Dividends

Whatever Model You Choose, Seek Dividends

Not all stocks pay dividends; many growth companies like Tesla and Google don’t pay dividends; they instead reinvest their dividends back into the market to grow. Companies are not mandated to pay dividends, and reinvesting dividends could be better than distributing cash to investors. That said, I love dividends, and I use dividends as my “shock absorber”; if I trade and fall on the losing side, I could use dividends to compensate for the lack of capital appreciation.

Dividends also allow you to compound your returns when you reinvest, which also drops your average cost of purchasing. So, I prefer dividend-paying stocks.

www.kaluaja.org

Business trading