The Nigerian Senate announced that it is committed towards reducing Nigeria’s borrowings and debt obligations in partnership with the Federal Government’s revenue-generating agencies.

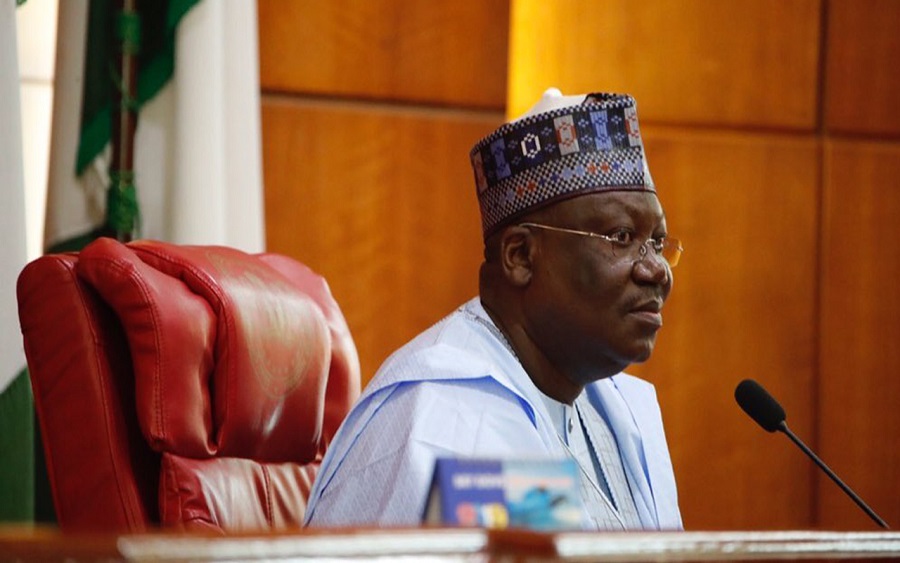

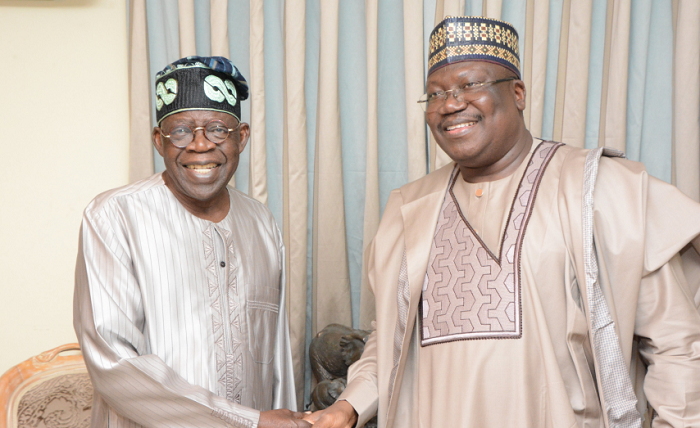

This was disclosed by the Senate President, Ahmed Lawan on Wednesday while marking his 63rd birthday, according to the News Agency of Nigeria.

He added that the Senate would support and supervise the agencies for Nigeria to have more revenues in order to reduce the level of borrowing.

Read: Senate President denies allegation of $10 million bribe to pass PIB

What the Senate President is saying

Lawan said, “The upper chamber in the first-quarter of this year will focus on addressing the challenges of revenue generation, collection and remittance to shore up earnings by the Federal Government.

“An improvement to the country’s revenue figures will reduce Nigeria’s dependence on external borrowings for the execution of capital projects captured in the national budget.

“We still have a huge responsibility, and in fact, it is something that we wanted to do last year, but because of the COVID-19 pandemic we couldn’t do so.

“This year, by the grace of God, we are going to resuscitate that plan and it is to keep and maintain focus on revenue generation, collection and remittance.”

Read: SERAP sues Lawan, Gbajabiamila over missing N4.1 billion National Assembly funds

He added that Nigeria’s revenue to GDP ratio is very low and that the economists will tell you Nigeria’s problem is not debt, but revenue, which means that the FG should focus on dealing with the challenges of revenue generation, revenue collection and remittance.

“This year, we are going to have engagements with the revenue-generating agencies such as Nigerian Ports Authourity (NPA), Customs, Federal Inland Revenue Service (FIRS) and so on, on a quarterly basis, to have their targets set for them, and we want them to come and brief us on their performance every quarter.

“We hope to start the first meeting, which is an exploratory kind of meeting with them either this month or early February.

“We want to see how we can make positive difference in the area of revenue generation.

“Nobody likes taking loans, borrowing or accumulating debts, whether as an individual, a family, a community or as a country.

Read: Nembe oil spill: Senate insists 2 million barrels of hydrocarbon and gas spilled

“But what can you do when you’re not able to generate enough? We are as concerned as anybody else about our level of borrowing, even though we have not saturated, but if we can do better why not reduce, and the best way to reduce is to get more revenues from especially independent sources.

He said that the government-owned enterprises are supposed to generate more revenue for the FG and that in 2022, the FG is expecting about a trillion.

In case you missed it

Recall Nairametrics reported that the Federal Government assured citizens that its debt level is still within sustainable grounds and that its target over the medium term is to grow Revenue-to-GDP ratio from the current 8-9% to 15% by 2025.

For debt servicing, the Minister of Finance, Budget, and National Planning, Mrs. Zainab Ahmed revealed that at the rate of N3.61 trillion, it would represent 21% of total expenditure, and 34% of total revenues, citing that the provision to retire maturing bonds to local contractors/suppliers of N270.71 billion is 1.6% of total expenditure.

The Minister added that the budget deficit is N6.39 trillion for 2022 which represents 3.46% of GDP and would be financed mainly by borrowings, which are: Domestic sources: N2.57tn; Foreign sources: N2.57tn; Multi-lateral/bi-lateral loan drawdowns: N1.16tn, and Privatisation Proceeds of N90.7bn.