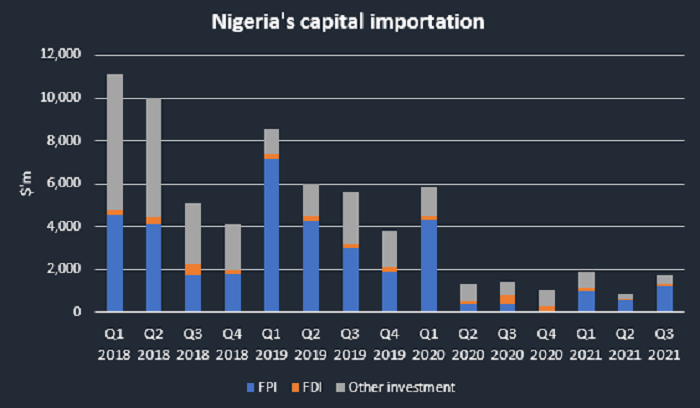

Nigeria’s capital importation rose to $1.73 billion in the third quarter of 2021, which is 98% higher than $875.6 million recorded in the preceding quarter (Q2 2021). This is contained in the capital importation report, released by the National Bureau of Statistics (NBS).

The increase recorded was due to the 120.8% surge recorded in the country’s portfolio investment. Foreign portfolio investments in the review period increased from $551.37 recorded in Q2 2021 to $1.2 billion.

A further breakdown of the report from the statistical bureau, shows that FPI (Foreign portfolio investments) accounted for 70% of the total inflows recorded in the period, FDI (Foreign Direct Investments) at $107.8 million, accounted for just 6.2%, while other investments with $406.4 million, represents 23.5% of the total foreign investments.

Read: FOREX inflow into Nigeria surges by 64% to $30 billion in Q3 2021

Despite the increase recorded in the review period, Nigeria’s capital importation is still significantly lower than pre-pandemic levels, averaging at $1.5 billion in 2021, compared to an average of $5.99 billion recorded in 2019 and $4.2 billion in 2018.

Highlights

- Capital importation rose by 97.7% and 18.5% from $875.6 million and $1.46 million recorded in Q2 2021 and Q3 2020 respectively.

- Direct investments increased by 38.3% quarter on quarter to $107.81 million in Q3 2021 compared to $77.97 million recorded in Q2 2021, while it declined by 74% compared to $414.8 million recorded in the corresponding period of 2020.

- Similarly, other investments attracted in the review period was $406.4 million, which is 65% higher and 36.5% lower than the $246.3 million and $639.4 million recorded in Q2 2021 and Q3 2020 respectively.

- Cumulatively, Nigeria imported capital worth $4.51 billion between January and September 2021, representing a 47.6% decline compared to $8.6 billion recorded in the same period of 2020.

Read: 2021: I&E window records $32.3 billion in forex turnover

By sectors, capital importation into the financing sector had the highest inflow of $469.17 million amounting to 27.1% of total capital imported in the third quarter of 2021. This was closely followed by the banking sector, which received $460.39 million (26.59%) and the production sector $323.83 million (18.70%).

Capital Importation by country of origin revealed that the United Kingdom ranked top as source of capital imported into Nigeria in the third quarter of 2021 with a value of $709.8 million accounting for 40.99% of total capital imported in the period under review. This was followed by capital imports from South Africa and United States of America valued at $389.54 million (22.50%) and $257.12 million (14.85%) respectively.

Read: Nigeria receives $9.68 billion capital inflows in 2020, lowest in 4 years

By Destination of Investment, Lagos State remains the top destination of capital investment in Nigeria in Q3 2021 with $1.48 billion accounting for 85.57% of total capital investment in Nigeria in the period under review. This was followed by investment into Abuja (FCT) valued at $249.19 million (14.39%).

By Bank, Stanbic IBTC Bank Plc ranked highest in Q3 2021 with $537.92 million (31.07%) of total capital investment in Nigeria. This was followed by Standard Chartered Bank (18.83%) and Citibank Nigeria Limited (14.34%).

What this means

Nigeria continues to suffer from low foreign investments, largely attributed to disruptions caused by the covid-19 outbreak, which affected most economies in the world due to travel restrictions and halt in business activities.

Nigeria’s low foreign inflow continues to affect the supply of forex in the country, piling more pressure on the exchange rate as the CBN continues to intervene in the FOREX market.

Nigeria will hope to turn things around by boosting its foreign inflows especially in terms of direct investments in order to drive economic growth.