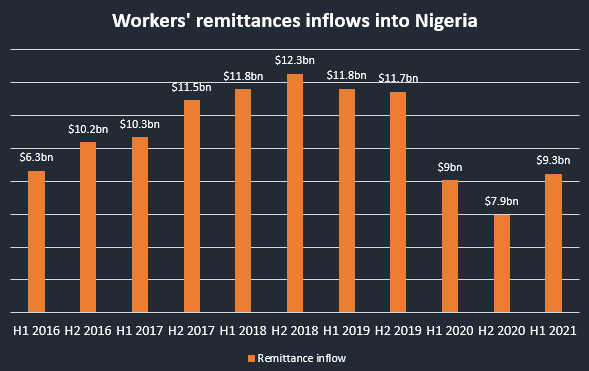

Diaspora remittances into Nigeria increased by 15.6% QoQ to $9.22 billion in H1 2021 compared to $7.98 billion recorded in the second half of 2020. It also represents a marginal 2.2% increase compared to $9.02 billion recorded in the corresponding period of 2020.

This is according to the review of Nigeria’s balance of payment account as released by the Central Bank of Nigeria (CBN).

The increase follows the continuation of the Naira4dollar initiative by the apex bank, which rewards recipients with N5 for every $1 they receive from licensed IMTOs and commercial banks. Recall that the Central Bank extended this initiative indefinitely earlier in May 2021, with a view to increase remittances so as to boost external reserves.

Read: Diaspora Nigerians switch away from real estate as depreciating exchange rate erodes returns

Although Nigeria’s inflow is yet to reach pre-pandemic levels, it is beginning to move upwards compared to 2020, which was soured by the global economic downturn caused by the covid-19 pandemic. Notably, in H1 2021 diaspora remittance inflow into Nigeria rose to its highest levels since H2 2019.

The latest increase in diaspora remittances has also supported the Nigerian current account balance, which has been on a net deficit since Q1 2021. However, Nigeria’s current account deficit improved to $424 million in the second quarter of 2021, from a deficit of $2.1 billion recorded in the previous quarter.

The breakdown of the data from the Central Bank shows that Nigeria has recorded diaspora remittance inflow of $115.15 billion in over 5 years, while outflow stood at $1.18 billion in the same period, indicating a net credit of $113.96 billion.

The breakdown of the data from the Central Bank shows that Nigeria has recorded diaspora remittance inflow of $115.15 billion in over 5 years, while outflow stood at $1.18 billion in the same period, indicating a net credit of $113.96 billion.

It is worth noting that Nigeria’s diaspora remittance outflow in the first half of 2021, dropped by 30.1% from $34.59 million recorded in H2 2020 to $24.18 million. It also recorded a marginal decline of 10.6% compared to $21.86 million recorded in the corresponding period of 2020.

Read: FG accuses Nigerians in diaspora of financing secessionists, spreading fake news

What the World Bank is saying

The World Bank had reported that Nigeria returned to growth in remittance inflows in 2021 as a result of the increasing influence of policies intended to channel inflows through the banking system, pointing at the Naira4dollar scheme by the Central Bank.

The report also indicated that Nigeria is currently the largest recipient of remittance inflows in the Sub-Saharan region of Africa in 2021. Meanwhile, remittance inflows to Sub-Saharan Africa grew by 6.2% to $45 billion in 2021, and is projected to grow by 5.5% in 2022.

According to the World Bank, remittances to low-and middle-income countries are projected to have grown by 7.3% to reach $589 billion in 2021. In a statement by Michal Rutkowski, World Bank Global Director for Social protection and jobs, he said:

“Remittance flows from migrants have greatly complemented government cash transfer programs to support families suffering economic hardships during the COVID-19 crisis. Facilitating the flow of remittances to provide relief to strained household budgets should be a key component of government policies to support a global recovery from the pandemic,”

Read: CBN issues modalities for payout of diaspora remittances in dollars

Factors contributing to the strong growth in remittance are migrants’ determination to support their families in times of need, aided by economic recovery in Europe and the United States which in turn was supported by the fiscal stimulus and employment support programs, said the World Bank.

The topmost bank also stated that in the recovery of outward remittances in the Gulf Cooperation Council (GCC) countries and Russia, was facilitated by stronger oil prices and the resulting pickup in economic activity.

Omicron could pose threat to Nigeria’s remittances

The new variant of the covid-19 disease could impede the growth recorded by Nigeria in its diaspora remittances, as the new Omicron virus which has proven resilient against the covid vaccine could halt economic activities of some of the top European countries.

The crude oil and the crypto market are already feeling the brunt of the new strain as bearish sentiments continue to cause huge sell-offs in the market. As of press time, the price of Brent Crude had already fallen to $70 per barrel, while WTI already fell to $67 a barrel.

If the new virus continues to threaten the recovery of most European economies, diaspora remittances into low and middle-income economies could be affected, with Nigeria not being exempted as they account for the highest inflows of remittances in Sub-Saharan Africa.

What you should know about diaspora remittances

Diaspora remittances represent one of the most important sources of external flows of capital and foreign exchanges for many developing countries. They play an important role in the lives of their recipients. It is the second-largest source behind FDI of external funding for developing economies. It is worth noting that CBN reports diaspora remittances as workers’ remittances in its balance of payment report.

Nairametrics had reported earlier in the year that remittances into the country fell by 24% in the first quarter of 2021, which was attributed to the downturn in developed economies, coupled with some Nigerian foreign policy that had left diaspora Nigerians with little option but to transfer funds through black market channels.

However, with the clampdown of the central bank on cryptocurrency transactions in the country and the incentive to Nigerians for every unit of dollar received through official channel, we have started recording appreciation in diaspora remittances. This increase, if it continues will boost dollar liquidity in the economy and help the apex bank continue FX market intervention.