There are some economic terms that may sound confusing when an investment is mentioned, especially if you are a young investor. Some of them are bears and bulls markets. The bear market simply means a market whose value has dropped 20% from the recent high point, over a period of 2 months. Bear market is usually caused by an economic recession or an unprecedented event that affects the economy, such as the novel Coronavirus.

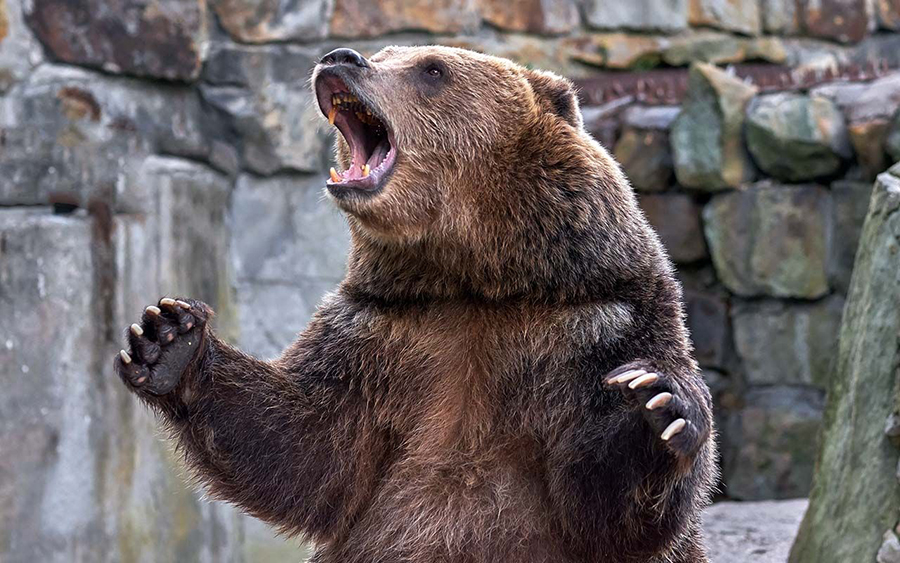

Some have opined that the origin of the bear market may have been inspired by an old proverb about not selling a bear’s skin before catching the bear. However, some evidence suggests that it is called a bear market because of the way a bear attacks its prey by swiping its paws downward.

Here is what might be happening in the middle of a bear market:

Stock prices keep falling and rising

Many factors affect prices in the stock market, including inflation, interest rates, energy prices, oil prices, and international issues, such as war, crime, fraud, pandemic, and political unrest. An example was what the world faced recently (COVID-19 pandemic). During that period, things were getting rough so fast that they affected the stock market. As we all know, stocks are volatile in nature, and volatility is common in a bear market.

During that period, investors were advised not to make any economic decisions. It was also imperative not to buy, sell assets, or modify investments. They were advised to stay put and see how things unfolded.

Sudden rises or drops in stock prices are often called spikes, which are extremely difficult, if not impossible, to predict. Stock market trends are like a person’s behaviour. After you study how a person reacts to different situations, you can make predictions about how that person will react to an event. Similarly, recognizing a trend in the stock market, or in an individual stock, will enable you to choose the best times to buy and sell.

Investors are worried and panicked

When investors are afraid to take on risks and worried about losing money, that is a sign that the bears are on the prowl and the bulls have left the building. You can get this information on your daily stock and analyst update, or from your daily tracking of the market. Nothing breeds investor panic like volatility and bear markets, and this is the period when financial advisors, are probably going to get bombarded with anxious calls and emails.

When this happens, it is important for financial advisors to put a call through to their clients, as the clients are looking for someone to tell them what’s going on. If they don’t hear from them, they might turn to someone else who won’t give the same level-headed guidance. It is imperative to create that relationship with your client to make sure they see you as a stable and reliable resource in an unstable and unreliable period.

Unemployment starts to rise

A bear market simply means the market is facing an inflation/recession. This implies that there is no money in circulation. During a bear market, broader economic indicators, like the GDP, start to decline, like what was experienced in 2020. Unemployment may rise, as companies start to lay off employees. Investor confidence is low, as many people are unsure about the future. Redundancy will take place during the period, as some companies will not be able to afford to pay their workers. Some companies will be out of business as a result of the recession, which will, in turn, lead to rising unemployment.

Consumer confidence drops

People usually go into conservation mode in a bear market, either because they have lost their jobs and need to focus on taking care of the essentials, or because they are afraid things might get worse.

The bottom line is that a bear market should not make you sweat, as good stocks can come out of it, and they are usually ready for the subsequent bull market. So, do not be so quick to get out of a stock. Just keep monitoring the company for its vital statistics (growing sales and profits and so on), and if the company looks fine, then hang on. Keep collecting your dividend and hold the stock as it zigzags into the long-term.