Flagship cryptocurrency, Bitcoin ended the previous week at its highest weekly close ever which stands at $63,326.99, according to coinmarketcap. As of the time of writing this report, Bitcoin is just 1.57% below its all-time high of $66,930.39, which was set just 19 days ago, towards the end of October.

Data from Glassnode reveals that Bitcoin had a negative exchange flow valued at -$2.1 billion. A negative exchange flow means that Bitcoin has been taken out of centralized exchanges to private wallets, indicating accumulation for the asset class. For the week under review, $10.2 Billion worth of Bitcoin was deposited into exchanges while $12.3 billion left exchanges.

Compared to the exchange flow that happened in the last two weeks, the negative exchange flow increased by 110% from -$1 billion in the week ended the 31st of October 2021.

According to On-chain Analytics expert William Clemente on Friday, a Bitcoin Volatility Squeeze is imminent and it is time for everyone to ‘pay attention.’

Volatility Squeeze

A volatility squeeze occurs when the volatility of an asset class falls below its recent levels. A fall in volatility usually means that the asset in question is in a period of consolidation and trending in a narrow range. When that period of consolidation ends, normal volatility will return resulting in a breakout to the upside or downside.

Bitcoin has been doing just that after it fell from its all-time high created on the 20th of October. The asset class took a ranging formation which indicates consolidation and this happened between $63,732.39 and $59,500 range.

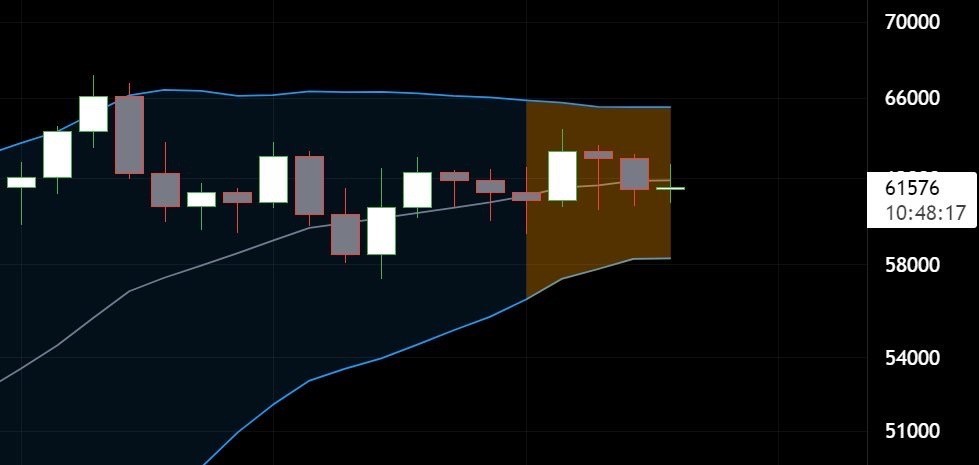

A simple way to identify a volatility squeeze is when there is a narrowing of the Bollinger Bands. In the image posted by William Clemente, it would seem like this was his approach in identifying the incoming volatility squeeze as the Bollinger Bands in the image narrowed when the price of Bitcoin traded $61,576 according to the image.

This method, however, is not the only way to identify a volatility squeeze. A squeeze can also be detected when the 2 standard deviation Bollinger Band (BB) narrows to within the Keltner Channel (KC). Bollinger Bands are very susceptible to volatility changes while Keltner Channels are a smoother, trend following, indicator.

The volatility squeeze would seem to be in full effect. This is because Bitcoin traded a high of $66,446.33 yesterday, rallying over $4,450, in an attempt to break its previous all-time high.

Whale accumulation

The possibility of Bitcoin hitting $80,000 in November is not only due to a volatility squeeze but also to a net accumulation by Whales, a term used to describe institutions or big-money investors in the cryptocurrency market who are playing a huge part. Asides from the Glassnode data earlier discussed, additional confirmation from Santiment, which tracks distribution/accumulation activities of the wallets with balances between 10,000 BTC and 100,000 BTC, explained that whales have been accelerating their buying spree.

These whale entities accumulated 43,000 BTC (worth about $2.82 billion) in the last five days and about 92,000 BTC (over $6 billion) in the last 25 days, just as the price rallied to a record high near $67,000, corrected below $60,000, and surged back above $66,000.

This whale-led buying at these higher prices indicates their preparations for the times ahead, which is that they anticipate Bitcoin to close beyond its previous record high.

William Clemente also explained that “In the last 4 months, just over 200,000 BTC have been moved off exchanges according to Glassnode. The equivalent of roughly $12.5 billion at current prices. This is another regime of outflows, illustrating a broader shift in dynamics for the Bitcoin market after March 2020.”

In addition, on-chain analyst Willy Woo noted that Bitcoin continues to move off exchanges to cold storage in recent weeks. At the same time, the deposits of dollar-pegged stablecoin USD Coin (USDC) surged in the same period, underlining a classic buying pattern.

Willy Woo in a note to clients stated, “Price was previously overheated, calling for a time of consolidation, since then we’ve seen significant buying from investors while [the] price has been sideways. It’s been a healthy consolidation. Meanwhile, significant whale activity has been spotted which suggests BTC’s next move in price may come soon.”

Taproot Upgrade

Another factor contributing to Bitcoin Bulls renewed optimism is the Taproot upgrade. The upgrade is set for deployment after achieving a 90% consensus among the Bitcoin miners (mining nodes). In the next seven days, the Bitcoin protocol will undergo a soft fork in the name of the Taproot upgrade, which aims to improve the network’s privacy, efficiency and most importantly, bring smart contracts capabilities to Satoshi Nakamoto’s creation.

Taproot is Bitcoin’s first major upgrade since August 2017. In 2017, the Bitcoin network was introduced to the Segregated Witness (SegWit) which gave birth to the launch of Lightning Network. While the previous fork primarily sought to fix transaction malleability and improve Bitcoin’s network scalability to over 25 million transactions per second, the Taproot upgrade aims to revamp transaction efficiency, privacy and support smart contracts initiatives.

The Taproot soft fork will see the introduction of Merkelized Abstract Syntax Tree (MAST), which introduces a condition that allows the sender and receiver to sign off on a settlement transaction together.

In addition, Taproot will also implement Schnorr Signature, an algorithm that will allow users to aggregate multiple signatures into one for a single transaction, reducing the inherent visible difference between regular and multisig transactions. Schnorr’s signature scheme can also be used to modify the user’s private and public keys, in a manner that can be verifiable to confirm the legitimacy of each transaction.

Bottomline

Bitcoin is up by nearly 50% so far in the fourth quarter of the year. Even with this rapid movement, Bitcoin miners continue to show solid resolve and ‘hodl’ (a term used to describe holding an asset long term without selling) their Bitcoin. Data from on-chain analytics service CryptoQuant shows that outflows from miner wallets, with few exceptions, have stayed flat in recent weeks and months.

The Bitcoin network hash rate, a measure of the processing power dedicated to maintaining the blockchain, continues to recover from a 50% crash, caused by China’s ban in May.

Inflation is also another factor to consider. An analyst told Bloomberg that the Federal Reserve, which recently signalled it would taper asset purchases, may even be forced to change course due to the current environment. Citigroup senior investment specialist Mahjabeen Zaman stated, “We are of the view that there is upside risk in both these CPI numbers and as a result, there is actually a risk the Fed might actually accelerate the pace of asset purchases.”

All these factors being considered, an $80,000 price point in November may turn out to be conservative as PlanB’s Bitcoin Stock-to-Flow (S2F) model targets $98,000 at the end of November. His model is based on the ‘worst-case scenario for 2021’.