Nigeria’s foreign reserve dipped $633.47 million in the month of November 2021 to close the month at $41.19 billion as of 30th November 2021. This is according to latest figures obtained from the Central Bank of Nigeria (CBN).

The country’s foreign reserve has been on a rather consistent decline during the month of November kicking off the month at $41.82 billion as of 30th, October 2021 and closing at $41.19 billion as of the end of November 2021. This represents a 1.51% decline in the foreign reserve level.

Nigeria’s reserve level had gained massively in the month of October, receiving an additional $5.99 billion, through proceeds from the $4 billion Eurobond issued by the federal government in September and a $3.35 billion SDR allocation from the International Monetary Fund (IMF), which saw our reserves surpass the $40 billion threshold.

Read: How Nigeria’s foreign (external) reserves rose to $40 billion

Why the decline in November

The decline in the country’s external reserve level in the month of November can be attributed to the continuous effort by the apex bank to maintain exchange rate stability by intervening in the supply of FX in the official market.

Recall that the central bank governor, Godwin Emefiele, after the MPC meeting in July 2021, accused Bureau De Change operators in Nigeria of going against the official model prescribed for them by the apex bank, which resulted in a ban on the supply of FX to the operators.

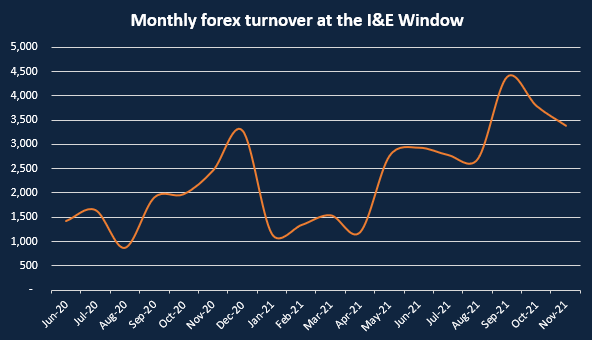

The central bank discontinued the sale of FX to BDCs and refrained from licensing new operators, hence, there was need to pump significant FX to the banks, to ensure demand is met at banks. A cursory look at the numbers from the Investors and Exporters window tracked by Nairametrics from the FMDQ, shows that turnover at the official window has improved significantly since then.

Read: What constitutes Nigeria’s external reserves?

A total of $3.38 billion exchanged hands in the month of November at the official I&E window, while a sum of $3.79 billion and $4.38 billion were traded in October and September 2021. It is worth mentioning that the amount of FX traded in September was the highest on record.

Nigeria’s official exchange rate averaged N414.92/$1, an appreciation compared to N415.1/$1 recorded in the previous month. This is in line with the CBN’s effort to ensure liquidity in the market despite continuous current account deficit, huge international trade gap and a lower-than-expected remittances.

Nigeria’s official exchange rate averaged N414.92/$1, an appreciation compared to N415.1/$1 recorded in the previous month. This is in line with the CBN’s effort to ensure liquidity in the market despite continuous current account deficit, huge international trade gap and a lower-than-expected remittances.

What you should know about foreign reserves

According to the Central Bank of Nigeria, foreign reserves are assets held on reserve by a monetary authority in foreign currencies. These reserves are used to influence monetary policies. They include foreign banknotes, deposits, treasury bills, deposits, and other government securities.

The International Monetary Fund (IMF) asserts that international reserves are those external assets that are available to and are controlled by a country’s monetary authorities.

Nigeria’s external reserve is very important in defending the naira and is used to cover the country’s huge import bills. An increasing external reserve suggests a higher inflow from crude oil earnings, inflow from foreign investors, and external loans.